Adviser exits have slowed but not for all licensees

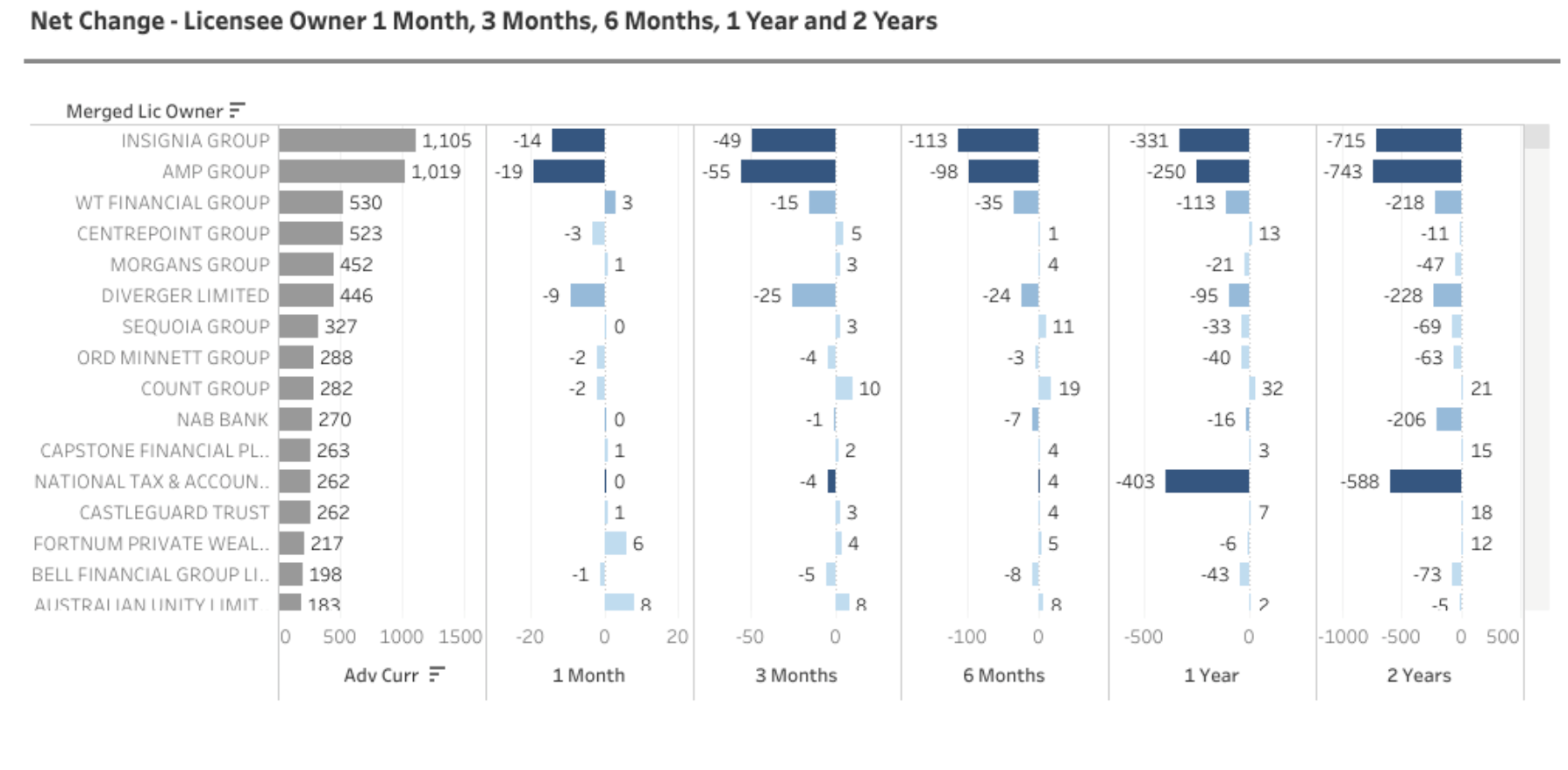

The rate of adviser exits from the financial planning profession has been slowing, according to new, two-year analysis of the Financial Adviser Register except with respect to AMP Limited.

The new analysis undertaken by WealthData has revealed the slowing with respect to virtually all the larger licensees, with AMP Limited being the exception largely result of the implementation of its transformation strategy.

The WealthData analysis has examined adviser exits across two years, one year, six months, three months and one month and confirms the manner in which the rate of exit has been declining, albeit sometimes only marginally.

However, WealthData principal, Colin Williams said that the picture might change when the results of the latest financial adviser exam became known and those who failed were forced to stop providing advice.

Key Adviser Movements This Week:

Key Adviser Movements This Week:

This week

Net Change of advisers (-8)

20 Licensee Owners had net gains for 28 advisers

22 Licensee Owners had net losses for (-34) advisers

1 new licensees commenced and (-1) ceased

4 Provisional Advisers (PA) commenced and zero ceased.

Summary

A slower week with a net decline of 8 advisers. The financial year still looks strong at plus 150 compared to 82 for the corresponding period last year.

Growth This Week

Ethical Planners Pty Ltd, (How To Retire Early), up plus 4 with three advisers moving across from National Advice Solutions. BLA Parker (Barnett Lilley) of ACT up plus 3 with Advisers who are still showing as authorised at Parker Wealth. 3 licensee owners are up net 2, Viridian, Bombora and Gary Thoroughgood (Vision Planning), with Vision Planning gaining their advisers from MCA Financial Planners.

15 licensee owners had net gain of 1 including WT Financial Group, Highfield Group, Capstone and Australian Unity. 1 new licensee commenced with just the one adviser.

Losses This week

Findex Group down (-4), losing 5 and gaining 1. Gail Glasby (National Advice Solutions) also down (-4) with three advisers moving to Ethical Planners (as noted above). Oracle Investment Management down (-3) and 4 licensee owners down (-2) including Insignia, Shaw and Partners and Telstra. 15 licensee owners down (-1) including Sequoia, ANZ Bank, Euroz, Fiducian and Unisuper. The one licensee that closed only had the one adviser.

Congratulations Canberra!! Well done!! Fantastic outcomes...

This will be a great case study regarding government intervention, and unintended consequences to the detriment of the consumer! Bravo…

Astounding group policies were not targeted by APRA. Further proof the government want Industry Super to rule the world. Even…

Read somewhere that there are only 200 life insurance advisers left in Aus. But thewre are unaccounted for numbers in…

My Level Premiums with One Path increased 300% since LIF and I recieved letters from ONEPATH / Zurich that they…