AMP’s reality – another two years of unprofitable advice delivery

AMP Limited is Australia’s second largest financial planning licensee and, for the past half-decade, has not been able to provide financial advice profitably. It is at least another 18 – 24 months before it hopes to move beyond break-even.

This is the stark underlying reality revealed in AMP’s half-year results provided to the Australian Stock Exchange (ASX) this week.

Where AMP’s financial advice business is concerned there are two key messages in the half-year results documentation it provided to the ASX – “losses on track to halve in FY 22” and the hope of achieving break-even some time after that.

The official explanation is that the “underlying FY 21 loss in Advice is expected to improve by 50% in FY 22 reflecting the exit of employed advice, right-sizing network support cost and improving revenues”.

This then needs to be seen alongside completing the reshape of aligned advice with a base of 300 to 400 scaled practices from FY 22.

The company then cites its “longer term ambition targeting breakeven of Advice by FY24 through further rightsizing to support activities and cost reductions from automation.

The bottom line is that AMP has been “transforming” its financial planning business for three years and imposing some significant cost reductions but it still has a long way to go before it is likely to make its shareholders happy.

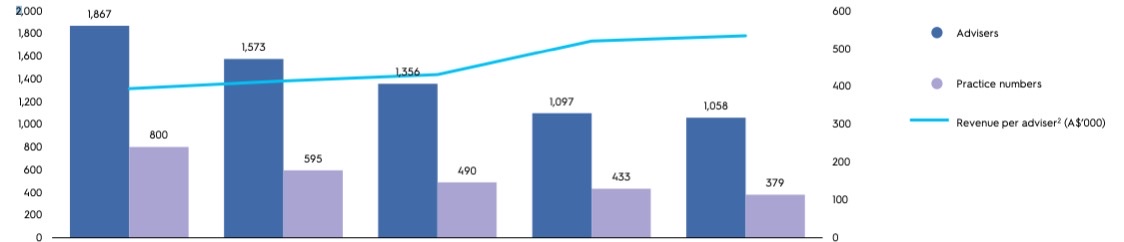

The cost reductions and reshaping within AMP are reflected in the fact that in its first half report in 2021 it had 1,356 financial advisers and today that number sits at 1,058 largely as a result of the sale of its employed advice business and the flow through from its divestment of majority owned practices.

Key to the AMP strategy to return to break-even is the reduction in adviser numbers and an allied increase in revenue per adviser. According to AMP’s half year results documentation the company has been growing revenue per adviser over the past two years but has still a long way to go to achieve break-even.

What is clear is that allied to its hopes of reducing costs and increasing adviser revenue is AMP’s ambition to attract independent financial advisers (IFAs) to use of its North platform and other services.

Indeed, AMP has highlighted that cashflows from IFAs to North were up 49% to $758 million together with an expanded range of managed portfolios with assets under management surpassing $5 billion.

Looking forward, the company has confirmed its intention to launch a retirement solution on the North Platform and to grow its distribution capabilities to support the IFA market citing investment in the North digital experience and functionality including digital consent, Record of Advice templates, digital integration and proactive workflow management tools.

AMP will never be genuinely profitable from advice. Nor will any other large licensee. Advice costs increase exponentially with scale, they don’t reduce. Monitoring and supervising the behavior of advisers is much more efficient when they are smaller in number, and directly employed by the licensee. No amount of technology will ever overturn that economic reality.

The only way large licensees make a profit is by generating more from inhouse product sales than they lose from advice costs. That has always been AMP’s model and always will be.

So AMP expect to increase profits by attracting independent financial advisers to North Platform. As an IFA i will never recommend an AMP product from the point of view that i do not trust them and as part of my risk analysis i would never put my client through a company that is dishonest, immoral and disingenuous. This is called Company risk and m clients see AMP as a whole company not just its Wealth Management division. On that note, my clients tell me that they dont want to investment their super in AMP.