No place for a superannuation oligopoly

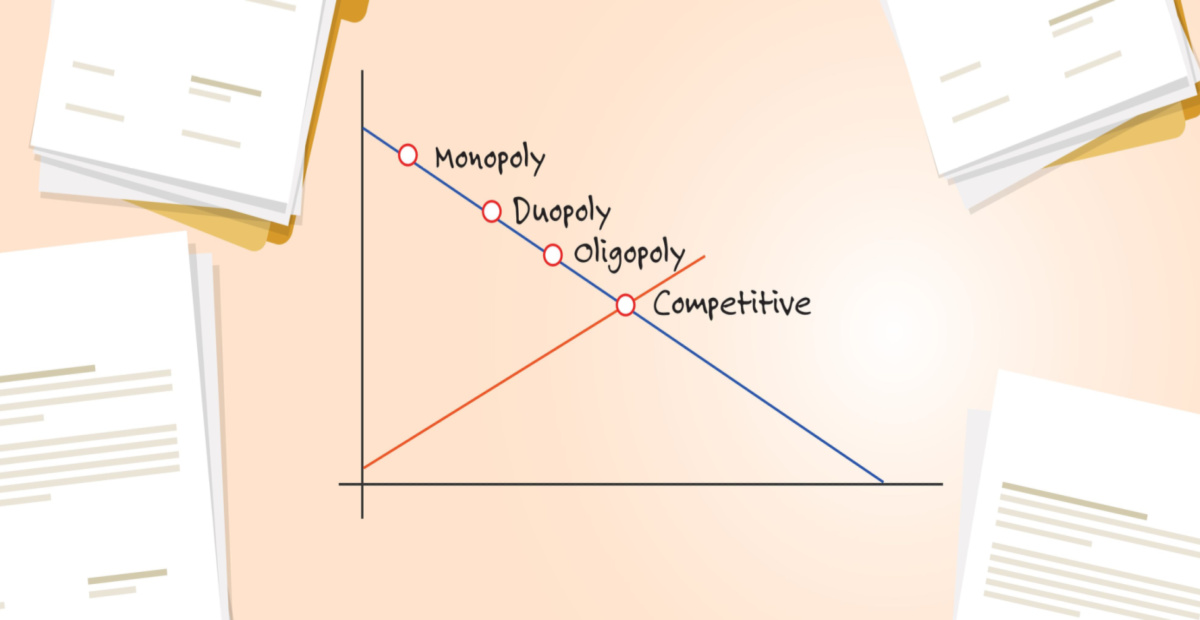

Just a week out from the results of the superannuation performance test the Government has been warned against allowing the number of superannuation funds to drop below 40 or 50 because it risks strangling competition and diversity.

What is more, industry veterans have warned of the problems which stem from a banking oligopoly being reflected in a superannuation industry reduced to as few as a dozen mega-funds.

Deloitte superannuation consultant, Russell Mason said he believed somewhere between 40 and 50 were necessary to ensure competition in the industry.

“I wouldn’t want to see it drop any lower than that level of retail and industry funds together with a number of larger corporate funds such as Qantas and Telstra Super,” he said.

While not wishing to nominate an ultimate number of superannuation funds, SuperRatings chief executive, Kirby Rappell told Financial Newswire that he believed diversity and competitive tension was healthy for the superannuation sector.

“Providing superannuation funds are delivering appropriately and efficiently for their members they should be allowed to remain,” he said.

Superannuation sector veteran and current general manager of Advice IQ, Paul Harding-Davis said that he believed that the number of APRA-regulated superannuation funds was starting to get dangerously low.

“It is getting to the stage where the competition tension which has helped drive fund performance is being put at risk,” he said.

At the same time, the chief operating officer of Infocus Wealth Management and Platform Plus, Steve Davis, said Australia’s banking oligopoly had proved problematic for successive governments and he believed there were dangers in creating what amounted to an oligopoly in the superannuation sector.

Deloitte’s Mason said he believed that the mega-funds such as AustralianSuper and the Australian Retirement Trust (ART) were well-run and successful but he believed super fund members deserved to have greater diversity.

He said the performance of small to mid-size funds such as Non-Government Schools Super (NGS) and Legalsuper deserved to remain in the sector on the basis of their performance and delivery to members.

At the same time, Mason said that superannuation funds covering workers in high-risk industries such as transport and electricity deserved special consideration, not least for the insurance cover they delivered to members.

Similar experience however due to health issues I am stuck with Zurich. Tried to make a trauma claim for cancer…

Using FSC's logic, a lack of indexation applying to income tax thresholds means that eventually every taxpayer in Australia will…

It would be interesting to know how many of those 15,587 licensed advisers have authorisations to provide insurance advice? My…

Meanwhile in the UK commissions increased to over 100% and the insurance level corrected. Australian Government Treasury and FSC are…

Congratulations Canberra!! Well done!! Fantastic outcomes...