3 in 5 Australian advisers now using managed accounts

Nearly three in five financial advisers are now using managed accounts in client portfolios with the main reasons being their availability and performance, according to new research from Investment Trends sponsored by State Street Global Advisors.

The research, published today, reveals that 59% of financial advisers are using managed accounts in client portfolios, up from 56% a year earlier.

Releasing the report, SSGA and Investment Trends noted that the use of managed accounts had tripled in the space of a decade with the growth trend likely to continue in circumstances where a further 16% of advisers have expressed interest in adoption.

They said this suggested that managed account use could, potentially, reach 75% of advisers in coming years.

Speaking to Financial Newswire, SSgA’s vice-president and ETF and Model Portfolio Strategist, Sinead Schaffer pointed to the US experience as an indicator of the potential for managed account growth in Australia.

“We tend to follow the US,” she said,

The latest SSgA Investment Trends Managed Accounts Report surveyed 946 financial advisers across Australia between November last year and January, this year, which showed that demand for SMAs and IMAs had remained robust despite global economic uncertainty and inflationary pressuers.

The Report showed advisers using managed accounts allocate, on average, close to three-fourths (71%) of clients’ total assets into these accounts. Additionally, managed accounts advisers are directing a record 48% of new client inflows to managed accounts, setting a new high—up from 41% in 2024, reflecting the growing prominence of managed accounts as a primary investment structure.

“This explains why funds under management (FUM) in managed accounts have surged 23.2% in the 12 months to December 2024 to a record-breaking $232.77 billion,” the report analysis said.

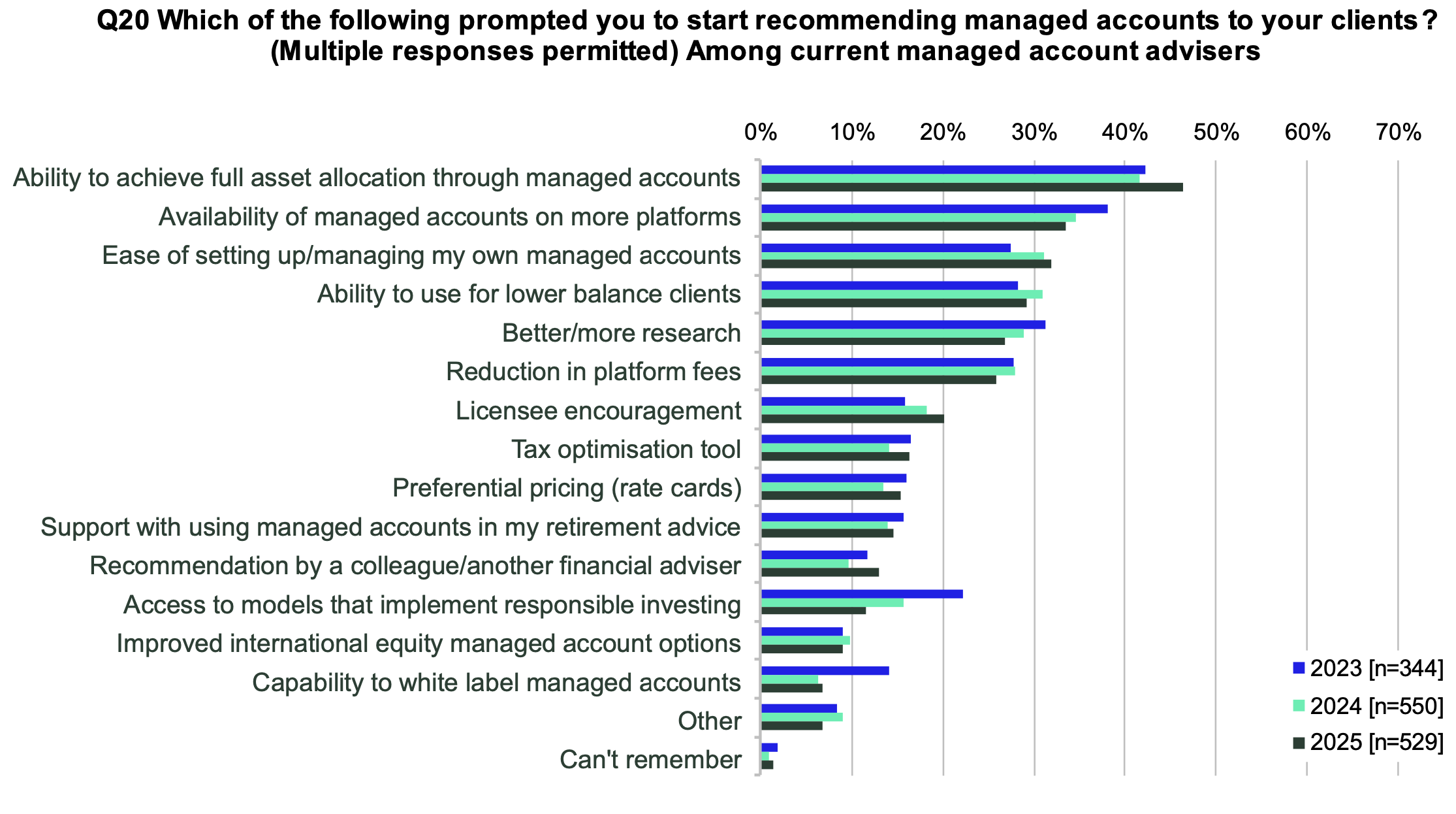

Schaffer said performance is the most important factor when selecting a managed account with advisers valuing the ability to achieve full asset allocation.

“Half of the financial advisers chose performance as the most important criteria when selecting a managed account, while availability on the main investment platform has now surpassed fees as the second highest priority,” Schaffer said.

The Report showed that multi-asset class models are the most widely used, as 68% of advisers recommended the models in the past year. Additionally, the ability to achieve full asset allocation is a key reason advisers recommend managed accounts to their clients.

That said, this year advisers have reduced the number of models they recommend to clients from 18.2 in 2024 to just 12.1 this year.

Roughly 3 in 5 advisers also work under licensees that provide managed accounts to generate product revenue for that licensee. And some of those inhouse managed accounts also incorporate other investment products associated with the licensee. All the talk about adviser efficiency is mostly just a smokescreen for inhouse product sales. It’s not very different to the old days of inhouse multi manager multi asset funds, like AMP’s Future Directions.

Not many vertically integrated licensees left now. Not sure where you pull these figures from.

Keep in mind that AMP is no longer VI.

Seen several clients with Managed Accounts and have used Managed Accounts myself. Each time the Managed Account with links to a licencee underperformed the equivalent portfolio by a significant margin, at least 1-2%pa. Each of these Managed Accounts were associated had ownership links with the licensee, and heavily used managed funds owned by the related license.

Regretfully, I am also seeing Research houses drop some services due to the profitable financial relationship they have with these Advice businesses, due to them promoting the Managed Accounts.

With technology I can use model portfolio’s and get better far returns than managed accounts, efficiently produce ROA documents and implement the switch in under 10 minutes, and not rip clients off. The time savings are promoted by brain washing product manufacturing licensee’s.

The sooner we get rid of the licensee the better.

I question the ethics of any Advisers in this situation. It reminds me of 1990. Those 9 hours of ethics are wasted.

So if an adviser uses a managed account which has nothing to do with the licensee, what would your opinion be then?

I strongly doubt your claim regarding managed account performance can be demonstrated.

I also doubt there is any hard evidence that ‘model portfolios’ get far better returns than managed accounts across the board.

I’m very happy using appropriate SMA’s from non-licensee sources and have no ethical dilemma in doing so.