Accountants hedge bets on Jones and TASA code

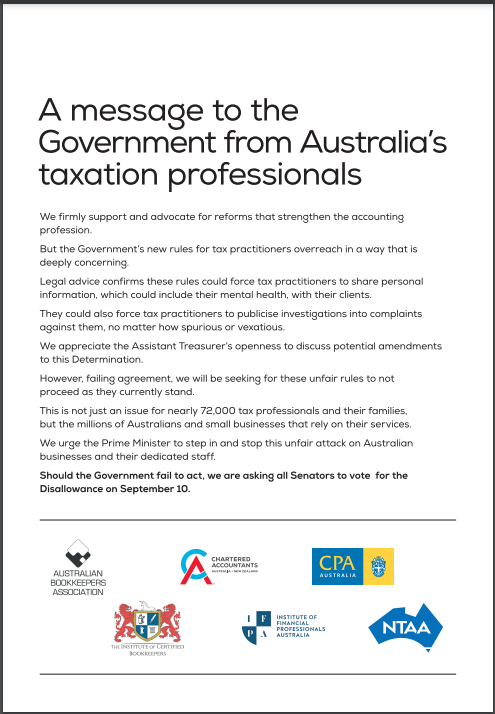

The major accounting bodies have further politically charged a meeting with Assistant Treasurer and Minister for Financial Services, Stephen Jones tomorrow by funding and publishing a critical open letter and urging a disallowance motion in the Senate.

The accounting groups published the open letter critical of the Government’s approach despite being scheduled to meet with Jones to discuss problems with the Tax Agent Services (Code of Professional Conduct) Determination.

Amongst other things, accounting groups have claimed the effect of the Government’s approach would compel BAS gents to reveal to clients personal information including with respect to their mental health and to publicise any investigations against them “no matter how spurious and vexatious”.

Commenting on the approach, Chartered Accountants Australia and New Zealand chief executive, Ainslie van Onselen said that since the changes were tabled in July her organisation had been in contact with Jones’ office expressing members concerns and “providing alternative wording in a bid to be helpful”.

“When it was suggested our members’ fears were ‘unfounded’, we shared with the Assistant Treasurer legal advice we obtained to validate their concerns.

“Many of our members have also written to their local parliamentary member explaining why the rules are not only unfair, but incredibly difficult to implement because they are so broad and open to interpretation.

“While the profession is being told that guidance from the Tax Practitioners Board (TPB) will solve this confusion, our members know this guidance is no replacement for black letter law.

“They can already see that the TPB is grappling with the interpretation of the Determination as it is currently written, evidenced by the numerous updates to their website,” van Onselen said.

Backing van Onselen, CPA Australia chief executive, Chris Freeland said the decision to publish the full-page open letter had not been taken lightly and reflected the deep concerns around the Government’s approach.

“We are committed to nurturing our relationships with government, parliamentarians and government agencies. While our decision to vocally express our concerns through the media is unusual, the unfairness of some aspects of these rules justifies our strong stance.

“We are particularly concerned about section 45 of the Determination which requires tax practitioners to disclose to clients ‘any matter’ which may significantly influence a decision of the client to engage the practitioner. In real terms, this may mean sharing irrelevant personal information with clients.

“These rules are causing real concern for professionals who already operate in an environment of significant scrutiny and regulatory burden,” Freeland sid.

“If Friday’s discussions between the profession and the Assistant Treasurer’s office cannot determine a suitable path forward, the bodies are asking for all Senators to support a disallowance motion in the Senate on 10 September 2024.”

Good on the accounting professional associations for taking a public stance. This is similar to what the mortgage brokers, pharmacy guild etc do.

However you’ll never find the FAAA doing it.

How can one Financial Services Minister reap such damage across multiple industries. A career union lawyer with zero business or finance experience in charge of making the rules for many small (and large) businesses without a thought to the consequences of his actions. The growth in red tape and reduced productivity is surely another issue too.