Class delivers ‘significant enhancements’ to platform

Accounting software developer Class has announced two “significant” automation enhancements to its platform that promise to increase the efficiency and simplicity for auditors and accountants in servicing their self-managed super fund (SMSF) clients and eliminate productivity-sapping manual processing.

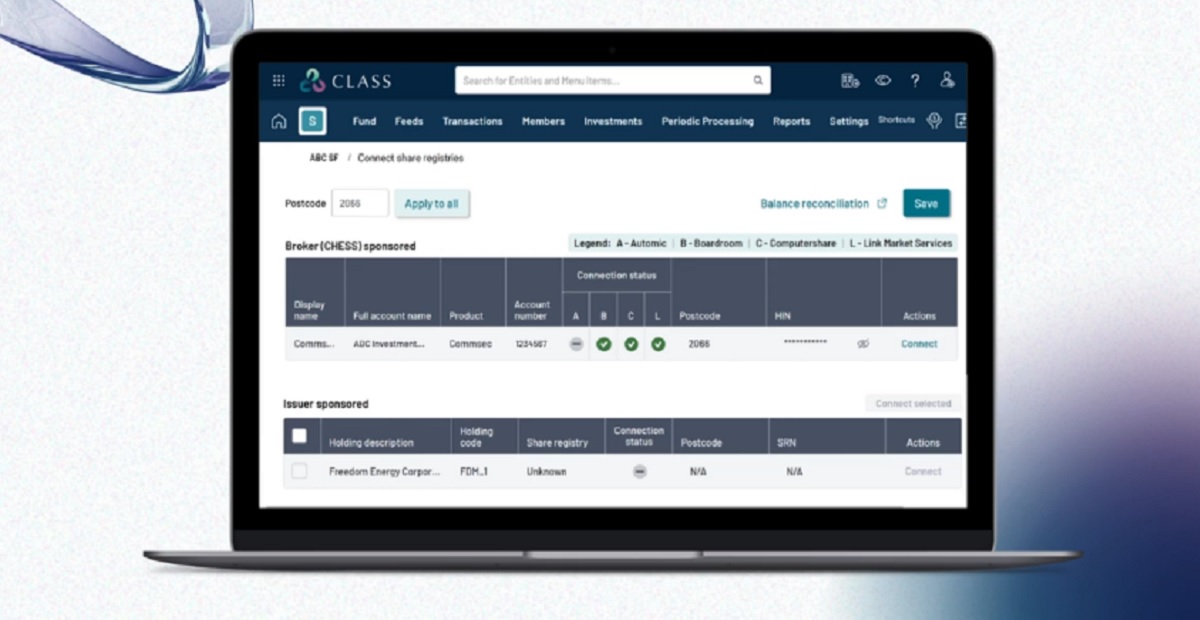

The platform will see the addition of new direct registry connections, with direct access to some of Australia’s largest share registries: BoardRoom, Computershare and MUFG Pension & Market Services (formerly Link Market Services).

The direct share registry connections, according to Class, eliminate the need for accountants to manually navigate registry websites and download documents for each security. This capability will, it said, lead to improved data accuracy, reliability and completeness, and deliver automated real-time reporting.

Together the connected registries provide data on more than two-thirds (69%) of ASX-listed companies and ownership and holding balances for more than 1,600 unique ASX-listed companies.

As well, Class has added an “industry-first” capability enabling directly sourced document feeds from major financial institutions, including Macquarie, effectively automating the retrieval of statements.

The two enhancements are the first in a series of planned efficiency and productivity-boosting releases for the platform.

“Real-time, accurate and automated data delivers improved efficiencies, greater productivity and better outcomes for clients,” said Class chief executive Tim Steele.

Citing Investment Trends data, Class notes that accountants currently spend around 7.3 hours annually servicing each SMSF client. By automating manual tasks, the researcher estimates that accountants could save an average of 3.2 hours per SMSF client annually.

These funds should be a lot more concerned about their investment returns, which are starting to look very sick. Waiting…

How deluded is this guy! Scandal after scandal and he thinks he has done a good job.

Phoenix has already begun ''Sequoia declined to confirm whether the end of the cross guarantee was part of a plan…

He “addressed regulatory through our simplification work”. This just shows how out of touch and clueless he is. We had…

Another failed bureaucrat blowing his own trumpet as $$Billions blow up from MIS fraud & failures, that ASIC were warned…