‘Get serious’: Australia facing ongoing shortages of accountants, auditors

The Federal Government has been urged to “get serious about” its skilled migration priority list after a peak financial services body identified a dearth of qualified local professionals in accounting, auditing and finance-related occupations.

The Chartered Accountants Australia and New Zealand (CA ANZ) flagged ongoing shortages across 11 finance-related occupations, including taxation accountants, general accountants, and external auditors.

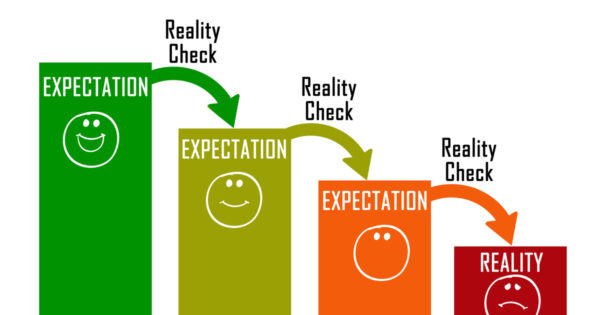

The CA ANZ called on the Government to add these occupations to its Final Core Skills Occupation List (CSOL), currently under industry consultation, arguing that these occupations are not being sufficiently filled by domestic candidates.

A recent survey by the CA ANZ of its members identified vacancy fill rates last year below 67 per cent for occupations including taxation accountants, external auditors, accountants (general), management accountants, internal auditors and finance managers.

The CA ANZ argued in a submission to the Jobs and Skills Australia agency, which oversees the formation of the draft CSOL, that skills shortages in these fields are “having significant impacts on business, the economy and capital markets”.

By adding these occupations to the Final CSOL, CA ANZ said that the industry would be able to “continue to enable employer sponsorship of these roles on skilled visas”.

The Federal Government said the CSOL will apply to the Skills In Demand visa for temporary employer-sponsored migration. While it may arguably be regarded as a migration ‘priority’ list, the Government says “there is no limit on the number of visas that could be granted for any given occupation”.

“The number of visas will be driven by the level of demand from employer sponsors, not by any assessment of priority by [JSA]”.

CA ANZ chief executive Ainslie van Onselen in a statement noted that, “with insolvencies continuing to rise”, Australian businesses are under increased pressure within these core functions.

“They need access to the expertise of accountants and auditors, not just now, but well into the future. That’s why we’ve lodged a detailed and practical submission on the draft CSOL with Jobs and Skills Australia.”

“While there’s been lively debate about why yoga instructors, martial artists and dog handlers are among the occupations the government is ‘confident should be on the list’, it’s time to get serious.

“Failure to include auditors and accountants on the final list won’t help organisations meet their mandatory legislative and regulatory audit requirements.

“This will be particularly important when new climate reporting and assurance requirements take effect next year,” van Onselen said.

Among the 11 occupations called on by CA ANZ to be added to the Final CSOL are:

- Taxation Accountant on the Final CSOL (currently in the list but urged by the CA ANZ to be retained).

- Accountant (General).

- Management Accountant.

- External Auditor.

- Internal Auditor.

- Finance Manager.

- Financial Investment Adviser.

- Financial Investment Manager.

- Management Consultant.

- ICT Security Specialist.

- ICT Business Analyst.

The peak body, however, called for the exclusion of Corporate Treasurer from the list.

IFPA sure DON'T represent advisers or SMC or Choice or FSC - these are all self interest anti adviser groups.…

If only Jim Chalmers would replace himself with a (suitably qualified) woman, maybe the economy would have half a chance…

So you want to fight the tide because...??? Those who are able to change tack and navigate around the obstacle...…

More anti adviser boffins. Ifs didnt understand the legislation around using the word independent and haven't been called out for…

Its impossible to argue Advisers shouldn't have this access. If anything, tax bas agents and accountants Shouldn't