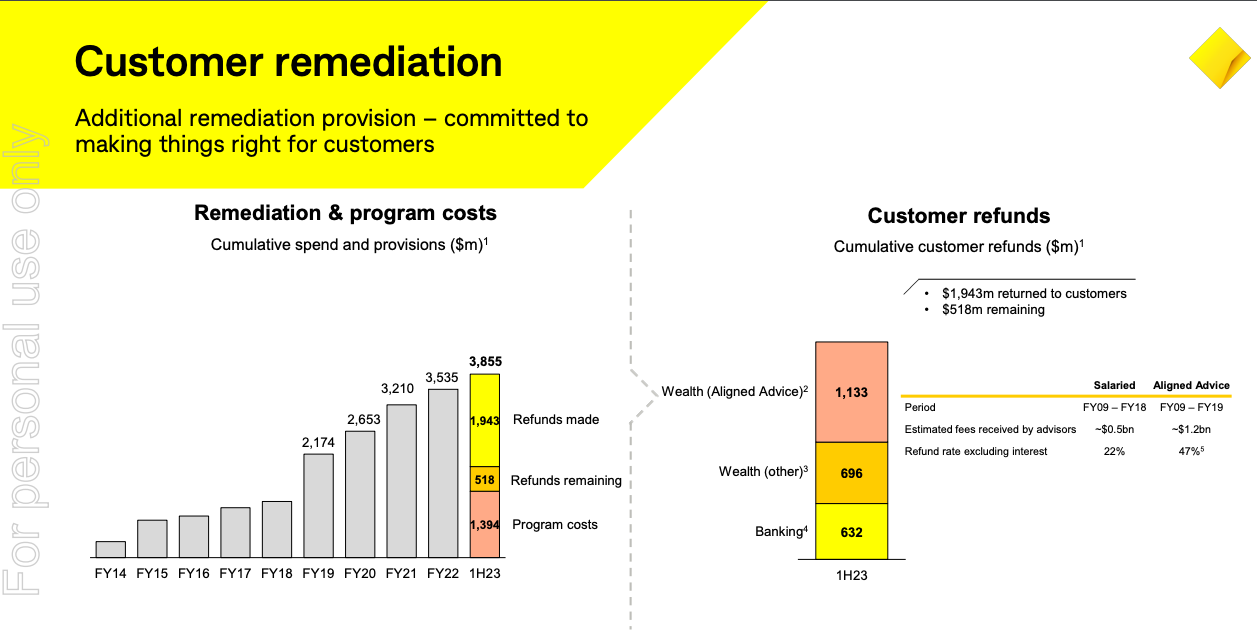

Nearly 5 years’ later, CBA has $518m in remediation to go

Nearly five years after the Commonwealth Bank began its exit from financial planning and four years after the Royal Commission final report the bank still has $518 million remaining to be paid in customer remediation.

As part of its half-year results announced to the Australian Securities Exchange (ASX) today, the CBA told shareholders that its cumulative spend and provisions with respect to remediation and program costs stood at $3.855 billion.

Of that, it said that $1,943 billion in refund made with $518 million in refunds remaining and $1.398 billion in program costs.

Just as importantly it said that $1.133 billion of the remediation was in relation to aligned advice primarily associated with ongoing service fees charged where no service was provided, while $696 million was related to an estimate of customer refunds relating to advice quality.

The bank announced in December that it had increased the limit of the indemnity it provided to CountPlus from $300 million to $520 million with respect to Count Financial sold to CountPlus in 2019.

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…