Advice, accounting groups ramp up $3m super cap pressure

The Government is under renewed pressure from the accounting and advice groups to significantly amend the legislation delivering the $3 million superannuation cap, particularly the taxation of unrealised capital gains.

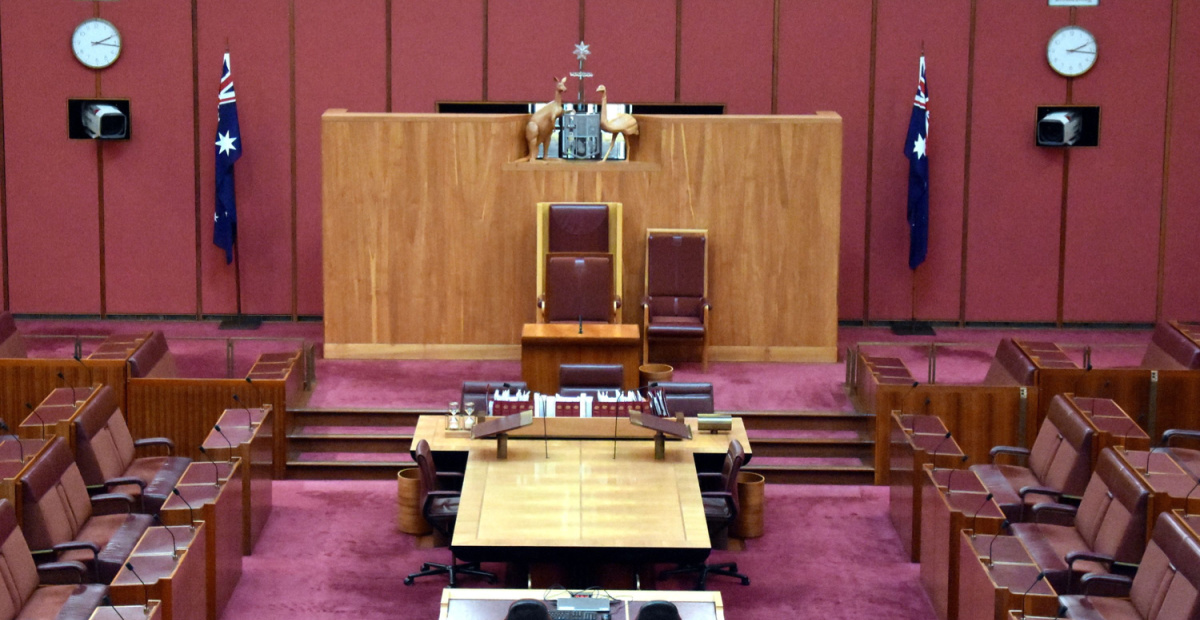

As the issue again faces scrutiny in the Senate, the Joint Associations Working Group has issued a statement recommending the removal of Schedules 1 to 3 of the legislation to enable consultation and to avoid significant unintended consequences.

It said JAWG members, which include the major accounting and financial advice organisations have identified four key issues which need to be addressed before the Bill is legislated:

- Taxing unrealised capital gains – an outworking of the calculations in the Schedules will see tax levied on the increase in the capital value of an asset, as well as actual taxable earnings. Capital Gains Tax will also be levied when the assets are sold;

- The absence of indexation – the $3 million threshold, left unindexed, will lead to generational inequity and unnecessary uncertainty for the superannuation system;

- Clarity on the proposed treatment of members in defined benefit funds, especially those already in receipt of pensions; and

- The impact of material increases to liquidity requirements for funds holding large and unlisted assets such as family farms and business real property.

“Applying different tax rates on capital gains, both notional and realised, is unnecessarily confusing and complicated,” the statement said.

The statement said the JAWG has broad industry concerns about the consequences of this approach, including both the impact on small business and primary producers who hold their small business premise and primary production land in an SMSF, and the constraints of applying these provisions in large funds.

“The JAWG notes there are other ways of reducing the tax concessions available to individuals with large superannuation balances that do not involve taxing unrealised capital gains.”

Providing background to their approach the JAWG emphasised the negative impact of taxing unrealised capital gains.

The JAWG is made up of:

Boutique Financial Planning Principals Association Inc. (BFP)

Chartered Accountants Australia and New Zealand (CA ANZ)

CPA Australia

Financial Advice Association of Australia (FAAA)

Financial Services Council (FSC)

Financial Services Institute of Australasia (FINSIA)

Stockbrokers and Investment Advisers Association (SIAA)

Institute of Public Accountants (IPA)

Licensee Leadership Forum (LLF)

Self Managed Super Fund Association (SMSFA)

The Advisers Association Ltd (TAA)

One must ask if the revelations of the union graft in the Victorian Big Build are true, then what is…

As the ACTU put together this statement whilst on the food and piss in the ISF members paid for MCG…

Does this mean APRA and ASIC staff are no longer welcome at the union fund super boxes at the NRL…

Couldn't care what the ACTU think. Just another diversion. They should be quiet. Ask yourself, if we started super again…

Based on this principle, advisers or super call centres recommending portfolio switches into Balanced Industry super options should be caught…