Advisers’ high net trust undermined by cost

Superannuation funds have signalling ramping up pressure on the Government to deliver the second tranche of the DBFO legislation following new research confirming that quality, professional financial advice remains too expensive for most Australians.

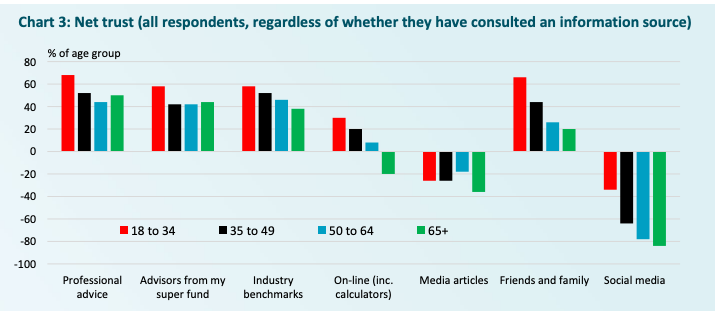

The ASFA research has confirmed the reality that financial advice clients are, generally, aged over 50, while younger Australians are prepared to consult other, less trusted sources such as family and friends and social media.

This is notwithstanding the fact that financial advisers have gained high levels of net trust among consumers, with the problem being that many regard accessing professional advice as prohibitively expensive.

The research, released by the Association of Superannuation Funds of Australia (ASFA), has prompted new calls for the legislative reforms to make high-quality, low-cost advice easily accessible via superannuation funds.

ASFA highlighted that their research had shown that only 51% of adult Australians, including around 60% of those aged over 65, had consulted any source of information on preparing for retirement.

Importantly, the ASFA survey found that Australians of all ages have a high degree of trust in professional advisers, advice provided by superannuation funds and industry benchmarks such as the ASFA retirement standard.

While super funds were some of the most trusted sources of advice, they remain highly under-utilised.

“Given the high degree of net trust in financial advisors and advisors from super funds, it’s concerning to see how low the use of these sources of advice are. This mismatch suggests that there are significant barriers preventing Australians from accessing the advice they need,” ASFA chief executive, Mary Delahunty said.

“Although people trust financial advisors as a source of information, the problem is that their services remain too expensive for the average working Australian to access. Sadly, these are the people most in need of quality financial advice to improve their retirement

ASFA is calling for the retirement income sector to work together and progress the second tranche of Delivering Better Financial Outcomes Reforms intended to make quality, trusted financial advice more accessible through super funds.

“The advice in super legislation will reduce red tape and improve the efficiency of accessing advice. It will be a revolutionary step for Australian’s access to trusted advice that will improve their financial wellbeing in retirement,” Delahunty said

“Our research shows how critical these reforms are to ensure that our superannuation system remains the envy of the world, we will continue to work closely with Government and with other stakeholders to align the sector to progress these issues as a matter of priority,” she said.

Nice try ASFA. But super fund advice is not professional advice. It is conflicted advice, designed to maximise super fund FUM, not client benefit.

The only solution to professional advice being too expensive is to fix the regulatory hot mess that unnecessarily drives up cost.

Typical Industry Super propaganda so they can flog more product, not real advice, via Uneducated, Unqualified, BackPacker call centres selling only single products, vertically owned and all paid for by HIDDEN COMMISSIONS charged to every member when most members get no sales advice.

This is becoming really, really boring – Cut the red tape for (existing) PROFESSIONAL Advisers.

What’s not to understand ?????

Why isn’t the solution ever getting rid of the bulls..t compliance requirements that simply confuse clients? If the powers to be wanted to do something it wouldn’t be that difficult, which shows that they want to move to conflicted vertical integration. Anyone who thinks an industry super fund will act differently from AMP or similar companies that have practiced vertical integration in the past is a fool.

Ah yes, but at least there will be a CSLR to pick up the cost. Dixons have taught Jonesy and his union mates that at least!

What a total shambles.

Time to retire I think … someone else can pick up the tab.

I cannot believe it just goes from worse to worser {if there is such a word}

When is the election again???