AMP back on top as largest licensee

The make-up of the top 10 financial planning licensees by financial numbers has changed with Insignia Financial dropping out of the equation as a result of the company separating out Rhombus Advisory Group.

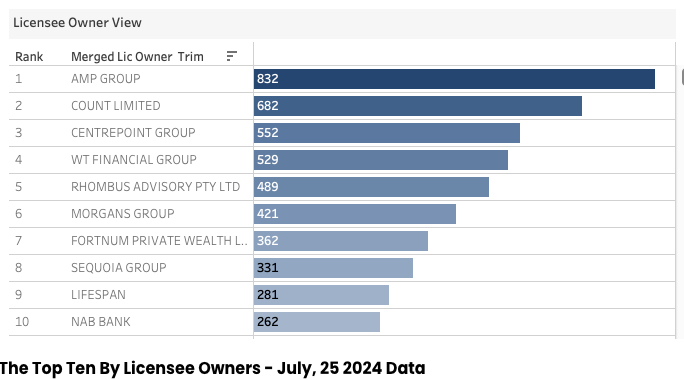

The latest analysis from WealthData reveals an advice industry in which AMP Group is the largest licensee with the next largest players previously having been regarded as mid-to-large entities.

Behind AMP in terms of adviser numbers are Count limited, Centrepoint, WT Financial Group and the 37% Insignia-owned Rhombus Advisory Group.

Key Adviser Movements This Week:

- Net change of advisers +13

- Current number of advisers at 15,493

- Net Change Calendar 2024 YTD (-127)

- Net Change THIS NEW 2024/25 Financial YTD +147

- Net Change LAST Financial Year 2023/24 (-215)

- 32 Licensee Owners had net gains of 46 advisers

- 22 Licensee Owners had net losses for (-30) advisers

- 3 new licensees commenced and (-1) ceased

- 18 New entrants – Same as last week

- Number of advisers active this week, appointed / resigned: 78.

Growth This Week – Licensee Owners

- Koda Capital increased by three advisers, all three leaving JBWere.

- Twelve licensee owners are up by a net of two advisers each, including:

- Viridian: Both are new advisers.

- Shaw and Partners: One new entrant and one adviser from Ord Minnett.

- Picture Wealth: Both advisers moved across from AMP Financial Planning.

- Lifespan: Both advisers moved from Millennium 3, now owned by WT Financial Group.

- Count: Both advisers are new entrants.

- ASVW Holdings: Both advisers moved across from Consultum.

- A new licensee: Both advisers moved across from Sentry Advice, owned by WT Financial Group.

- Nineteen licensee owners are up by a net of one adviser each, including the remaining two new licensees, Ord Minnett and Infocus Group.

Losses This Week – Licensee Owners

- WT Financial Group is down by seven advisers, with eight resignations and one appointment. Of the eight resignations, six are shown as being appointed elsewhere.

- Rhombus Advisory (see more below about Rhombus) is down by two, after appointing one adviser and losing three. Of the three who resigned, two went to ASVW Holdings and one is yet to be appointed elsewhere.

- ‘Total Wealth Planning’ also down by two and now down to zero advisers. Both advisers not showing as being appointed elsewhere.

- Nineteen licensee owners are down by a net of one adviser each, including AMP Group, Alteris Financial Group, Centrepoint, and Sequoia.

They’re like a zombie that you can’t kill

Well, there’s a very sound default reaction by any clear thinking adviser to this story – SO WHAT?! If there is a concern to be had then it is that AMP is still functioning and attracting advisers. This should be a concern to all advisers and their clients. After the beyond atrociously reprehensible way AMP treated advisers AND clients, why on God’s green and blue earth would ANY adviser willingly choose to have anything at all to do with such an untrustworthy organization? Why? AMP has destroyed adviser’s businesses and, in some cases sadly, their lives. Seems some never learn . . .

I imagine some people are between a rock and a hard place mate. Many one-man bands struggle to make ends meet, perhaps while the red tape dust settles, they are taking roles with AMP or quasi advising roles with superfunds.