Experienced advisers now commanding $200K plus

There has been an almost $40,000 increase to nearly $200,000 in the remuneration currently being demanded by experienced financial advisers, according to new research undertaken by consultancy Business Health and Iress-owned Advisely.

The research represents an update on an exercise undertaken in 2023 and reflects consequences of the decline in financial adviser numbers and the competition between financial planning licensees.

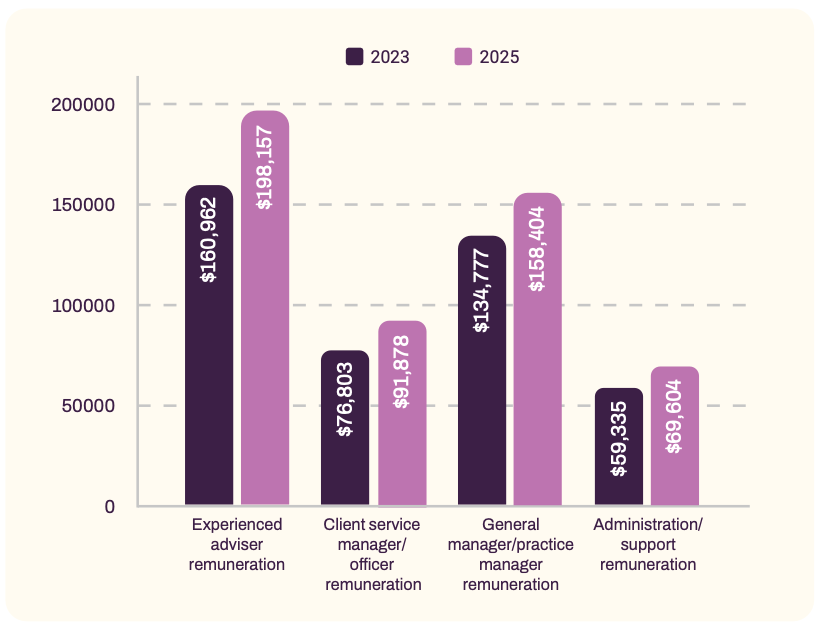

The research found that the average package being paid for experienced advisers is up 23% in 2025 compared to 2023 to just under $200,000 a year, while client service managers have seen a 20% increase in remuneration to $92,000.

It said the average compensation package for administration/support personnel was up 17% to $70,000.

However, senior paraplanners suffered a 2% decline to $107,397.

The research confirmed that in-house salaried advisers and employees were receiving less than their IFA counterparts, with an experienced adviser with more than five years’ experience earning just $175,377 albeit with access to a $22,780 bonus.

The research analysis said that with fewer firms directly employing paraplanners, and with AI promising to automate many of the key paraplanning functions, there appeared to have been a rethink in how the roles are structured.

Also reflecting the shortage of planners and continuing AFSL demand has been an increase in bonus payments over the two year period, with those paid to experienced advisers up 98% but, perhaps more interestingly, those paid to client services up 187%.

The research noted that while 45% of firms are offering some form of incentive plan, many of the bonus programs “lack clarity, inclusivity, objectivity, governance and structure”.

Further it said almost one in three owners (30%) said their incentive plan was not delivering the desired results for either their employees or their business.

“While this result is worrying, it’s even more alarming when taking into account the considerable increase in the size of bonus payments currently being made to employees,” the analysis said. “As stated in our 2023 report, continuing to invest money in incentive payments that do not incentivise is a very poor deployment of capital.”

In terms of in-house advisers, the $175,377 salary for experienced advisers declined to $109,206 for advisers with fewer than five years’ experience

Interestingly, the research revealed that while there was little difference in the average salary paid to experienced advisers along the eastern seaboard, experienced advisers in South Australia and Western Australia were being paid significantly more with an average salary of $211.519.

Always back self interest when a body is marketing a submission to the government

In other words the system is achieving what the government wanted to happen.

Every day I come on here it feels like it is just the SMC trying to lobby to make one…

Well our compliance and red tape costs average around $200-$250k per adviser. Go ask the government why advice is so…

Personal Financial Advice should be offered, but it needs to be independent of the Industry Funds and their trustees of…