HNWs getting richer but wealth managers still feel pinch

The number of high net worth individuals together with what makes them high net worth has increased in Australia over the past 12 months, outstripping many other developed economies.

But the problem for financial planning licensees, fund managers and others is that the increasing wealth among high net worth is not being reflected on the balance sheets of wealth management firms.

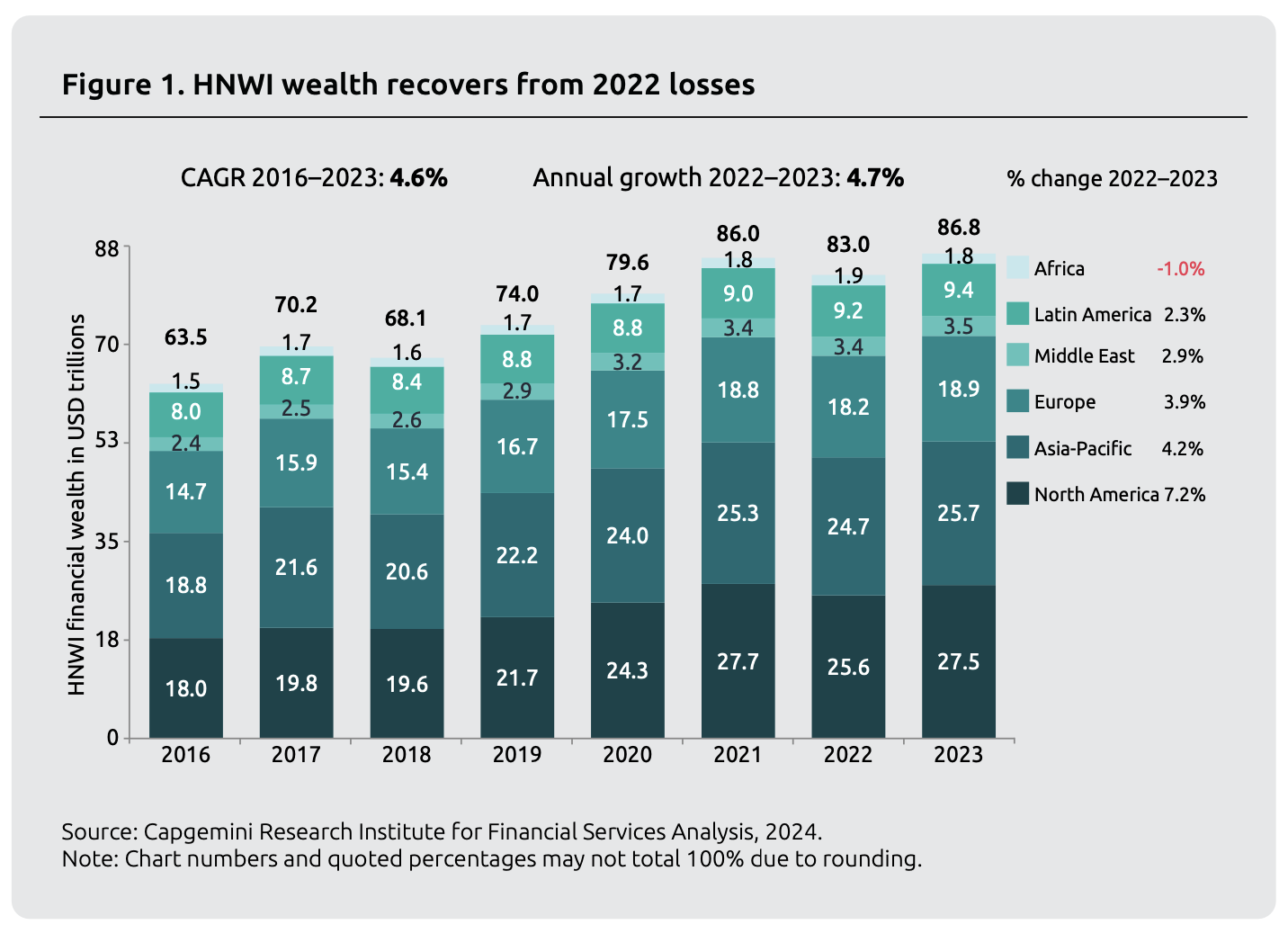

The latest Capgemini World Wealth Report identified Australia alongside India as being among the best performers in the Asia Pacific region (APAC) with Australia recording 7.9% wealth growth among high net worth individuals and 7.8% growth in its high net worth population.

This compared to India which recorded 12.4% wealth growth and 7.8% in terms of its high net worth population.

The Capgemini analysis said the increases in both countries were driven by resilient economies and robust equity market performances, noting that the Australian S&P/ASX200 index gained 7.8% over the period.

What Australian financial planning licensees will find interesting in the Capgemini research is that, globally, the fact that high net worth individuals are doing well is not actually translating into benefits for wealth management firms.

It said surveyed wealth management executives ranked the threat of recession, evolving interest rates, stock market uncertainty and geopolitical upheaval as their top concerns for 2024.

“These macroeconomic headwinds are squeezing wealth management firm revenues even as high net worth individual wealth grows.

“Our analysis of annual reports from leading wealth management firms uncovered that their primary revenue streams are currently facing substantial pressure,” the Capgemini analysis said.

“This pressure stems from external factors such as a challenging macroeconomic landscape and heighted geopolitical uncertainty in the short term.”

The analysis pointed to management and performance-based fees which comprise 55% to 70% of total revenue being under pressure due to slower market growth while advisory and value-added services fees which comprise 5% to 10% of the total revenue are under pressure due to competition.

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…