How the advice AFSL landscape is changing

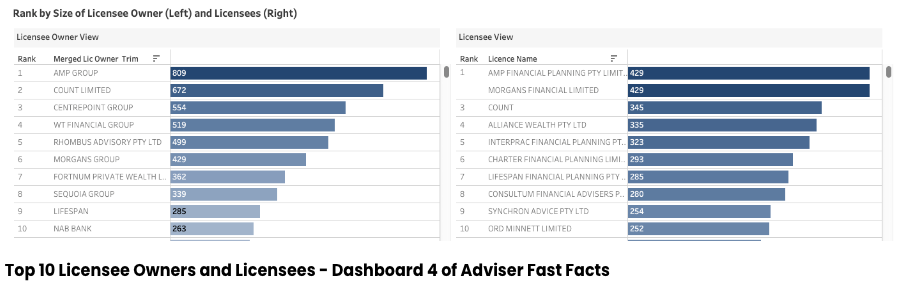

The changing texture of the financial planning sector has been reinforced by the latest analysis of the Australia’s largest financial planning licensees which still lists AMP at the top ahead of the transaction with AZ-NGA and Entireti (Fortnum) playing out.

The latest analysis conducted by WealthData principal, Colin Williams reveals a sector which has almost completed its transition away from the dominance of AMP and Insignia Financial with the resultant rise of players such as Count Limited, Centrepoint Group and WT Financial.

Williams said that, ultimately, Entireti would be the largest financial planning entity with 1,170 advisers.

But, as things currently stand, the below table reveals the groups making up the top 10.

Key Adviser Movements This Week:

- Net change of advisers +11

- Current number of advisers at 15,496

- Net Change Calendar 2024 YTD (-129)

- Net Change Financial YTD +153

- 30 Licensee Owners had net gains of 61 advisers

- 29 Licensee Owners had net losses for (-51) advisers

- 7 new licensee commenced and 1 ceased

- 12 New entrants

- Number of advisers active this week, appointed / resigned: 133.

Growth This Week – Licensee Owners

- Arthur J Gallagher up by 10, all advisers moving from VIAFGA Pty Limited (Via Financial Group), owned by LRM Wealth.

- New Licensee commenced with eight, all advisers moving from Havana Financial Services

- Another new licensee commenced with seven and all advisers moving from AMP Financial Planning

- Another new licensee commenced with four and again, all advisers moving away from AMP Financial Planning

- Six licensee owners up by net two:

- Two new licensees, one with advisers leaving Infocus and the other with advisers again leaving AMP Financial Planning

- Spark Partnership Group with one adviser from Statton Pty Ltd and the other from Private wealth Pty Ltd

- Pooledfunds with both advisers leaving Parkside Investorplus Solutions

- Macquarie Group with one new entrant and one from SGN Financial

- Finchley and Kent continue their growth with one adviser from Commonwealth Private and the other from Boston read.

- A tail of 20 licensee owners up by net one including two more new licensees, Morgans Group (see more below), Evan Dixon, and UniSuper.

Losses This Week – Licensee Owners

- AMP Group down by 10, it was a busy week, as noted above losing advisers who started their own licensees. They did hire two new entrants and two advisers from Alliance Wealth owned by Centrepoint Group.

- O & Z Pty Ltd losing six (after losing eight last week). Four joined Finchley & Kent and two others to separate licensees.

- Centrepoint Group down by four, losing two to AMP Group and two yet to appointed elsewhere

- Infocus down by three, two commencing their own licensee and one yet to be appointed

- Three licensee owners down by 2

- Bell financial Group – none appointed elsewhere

- Count Limited, appointing two advisers including one new entrant, and losing four, only one being appointed elsewhere

- Sequoia, gained one adviser from Infocus, and lost three advisers all yet to be appointed elsewhere.

- A tail of 22 licensee owners down by one including Findex, Fortnum and Lifespan.

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…