Industry funds back ASIC on publishing IDR data

Industry superannuation funds have drawn parallels between the Australian Securities and Investments Commission’s (ASIC’s) proposals around publishing financial services internal dispute resolution data and the workings of the superannuation performance test.

The Super Members Council (SMC) has told an ASIC consultation that publishing common measurable data helps deliver better member outcomes with an example being the performance test in the super sector, along with the ATO fund comparison tool.

It said the super performance test has been successful in weeding out poor performing funds and “ensuring a laser like focus to the importance of stronger returns” while the ATO comparison tool means members can compare for themselves the performance of different funds.

“Similarly, the proposal to publish firm level data about complaints and reportable situations is a logical extension of ongoing efforts to provide members with more information about super fund operations, service delivery and value for money, including in the areas of investment performance, fees, expenditure and externally mediated disputes,” the SMC told ASIC.

“Reporting on complaints and breaches will incentivise funds and other financial firms to uplift their service delivery. It will allow firms to benchmark their performance against their peers and provide useful insights to identify and target efforts towards areas where they are most needed,” it said.

But, at the same time, the SMC has argued that superannuation internal dispute resolution (IDR) data has “unique characteristics that indicate that a high level of caution should be adopted, particularly when using the data for comparative purposes.

“Superannuation is a compulsory product that enables retirement savings for all working Australians. The level of engagement, while growing with increasing account balances, remains low. The level and types of complaints made to a super fund can be a factor of the actions of the fund, the demographics of the fund, and the external regulatory environment,” the SMC submission said.

“It is important that published contextual information relating to super funds indicates that many complaints relate to matters that are not within the power of the trustees to resolve e.g. requests for early release of funds, or accounts transferred to the ATO under the unclaimed money rules.

“While there is an obligation on trustees to inform their members, being mindful of the demographics of the fund, some funds will continue to receive a higher level of disputes many of which will have no standing due to a misunderstanding of rights under the superannuation system,” the submission said

As an Adviser authorised on the biggest Industry Fund for a client for 9 years.

I ask for an updated client report for a review and they claim can’t find Adviser Authority, yet again and no service as want another one. We have sent one every year, 9 adviser authorities they can’t find.

Send another authority for myself and our team and they claim it has to name every admin person with authority or will only speak to me,

We have no access to member data or reports online.

Industry Super report sent then lacks members investment details?

And report says member does not have an Adviser.

I make a complaint to Industry Super about all these issues and get No Response, months later = No response.

Industry Super are immature, poor service, hard to deal with and flat out LIARS.

ISA won’t report real service complaints.

ASIC & APRA won’t make them do it.

And as for ISA complaints that we all know about, who is ever held accountable ???? NO ONE

Who is named and shamed ??? No One

Deliberate adviser blocking tactics by union super funds. Some are OK, such as ART and and Aware. But Australian Super is totally anti adviser, and uses all sorts of deliberate barriers and hurdles to prevent their clients from receiving professional independent advice.

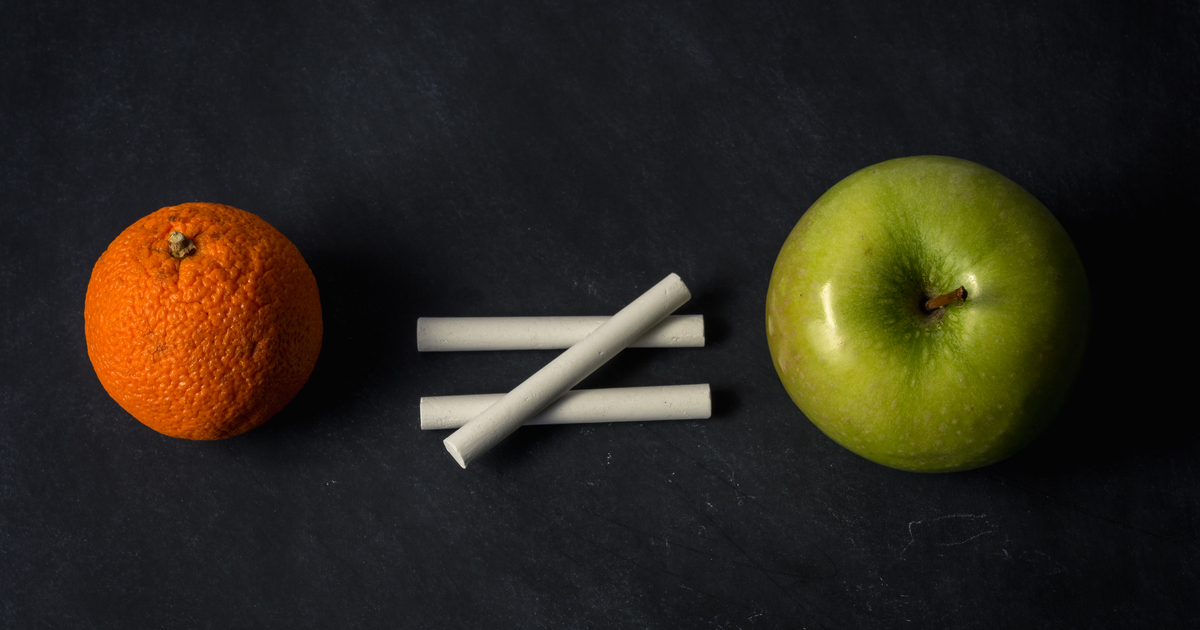

No this would be analogous with Industry Funds being named and shamed for individual breaches and incidents in IDRs and to ASFA. Their position is a false equivalency and the Associations should call them out. Already a completely unfair plying field, Tax us to death, now penalise firms trying to do the right thing and work collaboratively with the regulator. Disgusting given advice represents a tiny fraction under 2% of complaints while product providers and corrupt funds a great deal more

Has anyone noticed that most platforms try to classify complaints as feedback instead of complaints nowadays?

Even when you stipulate it is a complaint…

Of course the SMC supports ASIC’s IDR naming and shaming proposal—this is entirely in line with its broader strategic playbook. To understand the SMC, you need to see it as the lobbying arm of industry super, a dual-purpose operation: a funds management business wrapped in the rhetoric of public good, and an advice business chasing monopoly under the guise of accessibility. Their support for performance testing wasn’t about transparency—it was a commercial weapon. It cornered active managers, knowing even slight underperformance would kill them off under the weight of “benchmark accountability,” effectively pushing more money into passive products where industry funds already dominate and fees are easier to control.

This move on IDR data is part of a longer game—one aimed at undermining independent advice. SMC’s endgame has always been to dominate mass-market advice. First, they tried to throttle adviser fees from super accounts through s99FA. That failed. Then came the proposed New Class of Adviser—shelved, but not dead. What’s next is the push for collective charging for retirement advice, which would enable industry funds to offer “free” advice while using behavioural nudges to corral members into locked-up annuity-style products. Publishing complaint data, stripped of proper context, becomes just another way to discredit independent operators while industry funds, backed by a sympathetic media, look cleaner by comparison. Smart. Relentless. And entirely self-serving.