Interprac supplants Dixon on AFCA complaints list

Updated data from the Australian Financial Complaints Authority (AFCA) has confirmed the degree to which the Shield and First Guardian collapses will feed into the cost of the Compensation Scheme of Last Resort (CSLR).

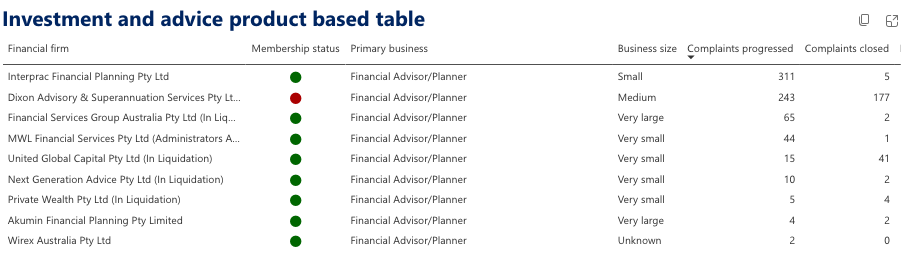

The AFCA Datacube has listed Shield and First Guardian exposed licensee, Interprac, at the top of its list of complaints received, now actually supplanting Dixon Advisory and Superannuation Services.

Also exposed to Shield and First Guardian and high on the AFCA list is MWL Financial Services, and United Global Capital Pty Ltd.

The AFCA Datacube reveals that that Interprac has had 311 complaints secured against it, with five closed, compared to Dixon Advisory which is listed as having 243 complaints with 177 closed.

The following represents the nine firms ranked in order of complaints received by AFCA.

The updated AFCA data comes at the same time as the Assistant Treasurer and Minister for Financial Services, Daniel Mulino continues to mull over how to the over-run in the financial advice sub-sector cap for the CSLR.

Mulino’s choices in dealing with the sub-sector cap over-run includes spreading the cost over a broader range of sub-sectors, with his decision expected before the end of the calendar year.

The anger of financial advisers at the mounting potential cost of the CSLR of the collapse of Shield and First Guardian is that those were both Managed Investments Schemes (MISs) which are not part of the CSLR levy catchment.

What is more, the AFCA complaints data dealing with investment and advice reveals that managed investments accounted for 21.6% of complaints received, with financial barely registering.

Where’s the Govt MIS review started 2023 by Hot Mess Jones ?

Hot Mess Jones buried it real deep. And screwed Advisers totally.

Should be fine though cause Crole said they did nothing wrong

ASIC should cancel Interprac’s AFSL already, like the other 4. Or is it too big to fail?

where are the RI Advice complaints I know of at 8, 5 from one adviser and 3 from another adviser????