Iress updates advice hub with new practice efficiency tools

Iress has added a new suite of tools to its community discussion platform Advisely, including a new benchmarking index to help advisers determine client service gaps.

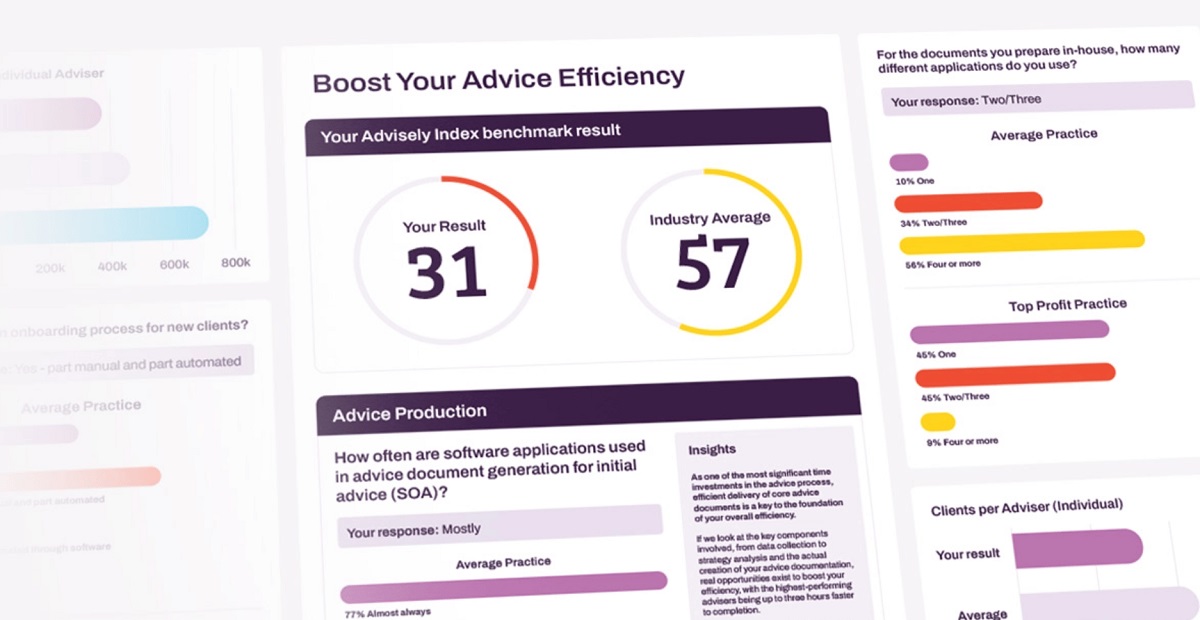

The ‘Advisely Index’ has been designed to help advisers, paraplanners and support staff unearth gaps in their advice production, execution, servicing and client engagement.

On completing a short survey, the Index will provide advisers and support staff with a personalised report comparing their performance against their peers in these key advice delivery metrics. The Index also provides personalised actions to improve advice efficiency.

Iress’ chief executive of Wealth APAC Kelli Willmer said top-performing advisers have saved almost one day per week as a result of efficiencies gained in advice delivery through the Advisely Index.

“That’s why we’ve created a resource pool of tools to further support Advisely members and the wider advice community to understand how they can capitalise on the advice opportunity ahead of us.”

Iress has also added a new Growth Masterclass from industry experts, which involves a first-hand case study of the transformation of fast-scaling financial advice business, Twomeys.

The series takes a behind-the-scenes look at Twomeys’ wholesale transformation program, including changes to its strategy, compliance, tech, leadership, people and cyber risk, and recommendations and guidance provided by experts. The first three of seven episodes of the series are now available.

Iress has also added a new Finding Time guide, providing advice businesses with tips to maximise practice efficiency and achieve results delivered by the Advisely Index Top 10.

The addition of the new tools comes off the back of the joint Iress/Deloitte Advice 2030: The Big Shift research report, which identified a “capacity conundrum” within advice practices, with many likely struggling to manage a tidal wave of new clients with capacity already stretched.

As noted in the report, Australia’s advice industry must contend with an additional 486,000 new clients, representing 30 new clients per adviser.

These funds should be a lot more concerned about their investment returns, which are starting to look very sick. Waiting…

How deluded is this guy! Scandal after scandal and he thinks he has done a good job.

Phoenix has already begun ''Sequoia declined to confirm whether the end of the cross guarantee was part of a plan…

He “addressed regulatory through our simplification work”. This just shows how out of touch and clueless he is. We had…

Another failed bureaucrat blowing his own trumpet as $$Billions blow up from MIS fraud & failures, that ASIC were warned…