Shield and First Guardian drive up adviser bans

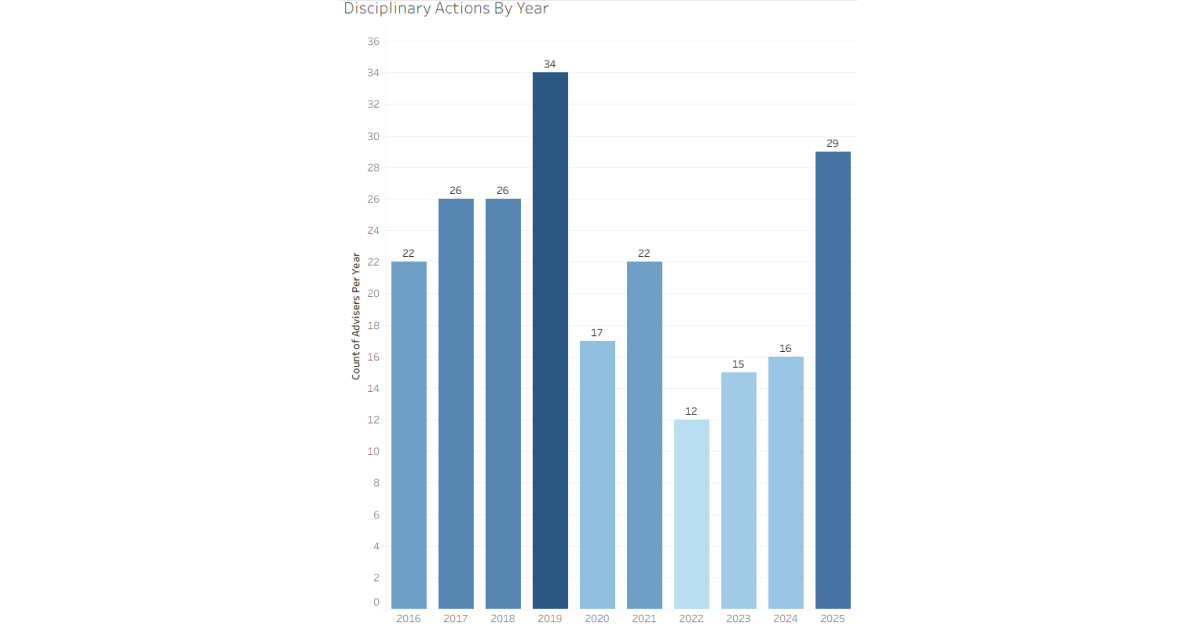

The inevitable fall-out from the Shield and First Guardian collapses have translated into 2025 delivering the highest number of financial adviser bannings and disqualifications since 2019.

According to data analysis conducted by Padua’s WealthData, disciplinary actions against advisers rose to 2029 last year, up from 16 the previous year. The high number of banning in 2019 (34) was a reflection of the continuing fall-out from the Royal Commission into Banking, Superannuation and Financial Services two years’ earlier.

WealthData principal, Colin Williams noted that none of advisers affected in 2025 are listed as “current” on the ASIC Financial Adviser Register (FAR) and that over the past ten years, 216 advisers were affected and only 11 are current on the FAR.

“Some may think these totals are low because adviser bans often appear in the news but many high-profile cases involve people not listed on the FAR (for example, Melissa Caddick), and some advisers appear in multiple reports as the same case progresses (identification, banning, sentencing),” Williams said.

The WealthData analysis has also revealed a solid week for financial adviser retention and growth with numbers on FAR growing by a net 11 to reach 15,141.

Key Adviser Movements for the week

- 15,141 current advisers

- Net change of advisers +11

- 26 licensee owners had net gains of 38 advisers

- 23 licensee owners had net losses of (-28) advisers

- 3 new licensees and 4 ceased

- 17 new entrants

- 82 advisers affected by appointments / resignations.

Other key dates affected by this week’s data

- Net Change Calendar 2026 YTD +69

- Net Change Financial YTD (2025/26) (-30)

- Net change last 12 months (-418).

Growth – Licensee Owners

- A new licensee commenced (details given to Members) with five advisers who were all previously at Sira Group, owned by Bannister Consulting (Note: one adviser still listed at Bannister Consulting).

- Sensible Investment Management, owners of licensee “Fish Tacos” up by four, all being new entrants

- Merchant Wealth Partners up by three, all three previously with Bombora Advice (one still listed as being with Bombora)

- Three licensee owners up by two each:

- A new licensee both advisers leaving Capstone

- Infocus Group, one adviser switching from Fitzpatricks Private Wealth and one new entrant

- Christopher Allan (AAG Financial Planning Pty Ltd), with one adviser switching from Fortnum Private owned by Entireti & Akumin Group and one from JFP Advisory

- A total of 20 licensee owners up by net one including: WT Financial Group, Ord Minnett Group and the remaining new licensee.

Losses – Licensee Owners

- Bannister Consulting (Sira Group), down by four, as mentioned above, the advisers commencing a new licensee

- Entireti & Akumin Group down by two

- Rhombus also down by two

- A tail of 20 licensee owners down by net one each including, AvalonFS, Insignia Group and Oreana. All four licensees that ceased were one adviser firms.

Based on this principle, advisers or super call centres recommending portfolio switches into Balanced Industry super options should be caught…

Members who paid $1.20 for something that was actually worth $1.00 should be compensated if the valuations were incorrect. Where…

Lying pigs! They want to use 10 years because they are getting beaten now that they are all "HUGGING the…

As reported in this publication last year, MWL’s Australian Financial Services Licence was cancelled by ASIC on 25 August 2025.with…

Interprac should be looking at a class action by the exiting adviser for unfair terms in an insurance contract!