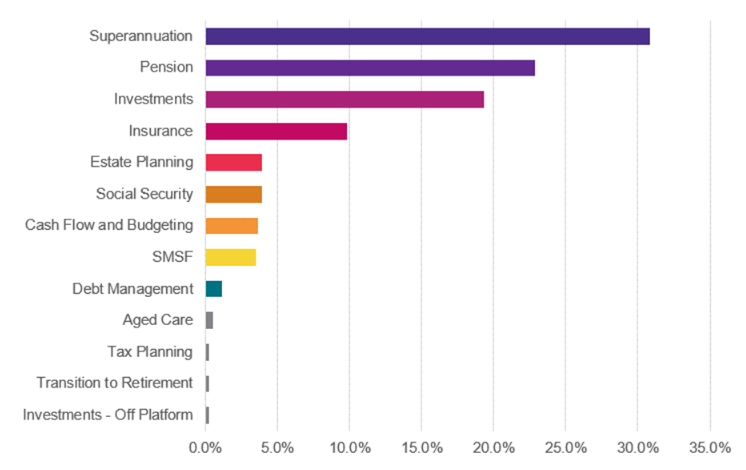

Super dominates advice strategies

At the same time as the Australian Securities and Investments Commission (ASIC) has sought to maintain a spotlight on financial advisers over superannuation fund selection, new data has confirmed just how dominant superannuation-related advice really is.

The latest analytics from Padua Solutions has revealed that superannuation-related advice accounting for more than 30% of that provided by advisers in August and that pension-related advice accounted for over 20%.

Interesting because of the position adopted by ASIC is that the Padua data points to the majority of the superannuation-related advice being around retaining or changing an existing superannuation account or retaining or changing an existing pension account.

But, equally importantly, “establishing a new super account” represented a comparatively small portion of the advice provided.

Padua co-founder, Matt Esler said there were 266 strategies recommended in August, representing 23.4% of the total technical strategies available to be recommended by financial advisers.

He said it also represented 74.4% of the total unique strategies in the June quarter.

"They need to ditch the “grandfathered” CFPs which totally undermine the value of the CFP designation." I said this years…

FAAA only has about half of the practising adviser population as members. (They also have lots of miscellaneous hangers on…

Anyone entering this profession to do the Professional Year would clearly lack the intelligence to gauge the probable risk/return of…

Utterly appalling from Cbus. Are the members paying the fines? Royal Commission required. This is a joke. Australia deserves better.

Ban them