Three years before adviser numbers return to genuine net growth

It may take another three years before the Australian financial planning profession returns to net growth, despite the latest data confirming that adviser exits have plateaued and, in some areas, started to rebuild.

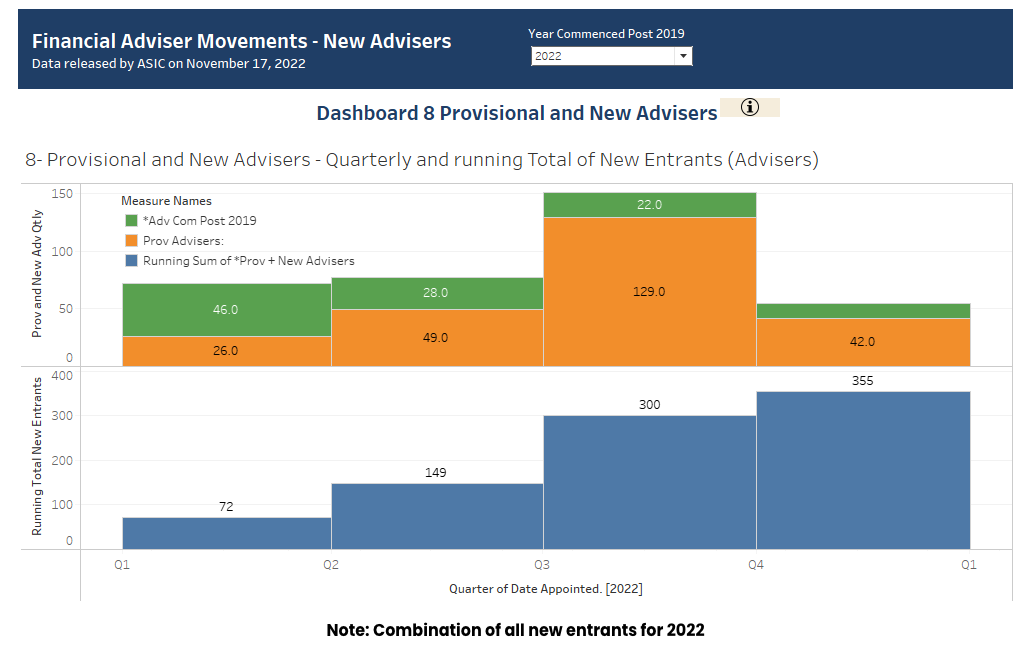

The bottom line confronting the profession is that notwithstanding around 355 Provisional Advisers and new entrants entering the industry so far this year, this amounts to barely half the number of advisers exiting the sector through simple natural attrition.

According to WealthData principal, Colin Williams the annual rate of natural attrition for financial advisers is around 5% which, based on slightly over 16,000 advisers, represents 800 advisers, or more than double the level of new entrants recorded so far in 2022.

But the important factor is that in the absence of exits generated by the financial adviser exam and the assumption that the “experience pathway” will be largely as predicted there are no looming catalysts for a further rush of exits.

Key Adviser Movements This Week:

Net Change of advisers -3

25 Licensee Owners had net gains for 29 advisers

26 Licensee Owners had net losses for (-30) advisers

2 new licensees “re-commenced” and (-2) ceased

8 Provisional Advisers (PAs) commenced and none ceased.

Summary

The number of advisers has well and truly steadied over recent weeks. The net numbers have been helped by a regular stream of new entrants. Closed licensees are small 1 adviser models and mostly associated with the restricted Accounting – Limited Advice business model.

Growth This Week

At the licensee owner level, 4 gained a net 2 advisers each. Beryllium Advisers picked up two advisers from Capstone Financial Planning. Andrew Wardle (Astute Planning Services) picked up two advisers from Madison AFSL owned by Clime. Affinity Group also up 2, one adviser coming back after a break and the other from Viridian. AMP group also up net 2 advisers, picking up 3 advisers and losing 1. For AMP one adviser is Provisional Adviser, 1 from AIA and the remaining adviser coming back into advice after a break since 2018.

21 licensee owners are up net 1 including both new licensees that effectively restarted after recently going to zero advisers. Licensee owners up net 1 include, Spark Partnership, Oreana, Evans Dixon, Fortnum and Fiducian.

Losses This Week

Clime tops the losses at (-3), as mentioned losing 2 advisers to another licensee. MCA Financial Planners and NGAA Pty both down by (-2). A tail of 23 licensee owners down (-1) including each of the 3 closed licensees. Insignia also down (-1) after taking on 2 Provisional Advisers and losing 3 experienced advisers.

New Entrants – 2022

The chart below highlights a running total of 355 new entrants for 2022. This is made up of a combination of Provisional Advisers and ‘advisers’ with a formal start date of 2022. Important to note that some of the ‘advisers’ may well have been appointed as Provisional Advisers before 2022.

While the numbers may be considered low by industry observers, it is a good jump of new entrants to what we had in the prior years. For context, the number of 355 new entrants would make this cohort the third largest licensee in the country. Of interest, AMP group have 23 (of the 355) which represents 2.39% of all their advisers, followed by Insignia at 22 (2.03% of their advisers). Fortnum at 10, which is 4.5% of all of their advisers.

95% of advisers I speak to have either had or have approached a mental health situation in the past 3 years. Realistically it is a crap job and even people entering the profession are working that out quickly.

You guys are dreaming – wait until 2026 when the educational requirements need to be met! The exodus will be biblical…

Mike seems to assume the “experience pathway” will remove the 2026 exodus. But Jones’ draft proposal has already increased the experience requirement to 17 years, rather than his originally promised 10. Who knows what additional limitations there will be when it is finally released. There was also absolutely nothing in the draft proposal about fixing the corrupt FASEA rules that unfairly disregard so much prior learning many planners have completed. I think 2026 is indeed likely to be another cliff.

17 years? what’s the start date?

The start date for new education/experience requirements is 1 Jan 2026. But to qualify for the currently proposed experience exemption, advisers need 10 years of experience prior to 1 Jan 2019. This effectively equates to 17 years of experience at the 1 Jan 2026 start date.

Agree. I am fuly qualified to continue beyond 2026…but can’t see myself still being in the industry 12 months from now.