Top 10 advice groups account for 31% of advisers

The days of the major banks and AMP Limited dominating financial planning and accounting for close to 50% of advisers are long gone, with top 10 licensees now accounting for barely 31.5% for all employed advisers.

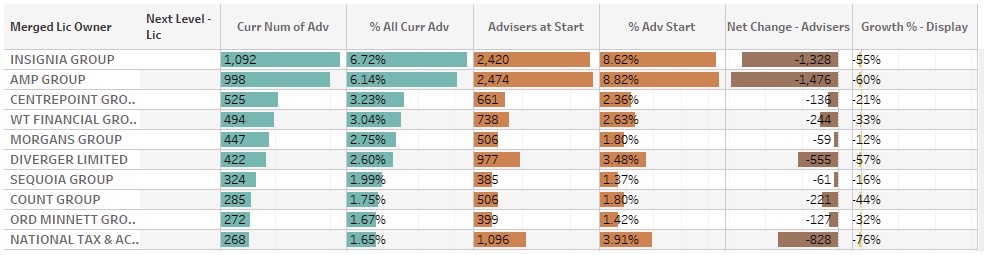

An analysis of where advisers are currently employed undertaken by WealthData confirms the degree to which the profession has changed with not one of the top 10 companies accounting for more than 7% of advisers.

This represents a far cry from the pre-Royal Commission days of 2017 when AMP boasted 2870 financial advisers, the Commonwealth Bank accounted for 1719 advisers, National Australia Bank accounted for 1667 advisers, ANZ accounted for 1151 advisers and Westpac accounted for 1136 advisers.

Importantly, licenses owned or controlled by the banks, AMP and IOOF accounted for around 50% of advisers in 2017.

IOOF, now Insignia, accounted for 860 advisers in 2017 meaning that out of all the groups dominating the profession half a decade ago, it is the only one to have grown in net terms.

In fact, these days Insignia leads the list of Top 5 companies by adviser numbers with 1,092, followed by AMP Group with 998. Centrepoint Alliance with 525, WT Financial Group with 494 and Morgans Group with 447.

While the WealthData analysis has pointed to the 10 largest advice entities losing advisers this year, the picture is not as grim as it might first seem.

WealthData principal, Colin Williams said that the vast majority of advisers who had exited Insignia, AMP Limited and the other larger licensees had found new homes with smaller financial planning groups.

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…