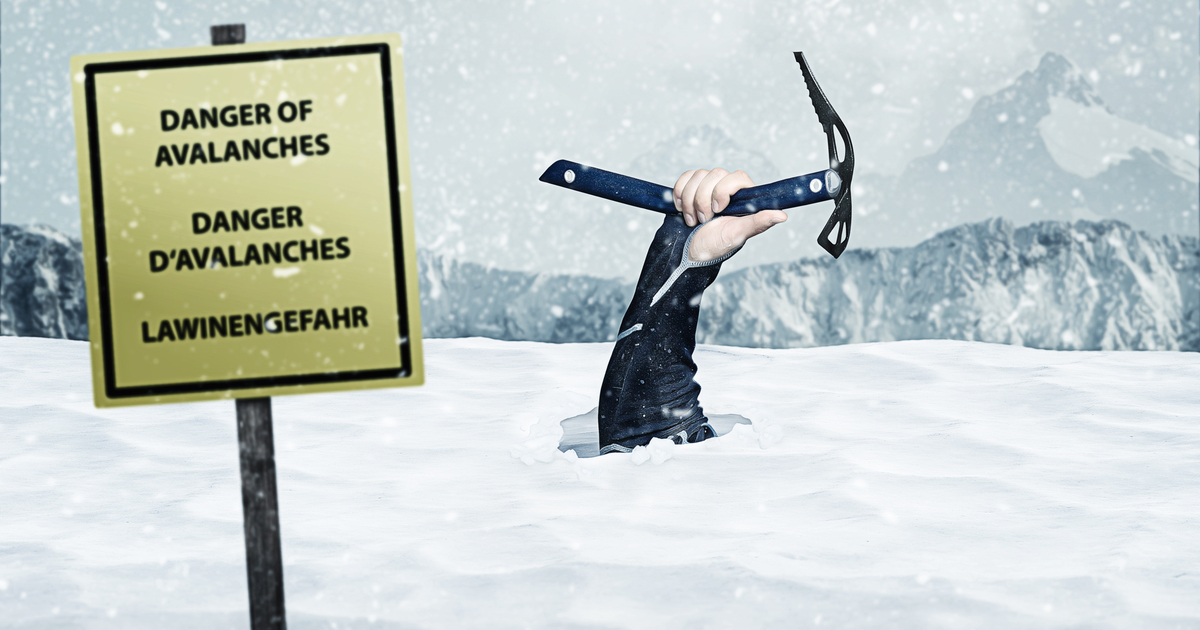

Who triggered the regulatory avalanche burying financial advisers?

ANALYSIS

In the eight years of the Federal Coalition Liberal and National Parties holding office in Canberra it is arguable that the financial services has been obliged to accommodate an avalanche of legislative and regulatory change much of which will climate next month – on 5 October, to be precise.

And most of that regulatory change has been the result of the Government having first doggedly pursued the 44 recommendations of the Financial Systems Inquiry (FSI) overseen by former Commonwealth Bank chief executive and later AMP chairman, David Murray, and then its dogged implementation of virtually all of the recommendations of the Royal Commission into Misconduct in the Banking Superannuation and Financial Services Industry.

But the event which really generated the regulatory avalanche now being suffered by financial advisers was the FSI process overseen by Murray because, embedded in its 44 recommendations sat the origins of the Design and Distribution Obligations, the ASIC funding levy, the Financial Adviser Standards and Ethics Authority regime, the increased powers handed to ASIC and the changes to superannuation.

Financial advisers and others in the financial services industry would do well to read the final report of the FSI and then measure its recommendations against the regulatory measures which will be introduced next month:

Reference checking and information sharing requirements

Breach reporting and the ‘notify, investigate and remediate’ obligations

Design and distribution obligations (DDO)

Hawking

Deferred sales model for add-on insurance products

Internal dispute resolution

What must be remembered about the FSI was that its final report was completed in 2014 so its recommendations are now more than half a decade old and that it came to its conclusions while the implementation of the Labor Party-inspired Future of Financial Advice (FoFA) regime was still on foot.

Then, of course, no one should forget the machinations which gave rise to the Life Insurance Framework (LIF) which was kicked off under the exertion of pressure from former Labor Financial Services Minister, Bill Shorten, but largely implemented by Liberal minister, Kelly O’Dwyer.

It is worth acknowledging that the newly-elected Abbott Government in 2013 undertook to moderate the impacts of the FoFA regime and promised not to introduce any unnecessary adverse changes to financial service.

Then, of course, came the revelations around fee for no service which acted as the catalyst for the Government acceding to the Royal Commission.

But it is worth noting that when the FSI report was being developed the major banks represented the strongest and most influential bloc within the financial planning and now, seven years later, they have almost entirely exited the arena.

As well, while the FSI final report offered up a smorgasbord of recommendations, it did not suggest the Australian financial services system was particularly broken, rather it acknowledged that there were areas in which it could be improved.

Amid all the discussion and debate in the financial planning community about the implementation of the DDO regime, a very senior licensee executive told Financial Newswire that the regime represented the answer to a question which nobody in Australia had actually asked.

He was right. The notion of the DDO regime was borrowed by the FSI panel from the United Kingdom which, while having a similar financial services industry to that which exists in Australia, also has significant differences.

When explaining the proposed DDO regime to the Royal Commission in 2018, the Federal Treasury said it, together with ASIC’s product intervention powers were intended to “protect consumers from unsuitable products”.

But, at the same time, it said the PIP and DDO regimes would not involve pre-vetting of products by ASIC – “Issuers and distributors would be responsible for ensuring their products are suitable for the customers to whom they are sold”.

So, the bottom line is that the financial services industry will do a lot of paperwork and ASIC will do what it, or the Government, sees fit.

Can someone please remind me of David Murray’s successes in financial services.