Platforms will pay for increased regulatory scrutiny

ANALYSIS

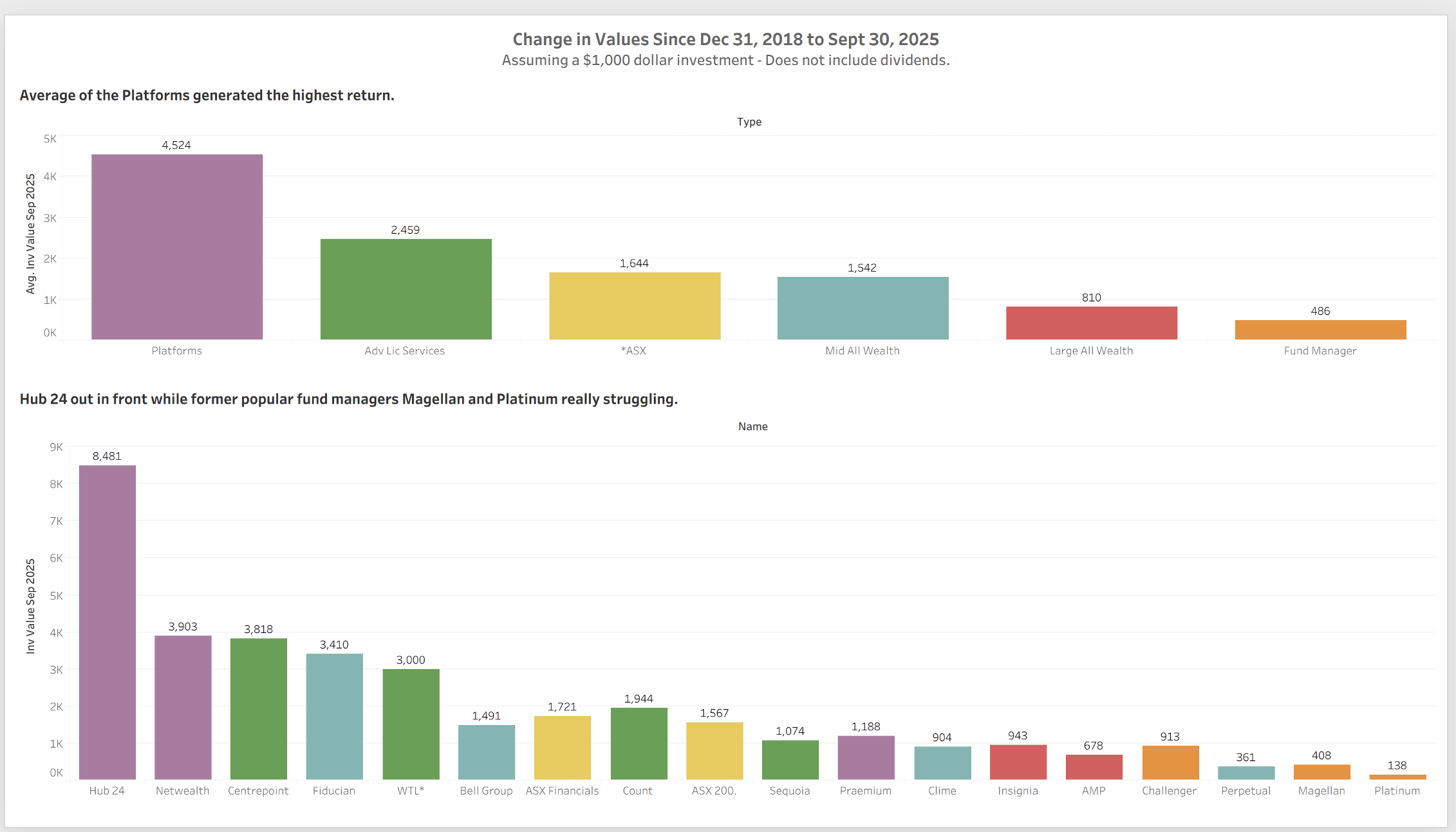

For the past five years investment platforms have been the most profitable segment of the Australian financial services sector far outstripping fund managers and financial advice licensees in terms of return on investment.

As the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) more closely scrutinise the superannuation platforms, analysis by Padua Solutions’ WealthData has confirmed just how well the segment has done relative to other businesses.

The analysis, undertaken by WealthData principal, Colin Williams, reveals that in terms of share price the platforms have been on a solid growth trajectory since 2023 while other segments such as licensees have flat-lined while fund managers have declined.

When it comes to the platforms, at the top of the tree in terms of fund flows over the past 12 months or so have been HUB24 and Netwealth followed by Macquarie.

However, and importantly in the context of the increased regulatory scrutiny prompted by the collapse of the Shield and First Guardian funds, HUB24 does not have an exposure and Macquarie Investment Management has already agreed with ASIC that it will remediate affected clients.

The full-year results published by Netwealth and HUB24 in August would have made heartening reading for investors with Netwealth reporting a 40.4% increase in net flows to $15.8 billion, bringing funds under administration to $112.8 billion, while HUB24 reported platform net inflows of $19.8 billion and platform FUA of $112.7 billion.

The investor briefings provided by both companies underlined the importance of superannuation in the FUA equation, with Netwealth stating retail super as accounting for 33.5% of FUA, with wholesale investment accounting for 42% of FUA.

For its part, HUB24 noted that superannuation assets regulated by APRA comprise 65% of the platform market.

The question for the platforms is to what degree the regulatory fall-out from the collapse of the Shield and First Guardian funds will impact their cost base in terms of investment oversight and governance around who they onboard to their platforms.

At the very least, APRA has signalled that the platforms cannot outsource accountability and in doing their due diligence around onboarding should not be reliant on a single source of investment ratings.

The current super products offered by platforms are now under huge threat, due to the regulatory risk of acting as trustee. Expect a massive streamlining of investment menus for the super environment, and a push to use SMSFs instead. Members with large unrealised capital gains in some super options are likely to be forced to sell, when those investment options are removed from the super platform.