Top wealthtech platform ups game with iFactFind integration

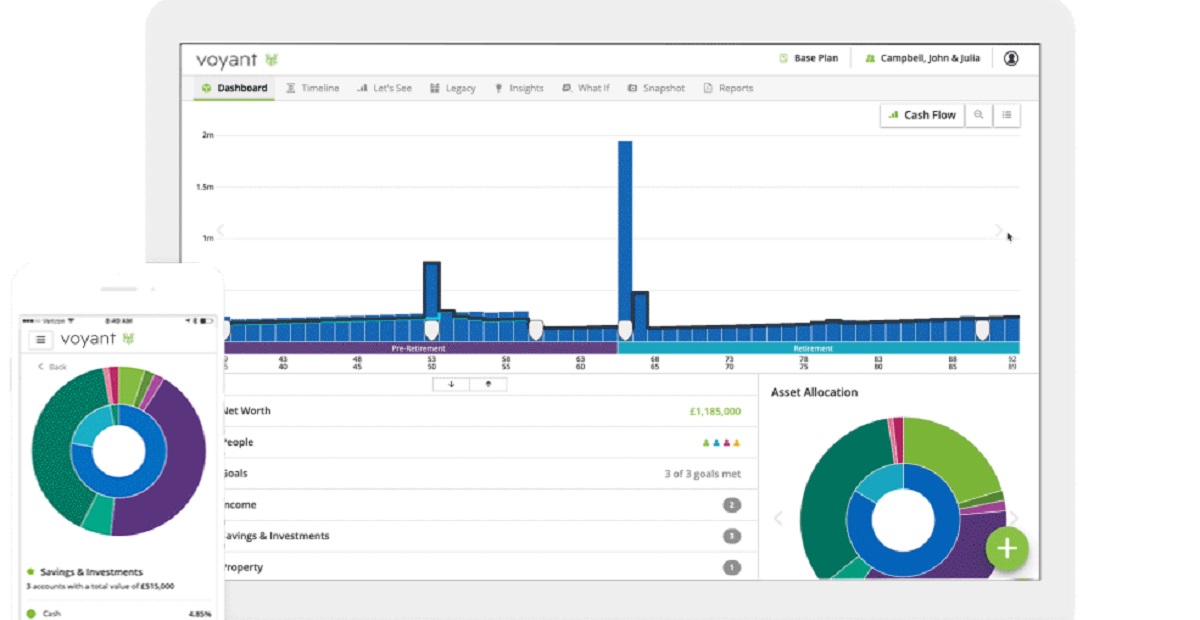

Voyant, a global financial planning technology company with a fast-expanding presence in Australia, has announced an upgrade to its AdviserGo platform, with the integration of Aussie fintech iFactFind’s client data analysis technology.

Voyant boasts that the addition iFactFind to its flagship AdviserGo platform will provide users with a “more accurate, holistic view of clients’ financial health, goals and prospects”.

This, it added, would facilitate “more enriching and productive discussions” with clients.

The cloud-based iFactFind is touted as a ‘living document’, designed to gather, manage and store client information.

The iFactFind integration, enabled through APIs, promises for users of AdviserGo to eliminate the need to manually re-enter data, “minimising administrative tasks and reducing the risk of errors”.

AdviserGo users will also benefit from iFactFind’s ‘one click instant modelling’ of clients, as well as more extensive modelling enabled through deeper data analysis.

“This can form the basis of insightful and robust client discussions. It also speeds up the delivery of advice, [and] facilitates more efficient meetings,” said iFactFind co-founder Dr Paul Moran.

Stephen Browne, Voyant’s vice president of business development for Australia and Europe, acknowledged AdviserGo’s API-first architecture, making it, he said, “relatively simple and inexpensive” to integrate AdviserGo with other API systems like iFactFind to “share data, improve processes, and foster more dynamic client discussions and meetings”.

AdviserGo is Voyant’s flagship financial planning platform, providing a “holistic approach” to retirement, cashflow management, investments, educating funding, life insurance, and estate planning, among others.

The US-headquartered Voyant recently broke into the Australian market, with Browne noting that the company has been listening to local planners and developing its system for Australian users over the last couple of years.

“Australia is a very important market for Voyant and relationships with innovative groups like iFactFind are extremely valuable and exciting,” he said.

Voyant is the UK’s largest financial planning software provider, developing solutions for Lloyds Bank, St James Place, HFMC Wealth and Abrdn Financial Planning (formerly 1825), and also has a strong presence in Canada, with clients including the Bank of Montreal (BOM) and Toronto Dominion.

As an employee who has lost super due to 2 small businesses, and as an adviser who has seen many…

Former adviser to Bill Shorten, when he was the Minister for Financial Services, He'll put us to the sword!

here we go, new member, new advice, new wooden steering we have to carve in order for him to "Steer…

Haven't they had a couple of years to prepare already?

Yep in fact watch a stack of previously “signalled” changes take centre stage again j fear for the diagonal if…