Active and green ETFs out of favour

Actively managed and clean energy exchange traded funds (ETFs) have struggled to gain investor interest over the past 12 months, according to the latest analysis from Global X.

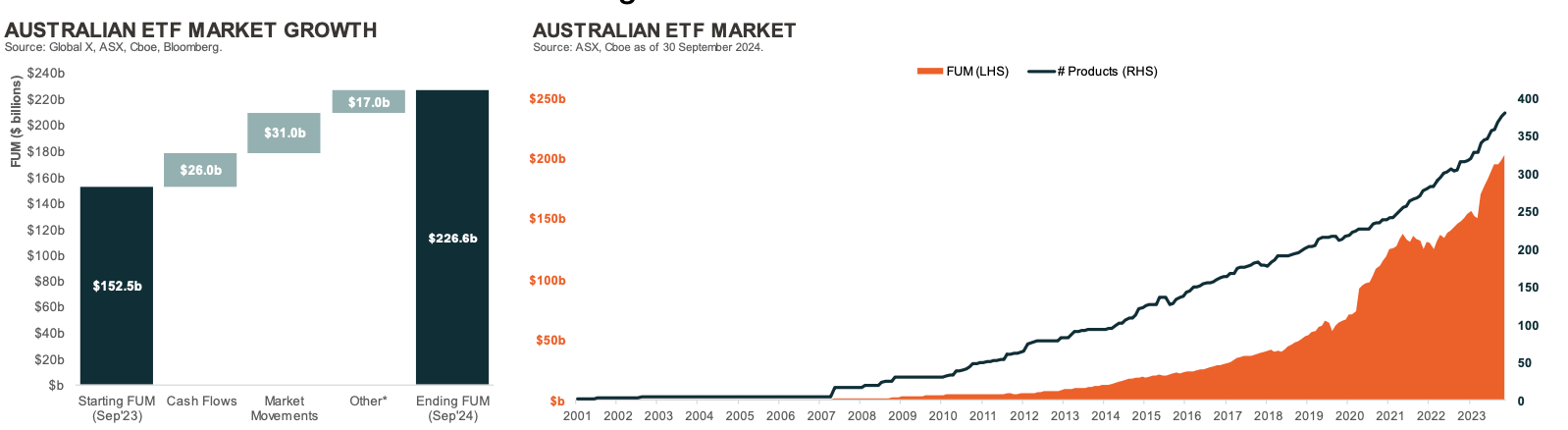

The latest Global X ETF market report pointed to the investor reluctance around actively managed and green energy ETFs notwithstanding the fact that the Australian ETF market grew by 48.6% over the past 12 months to be worth $226 billion across 394 products.

Global X said the increase was driven by $26 billion in net inflows, positige market movements and numerous unlisted active funds converting into active ETFs.

The analysis said that Australian investors seem to be favouring two things – low cost and simplicity.

“Most of the investor dollars have flown into broadly diversified cheap ETFs such as A200 and VAS, with both funds each receiving around $2 billion in net flows. Factor ETFs such as quality remain popular, and greater product proliferation (such as those combining factors like growth and value) could see continued interest,” it said.

However, it noted that not all factors are winning, with minimum volatility seeing less popularity.

“High-cost active ETFs continue to be shunned by investors in favour of their low-cost index ETFs. MGOC led the outflows with -$2.9 billion, while minimum volatility strategies also saw large withdrawals.”

The analysis said Cryptocurrency ETFs continue to be the best performing ETFs over the past year, buoyed by a falling interest rate environment, higher risk appetite by investors and strong flows into bitcoin ETFs.

The PHD in economics is the scariest. How many academics actually understand the real world

Money is leaving at a slower rate with this being considered by AMP management as a positive. Australia's Money Pit…

"Our recently launched digital advice solution for AMP Super members is providing simple, intuitive retirement advice at no extra cost.”…

Assistant to Bill Shorten...FoFA, A time when dozens of submissions were made, 90 odd submissions ranging from clients be sent…

Only way to get that 1.25 times back will be to move clients from Brighter Super into their SMA on…