All credits due to the “happy marriage” making Apis Capital last

The 21 years Eric Almeraz and Daniel Barker have spent “happily married” in their investment partnership at New York-based Apis Capital Advisors have been undeniably fruitful: strong performance, consistency and an award win, to name a few.

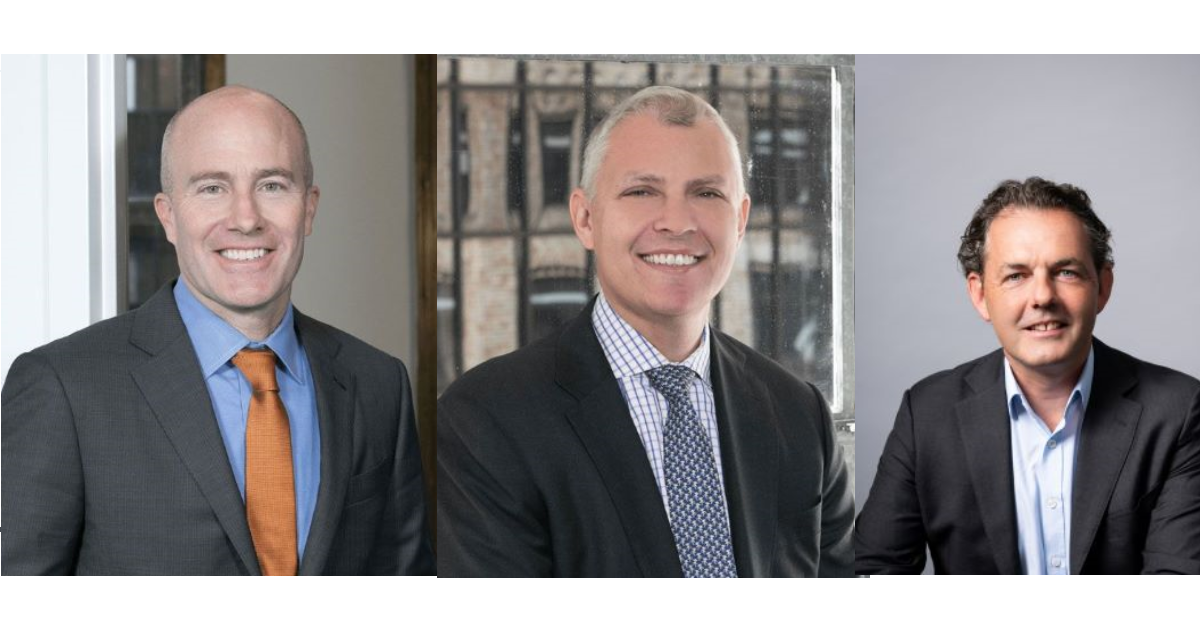

Upgrading their recognition from award finalist in 2023 to the Long/Short Equities category winner at the Financial Newswire/SQM Research Fund Manager of the Year Awards 2024, the dynamic duo of Managing Partners and Portfolio Manager (Barker) and Director of Research (Almeraz) presented a refreshingly authentic perspective on the success of their Apis Global Long/Short Fund.

Over two decades of mistakes made and lessons learned, and maybe coming to terms with the fact that they’re “great stock pickers but probably terrible market timers”, has brought Almeraz and Barker to this landmark point: trusting that their long-time consistency and tried and tested approach will deliver.

“When I think about Apis Capital and other investment organisations out there, stability of the team and consistency of process come to mind. Daniel and I are proud that we have been doing this as long as we have, applying the same process with the same team,” Almeraz said.

“Daniel has been at the helm as portfolio manager of this fund since day one. The opportunity set is as good today as it’s ever been, if not better. We haven’t taken on as many assets that we’ve grown out of the opportunity, and we’ve continued to deliver the same process.

“We really are focused on the smaller end of the capitalisation spectrum, in the one-to-five-billion-dollar market cap range. It’s unique that it has a 20-year track record, so you can see how well the fund has performed through several different market periods.

“This area of the market rewards us for experience and familiarity with this large variety of different stocks. There are all sorts of names that others may be unfamiliar with across Asia, Europe and North America.

“Doing this for 25 to 30 years like we have, you start to gain a level of familiarity that is unable to be replicated. There’s no reason why we shouldn’t be able to continue repeating this performance in the future.”

Barker echoed similar sentiments, confirming Apis’ foundational building blocks from more than 20 years ago are still in practice: simple yet effective.

“The underlying idea of Apis was to have flexibility and a truly global approach to go wherever the research takes us and go wherever we find a great opportunity set,” he told Financial Newswire.

“One of the areas, for example, that have been successful for us is the ‘electrification’ theme. These are companies that provide products for the power grid – transistors, switch gears and more. Due to artificial intelligence and antiquated infrastructure, there needs to be tremendous investments in this area.

“It’s a perfect sector for us because it’s very global – there are companies in Europe, America and Asia, but because we’re Apis we can go wherever the research takes us. We’ve latched onto some names in Korea within that segment.

“We’re looking for situations where we can get the best of both worlds: the highest growth as well as the lowest valuation.”

And this strategy has ultimately delivered. According to the latest quarterly report to 30 June released by local distribution partner, Ironbark Asset Management, the fund returned 13.52 per cent net per annum in the five-year period.

The fund has weathered the storms of several market environments with varying levels of risk and has managed to more than stay afloat. Almeraz credited the team’s regular reviews, an adaptive attitude and a focus on improving the investment process.

“From our perch, long/short is very labour-intensive. You’re not able to load an algorithm into a computer and then just deploy capital,” Almeraz said.

“What I’ve noticed over time is that money tends to flood into strategies when they’re ‘hot’ and then that investment opportunity fades away as more eyeballs flock towards it. I like our space because it doesn’t really lend itself to that. We don’t see a lot of competition in what we do, because it doesn’t scale to tens of billions of dollars.

“We’re never going to have an enormous fund like that. And for that reason, you don’t see a whole lot of money rushing in, which is great because there’s going to be alpha available to us.”

Barker and Almeraz confirmed that their work with Ironbark has gone from strength to strength, as Apis brings a distinctive approach to the long/short peer group in Australia.

“Most of the peers would generate most of their returns from their long-only fundamental book, and then be doing index or sector based shorting,” Alex Donald, CEO of Investment Solutions at Ironbark, said.

“One of the things that clearly differentiates Apis is its single name, single stock shorting. They have shown real long-term skill and have been able to drive returns for both the long-only book and their shorting capability.

“That is unusual and the specialisation of the group in this area and their track record brings something different to the Australian market.”

The Australian market also presents a unique opportunity for Apis to capitalise on the demand from the type of high-net-worth (HNW) and private wealth businesses that prefer managed accounts and utilise some level of “institutional-style decision making”.

“Skill-based, less systematic long/short strategies like this that are capacity-constrained have not really been used by institutional clients,” Donald said.

“I think the profile of this strategy, its specialisation and the people that are involved resonate incredibly well with this other kind of private wealth and HNW advisory groups that are using SMAs, because we’ve been able to deliver the strategy in a daily liquid form, which is unusual.

“That’s our target market, which is perfect for us because they’re sophisticated, they understand, and it’s in a portfolio to provide that sort of alpha with a defensive characteristic from the shorting side.”

These funds should be a lot more concerned about their investment returns, which are starting to look very sick. Waiting…

How deluded is this guy! Scandal after scandal and he thinks he has done a good job.

Phoenix has already begun ''Sequoia declined to confirm whether the end of the cross guarantee was part of a plan…

He “addressed regulatory through our simplification work”. This just shows how out of touch and clueless he is. We had…

Another failed bureaucrat blowing his own trumpet as $$Billions blow up from MIS fraud & failures, that ASIC were warned…