Big industry funds finalists in fund manager awards

In what is believed to be a first, Australia’s two largest industry superannuation funds have been named as finalists in the annual Morningstar fund manager awards.

Morningstar has named both AustralianSuper and the Australian Retirement Trust (ART) as two of three finalists in its “Multisector” category in competition with UK-based manager Ruffer for its Ruffer Total Return International Fund.

While industry funds have sometimes been named in retail fund manager awards, it is usually because of the mandate they have handed to an external investment manager, not as stand-alone investment products.

AustralianSuper was amongst the first funds in Australia to bring investment management in-house, doing so in 2013, while the ART was born out of the merger of Sunsuper and QSuper with the latter having a long track record of using both in-house and external investment advisers.

Commenting on the two big superannuation funds making the fund manager finalists list, Morningstar’s director, Manager Research Ratings, Anika Bradley said they had been very well-performed in 2022.

She said that beyond their performance in 2022 the funds delivered low fees – something which was favourably regarded in the Morningstar methodology.

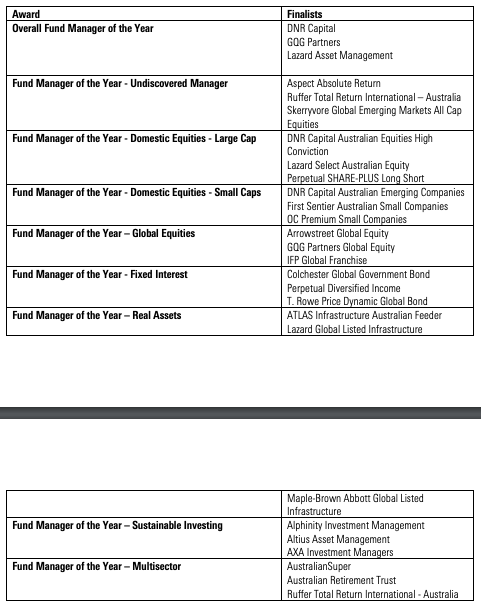

The full list of Morningstar Australia Awards finalists are:

It would give me more confidence to see the valuation, timing and methodology of those unlisted assets.

Agree. Open the books on the performance attribution. Host Plus a good example. Please show us how you generate a positive return in 2021/22 when more than 60% of your allocation was in sectors down 10-20% in that year. Those unlisted valuations must have really popped. Oh, and the Tooth Fairy is real too. Any chance the financial media will stop accepting industry fund fantasy returns at face value and actually ask tough questions or do we just believe that they are so much better at funds management than retail peers.

It’s a Ponzi scheme if inflows cover over the cracks of your fake elevated unlisted valuations but keep giving them awards and see how that works out.

Massive potential equity problem in my opinion.

Why should a 25 year old accumulator client pay $1.25 for something that is really worth $1.00?