Equities and fixed income to return less than expected

Despite robust GDP growth, unchanged inflation, and favourable interest rate expectations, global asset manager Capital Group has trimmed its 20-year return outlook for equities and fixed income in its latest capital market assumptions (CMAs).

The firm with US$3.3 trillion in assets under management has stated that strong market performance and elevated valuations forced it to adjust the return on equities whereas fixed income returns will lower due to softer starting yields.

Head of Asset Class Services for Europe and Asia-Pacific at Capital Group, Alexandra Haggard said while return expectations of major asset classes have eased, technological innovation provide new opportunities.

“As long-term investors, we continue to see a constructive landscape presenting investment opportunities across global markets supported by innovation cycles, advances in AI, and inflation that remains anchored near central bank targets,” Haggard said.

“AI remains a structural driver of long‑term economic resilience through its productivity gains, and in a more complex environment, this only heightens the importance of active investing and thoughtful navigation.”

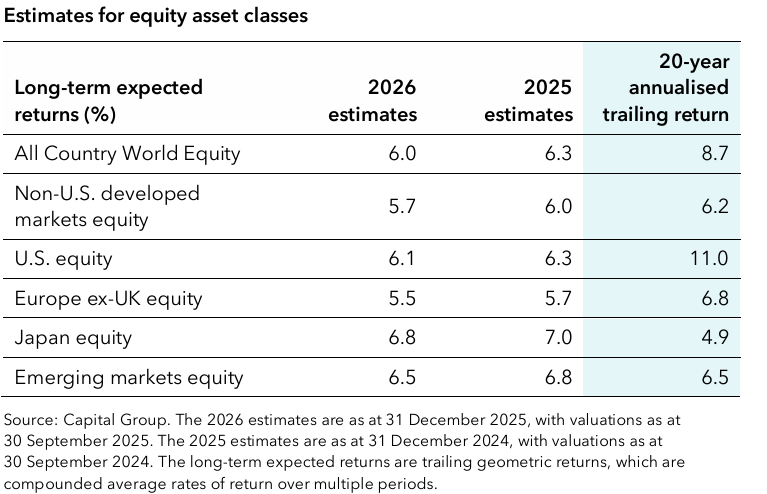

The Group now expects global equities to return 6.0% annually over two decades, below last year’s forecast of 6.3%, in line with equity of US, non-US developed markets and emerging markets.

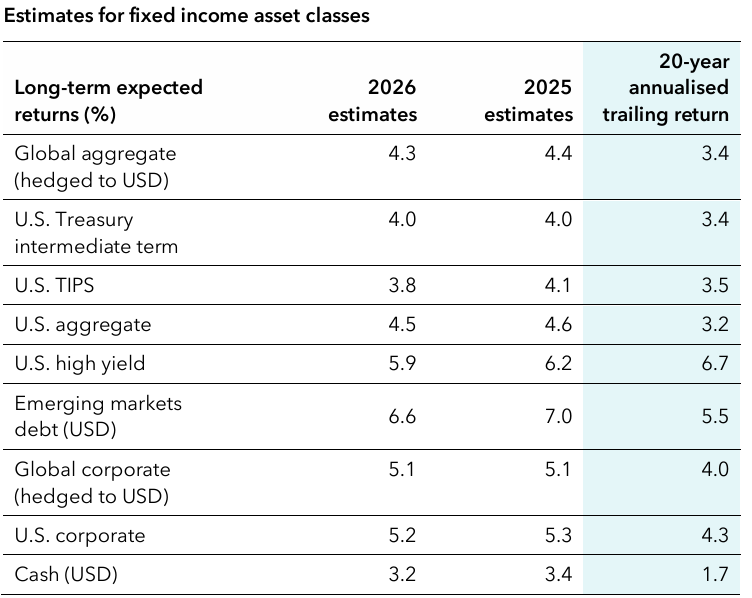

Furthermore, while the firm has projected fixed income return for US treasury intermediate term to remain stable, it estimates decline in all other major categories including US high yields.

The manager has predicted AI-powered productivity gains and increased capital investment to fuel GDP rise in US, in contrast with emerging markets which will see growth fall from 3.2% to 3.0% over the next two decade.

On inflation, the report has stated technological progress to help contain it near central bank targets even if tariffs and supply chain adjustments push near-term inflation higher.

In addition, the firm says it sees no threat to dollar dominance in near future despite challenges driven by risk to U.S. Federal Reserve independence, fiscal vulnerabilities and growing momentum behind de-dollarisation.

So now ASFA, and probably all the other adviser hating organisations, want to change the performance test to suit themselves…

Seems reasonable. It might not be perfect but those big Super balances have had massive tax concessions from 2007 -…

That will be ASIC's next move and no one should be surprised. Dealer groups have a responsibility to both the…

Why not go after The Dealer Groups as well that had them on there APL!!!

I guess it depends if it's "one of these" super funds or not. Not sure of Shield's AA but AusSuper's…