ETFs increasingly supplant unlisted managed funds

Two-thirds of financial advisers rely on asset consultants to shape the fund recommendations they deliver to clients, according to new research from Investment Trends.

The research finds that larger practices make even more use of consultants with respect to such decisions.

The report also points to the degree to which unlisted managed funds have fallen out of favour losing market to exchange traded funds (ETFs)

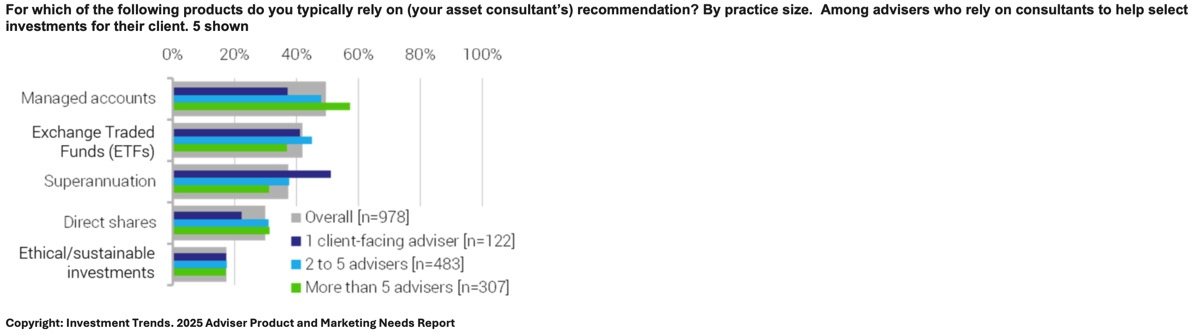

The firm’s 2025 Adviser Product and Marketing Needs Report found that research and asset consultants continue to be pivotal in adviser product selection, particularly with respect to managed accounts and superannuation.

It found that, overall, 77% of advisers rely on a third party, with usage rising to 90% for larger practices.

“Their recommendations influence decisions around managed accounts (49%), ETFs (42%) and super (37%), with research, reputation and expertise among the most valued attributes,” the Investment Trends research analysis said.

Commenting on the research, Investment Trends director, Cameron Spittle said practices are leveraging a combination of research including that provided by their licensees and external, as well as from asset consultants and in some cases platforms.

“For asset managers, the findings highlight the importance of building strong relationships with a broader range of consultants and influencers, whose recommendations can significantly shape product uptake,” he said.

The report also shows that ETF usage continues to climb across both index and active categories, largely at the expense of unlisted managed funds.

It found that among new non-super inflows not placed in managed accounts, 24% (up from 21%) go to ETFs compared to 31% (down from 43%) to unlisted managed funds.

The report noted that advisers favour ETFs for international equities and are expanding their use of active ETFs across all asset classes, especially where structure, access and cost-efficiency are key.

“The structural appeal of ETFs is accelerating adviser adoption, not just for index exposure but increasingly for active strategies,” said Spittle. “Fund managers who adapt strong-performing strategies into ETF vehicles will be well placed to attract new client flows as advisers continue to shift toward more accessible product structures.”

The report also highlights that rising market volatility is prompting advisers to step up client engagement. Nearly half report increased client contact over the past six months. While advisers generally prefer fewer touchpoints, those anticipating further turbulence are calling for deeper engagement, particularly via in-person events, videos or informed BDMs.

“Volatility isn’t just reshaping portfolios, it’s reshaping relationships,” said Spittle. “Advisers want fewer but more meaningful interactions, led by BDMs who bring real insight. Responsiveness and product knowledge matter most, cited by 66% and 60% of advisers respectively.”

Will we be able to look up and compare AMP’s underperforming and performance test challenged funds too?

Yawn. This is pretty rudimentary stuff, and largely looks like regurgitated and reskinned stuff that anyone can get off the…

The pay for research model is not perfect but I note ASIC have not actually raised this as an issue…

Here we go. The current test is rubbish, notably the Trustee Directed Product one, yet this feels like rationale for…

I think there needs to be a Royal Commission into the links between legislators, unions and super trustees. A deep…