Morningstar marks down Magellan on Stack departure

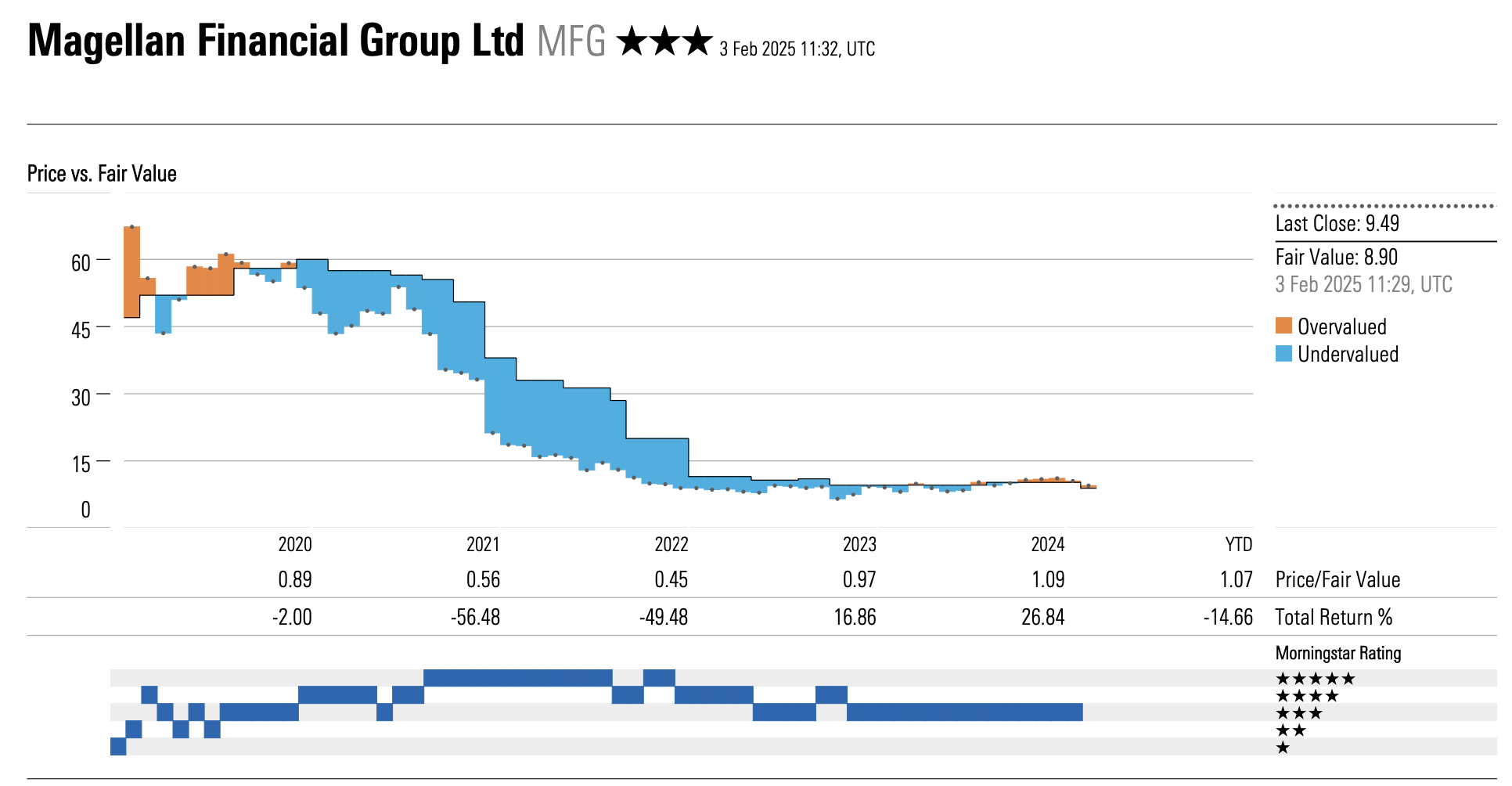

Research and ratings house, Morningstar has cut its fair value estimate for Magellan Financial Group from $10.20 per share to $8.90 per share based on the July exit of the fund manager’s head of infrastructure, Gerald Stack.

Morningstar analyst, Shaun Ler said Stack’s departure raises the risk of redemptions and that it could take time for investors to gain confidence in the new team, noting that Stack had led the infrastructure since 2007.

Ler said that the stability of Stack and his during Magellan’s turbulence in 2022-23 had been a reassuring factor for investors.

He also pointed to the level of institutional money tied up in Magellan’s infrastructure funds (75%) and suggested it “typically less sticky”.

“These clients may redeem funds following a key manager departure, a concern compounded by the strategy’s underperformance relative to its benchmark,” the analysis said.

Ler said it was also likely to take time for clients to retain confidence in Magellan given changes to its investment fund adding that “Also, the flagship global equities strategy continues to trail its benchmark, limiting prospects for inflows for now”.

“We cut our fair value estimate to $8.90 per share from $10.20, reflecting higher redemptions. We assume roughly $8 billion of one-off redemptions from the Infrastructure strategy – around 50% of infrastructure FUM and 22% of group FUM – throughout fiscal 2025-26,” the analysis said.

“While Stack’s brand reputation may not hold the same weight for Magellan as Hamish Douglass once did, the reliance on predominantly less-sticky institutional money within the infrastructure strategy highlights the persistent risk of mass redemptions following key personnel changes.”

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…