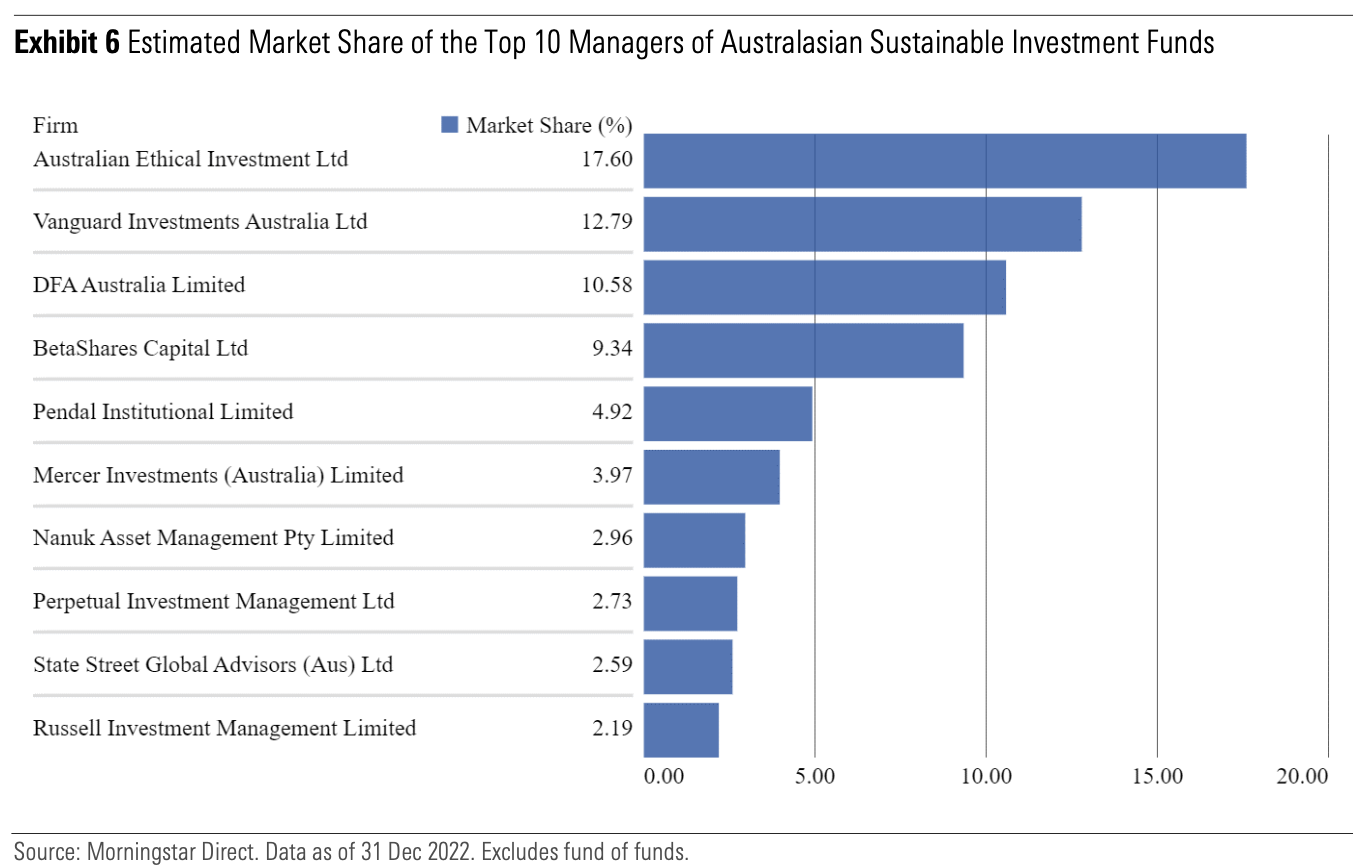

The 10 managers dominating ESG in Australia

ESG investing continues to prove popular in Australia, but the local sustainable funds market is dominated by just 10 fund managers who account for 70% of total assets, according to the latest analysis from research and ratings house, Morningstar.

What is more, the latest Sustainable Investing Landscape Report issued by Morningstar reveals that at the fund level, Australian Ethical and Vanguard account for more than a third of that market with 17.60% and 12.79% respectively.

The top five investment managers in terms of market share are:

Australian Ethical

Vanguard Investments Australia

Dimensional Funds Australia Limited

BetaShaes Capital

Pendal Institutional Limited

Importantly, Australia managed to defy international trends in terms of sustainable investment and, according to Morningstar, sustainable funds continued to eschew the broader market trend of significant outflows experienced last year.

It said that when it comes to sustainable investing, active strartegies are currently favoured over passive, with 72% of assets invested actively.

“The trend of new sustainable products being brought to market remains strong,” the Morningstar report said.

“In 2022, we saw a total of 23 new funds launched. While this was 13 fewer funds than in 2021, it was the second-highest year of fund launches on record,” the report said noting that the metric did not capture asset managers repurposing and rebranding conventional products into sustainable offerings.

Further it said the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider environmental, social, and governance factors in their security selection.

The report noted the degree to which Australian Ethical’s inflows had been influenced by its merger with Christian Super, but did not note the likely impact of Perpetual’s acquisition of Pendal.

Probably the biggest failure was ASIC. This is why the Dixons Advisory inquiry should have gone ahead because like Frist…

One of the EQT directors is Kellie O'Dwyer, the former Financial Services Minister who oversaw the introduction of LIF and…

Been saying this for years anyone who offshores has to think long and hard

"We confirm that ASIC is still looking at the matter regarding Lion Property Group Pty Ltd and anticipate to revert…

Can we get over this whole "cold calling" thing? Cold calling was not the cause of this problem. Conflicted arrangements…