Vanguard points to 2,200% return over 30 years

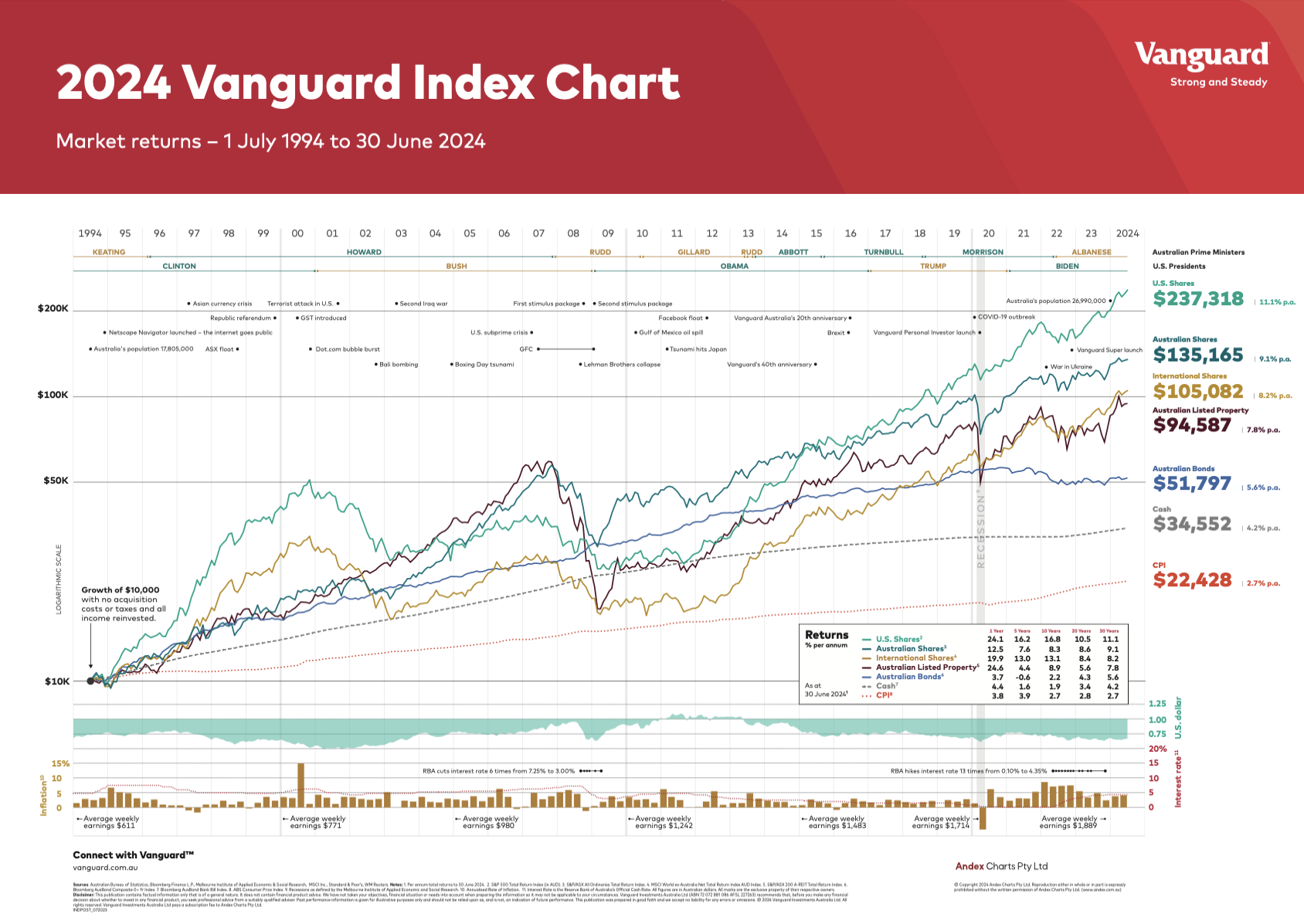

A $10,000 investment in the top 500 US shares made on 1 July, 1994, would have grown by 2,200% to $237,000, according to an analysis of the latest Vanguard Investments Index Chart.

At the same time, Vanguard has pointed out that the same $10,000 invested in the top 500 Australian shares would have grown by 1,250% to around $135,000.

And the message from Vanguard is, unsurprisingly, to be appropriately diversified and track the index.

Commenting on the release of the Vanguard Index chart, Vanguard Australia head of personal investor, Renae Smith said it highlights the upward momentum of different asset classes over time and the value of having a long-term investing mindset.

“There have been various times over the last 30 years when markets have been highly volatile. In early 2020, for example, global share markets fell heavily amidst the onset of COVID-19. Such events can be very disconcerting for investors at the time.

“Yet, as the Index Chart shows, most events are typically short-lived. Bear markets on average last less than a year and are generally followed by a bull market, averaging 6.5 years.

“Although past performance is not an indicator of future performance, history shows us that investors who have avoided the temptation to sell or switch their investments, especially during periods of extreme volatility, have been well rewarded over the long term. It definitely pays to stay the course,” Smith said.

The Vanguard analysis also counselled against chasing last year’s returns noting that in the 2023-24 financial year, Australian listed property was the best-performing asset class, returning 24.6%, with U.S. shares returning 24.1%, and international shares 19.9%.

Australian shares returned a lower 12.5%, while the impact of higher interest rates lifted the investment return on cash to 4.4%, which was above the 3.7% return on Australian bonds.

By contrast, in the 2022-23 financial year, U.S. shares were the best performing, returning 23.5%. Australian listed property returned 8.1%, and Australian bonds 1.2%.

“The returns from asset classes vary from year to year, so chasing last year’s returns is a bit of a losing strategy,” Smith said

“Being diversified across asset classes, with exposure to growth assets such as equities and defensive assets such as bonds and cash, will invariably deliver smoother returns over the long term.”

Will we be able to look up and compare AMP’s underperforming and performance test challenged funds too?

Yawn. This is pretty rudimentary stuff, and largely looks like regurgitated and reskinned stuff that anyone can get off the…

The pay for research model is not perfect but I note ASIC have not actually raised this as an issue…

Here we go. The current test is rubbish, notably the Trustee Directed Product one, yet this feels like rationale for…

I think there needs to be a Royal Commission into the links between legislators, unions and super trustees. A deep…