Balmain Private, delivering first mortgage investments since 2012, a decade of results.

Welcome to Balmain Private, a better way to invest with interest paid monthly.

Balmain Private offers investors an exclusive opportunity to build their own portfolio of 1st mortgage commercial real estate loans. It is designed to allow both direct investors and those that invest using the assistance of accountants or financial planners to participate.

Balmain Private was established to meet the needs of Retail, High Net Worth and Self Managed Superannuation Fund investors who seek different sources of income outside those traditionally available.

Balmain Private is managed by the Balmain Group, Australia’s largest and longest established commercial loan manager outside the major banks. Launched in 1979, Balmain has focused on commercial real estate lending and arranged over $35bn in commercial loans on behalf of many thousands of Australian businesses and high net worth individuals.

Our Performance.

Balmain Private is very meticulous in the approval process of all investment offerings, this means only the best loans are offered to investors.

As of June 2022, the average return for all investments since inception is 7.62%* p.a. net. Of all loans repaid, over 20% exceeded the target return rate, with all remaining meeting their target rate of return.

*Since inception. Past performance is not indicative of future performance. Investors should consider the risk associated with any Loan as set out in the PDS and any relevant Supplementary PDS (SPDS) pertaining to that Loan.

You choose, you’re in control.

The decision of what to invest in is firmly in your hands. This includes the level of risk and reward sought, term, asset type, location and more.

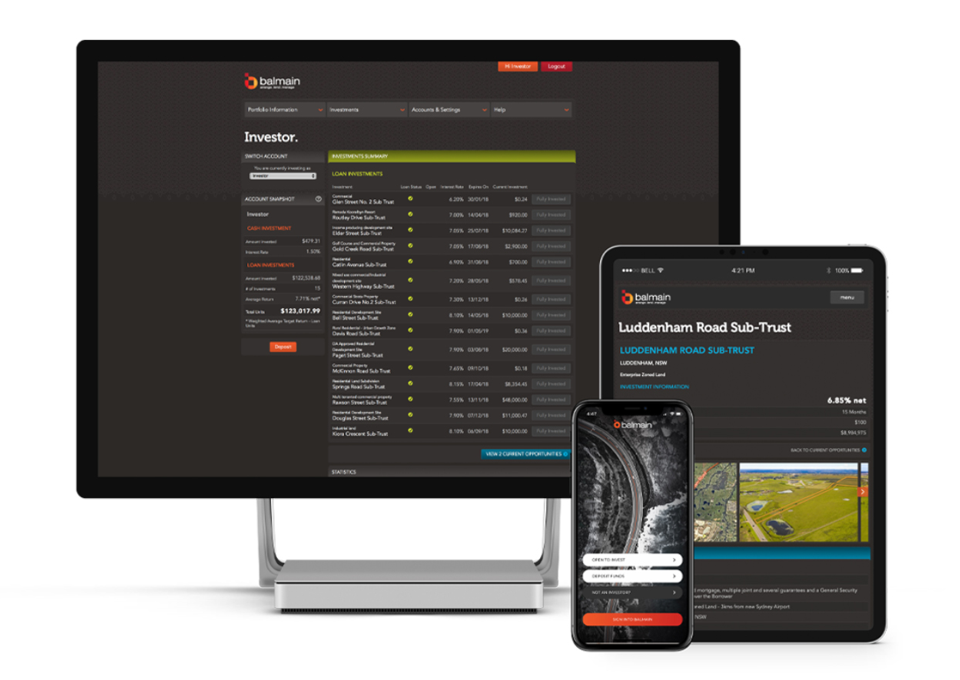

The investing process is all online, allowing you to invest and transact at your leisure. It is paperless, accessible via PC, tablet or smartphone and is simple to use – just point and click. Of course if you have any questions you can contact Balmain Private directly.

Investors or their advisers manage their portfolio via an online investor portal which details your current investments, provides you complete details of all capital movements, income distributions and transactions.

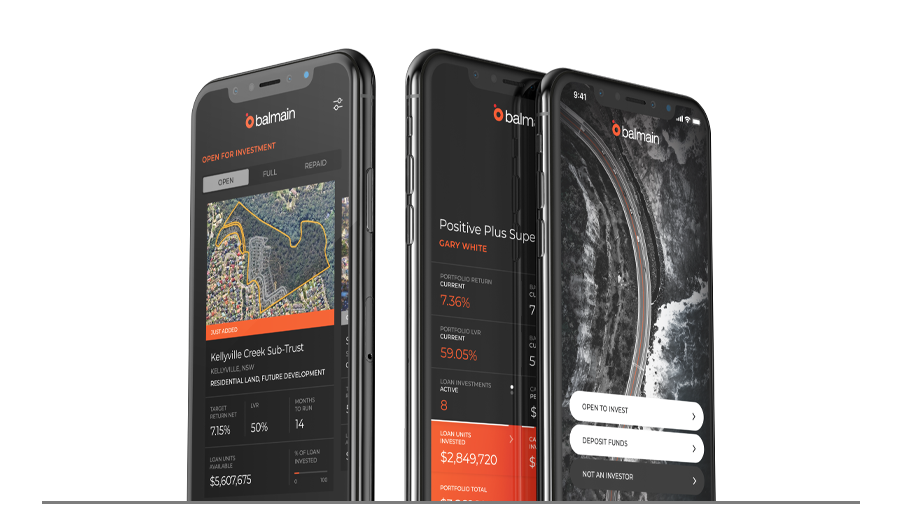

Invest on the go, 24/7.

As well as the website, the Balmain Private Mobile App allows investors and advisers to manage, invest and review their portfolio on the go. The App enables users to deposit or redeem funds and download reports straight from your portfolio to your mobile phone.

Ready to discover more?

Download the Balmain Private complimentary Fact Sheet or alternatively, telephone the Balmain Private Investments Team on 02 9232 8888.

You can also view a library of more detailed Balmain Private material by visiting https://linktr.ee/balmainprivate.

Balmain Fund Administration Limited ABN: 98 134 526 604 and AFSL No: 333213 (Balmain) is the issuer of units in the Balmain Discrete Mortgage Income Trusts ARSN 155 909 176 (the Trust). It is important for you to read the Product Disclosure Statement (PDS) and the Target Market Determination (TMD) for the Trust before you make any investment decision. The PDS and TMD are available on our website www.balmainprivate.com.au or by calling 02 9232 8888. You should consider carefully whether or not investing in the Trust is appropriate for you. The rates of return from the Trust are not guaranteed and are determined by future revenue of the Trust and may be lower than expected. Investors risk losing some or all of their principal investment. Past performance is no guarantee of future performance.

Dear ASIC, I often tell my clients that I don’t have a crystal ball to predict market movements. Now, I…

Please save us the reading time Phil and give us a couple of main points

ASIC need to understand that a new or emerging small business owner is adversely affected by the impost of CSLR…

ASIC need to stop acting like a business and start acting like a regulator. Stirring up buses so it can…

Kirkland , ex Choice CEO / activist, should never have been appointed commissioner.