Betashares debuts Direct platform, touts brokerage-free trades

Betashares has unveiled new features on its Direct investment platform, adding brokerage-free Australian Securities Exchange (ASX) listed shares to its existing offering.

The expanded Betashares Direct platform offering gives retail investors access to more than 300 brokerage fee-free ASX shares – including CBA, Rio Tinto, Coles Group and Telstra Group.

This expanded share offering adds to the existing suite of ASX-traded ETFs (including fee-free Betashares and non-Betashares ETFs) available on the platform, which debuted in 2023.

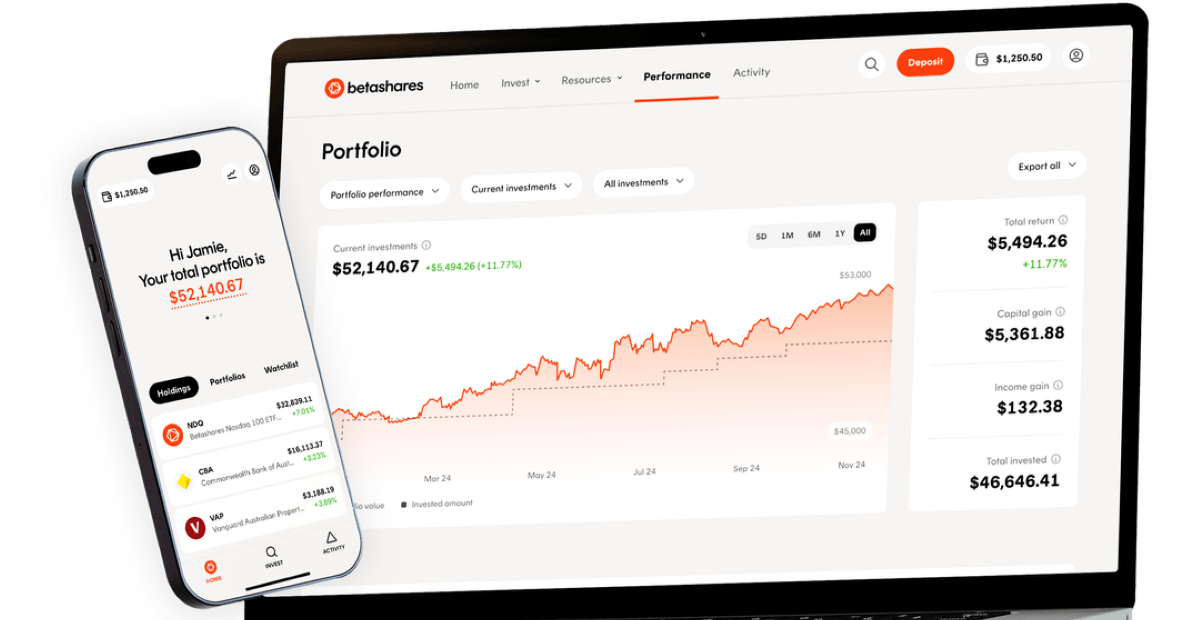

As well, the comprehensive investment platform, available on mobile and desktop, boasts several features, including personalised tax and performance reporting tools, an automated recurring investments feature, an investment insights library, and a suite of low-cost Betashares built managed portfolios.

“Unlike other platforms and online brokers, we don’t rely on making money from getting you to trade more often,” Betashares states on its website.

“Our goal is to help you build long-term wealth – and we succeed only when you progress towards that goal. If you invest in one of our 90 [or more] funds, or choose to use managed portfolios, we earn transparent low fees as your wealth grows.”

Betashares said the new all-in-one Direct platform was launched with the aim of “removing friction from the investing experience”, providing for Australian investors the “global standard of brokerage-free investing”.

“This underscores Betashares’ commitment to elevating investment standards in Australia by offering sophisticated, accessible, world-class investment solutions.”

Betashares chief executive and founder Alex Vynokur, added: “By removing brokerage on ETFs and now on over 300 Australian shares, we are furthering our goal to become the home of investing for Australians.”

“Removing brokerage from the investment equation is more than just making investing more cost-effective. More importantly, the world without transactional brokerage opens up a wide range of new opportunities and new functionality, previously not available in the Australian market.”

Alongside individual accounts, the Direct platform is also available to self-managed super funds (SMSFs) and trusts, which users can toggle between using the same login profile.

The platform will be expanded to enable children’s (under 18s) accounts, company accounts and joint accounts.

Utterly appalling from Cbus. Are the members paying the fines? Royal Commission required. This is a joke. Australia deserves better.

Ban them

If this was a retail fund the manager would be paying the fine. In this case it's the members bill…

Cbus "MEMBERS" hit with $23.5m penalty Any CBUS Trustees / Directors / Responsible Managers / Life Insurance Managers etc Finned,…

Yet ASIC wrote press releases and ordered advisers to write letters to clients about mere spelling mistakes in "defective fee…