Favourable signs for Financial Services M&A

The Australian financial services industry appears set for another uptick in merger and acquisitions activity, according to the latest analysis from Deloitte, with double the number of companies expecting deals to increase.

The Deloitte M&A Survey 2024 has highlighted financial services as being a sector which is “all cashed up and[has] nowhere to grow”.

“An incredible 90% of M&A leaders surveyed from financial services are highly confident their balance sheets are strong and cash reserves good (compared to 68% survey wide),” the Deloitte analysis said.

“This confidence is flowing through to deal-making plans in the next 12 months, with 48% (double last year) expecting deals to increase and 43% expecting the same.”

“However, money and strong balance sheets can’t guarantee transaction success in a market with limited avenues for organic growth and fierce competition for inorganic opportunities, including strong private equity interest,” the analysis said.

It pointed to the need for organisations to focus on identifying capability gaps and exploring strategic acquisitions or partnerships to gain access to new customers, technology, products, or capabilities.

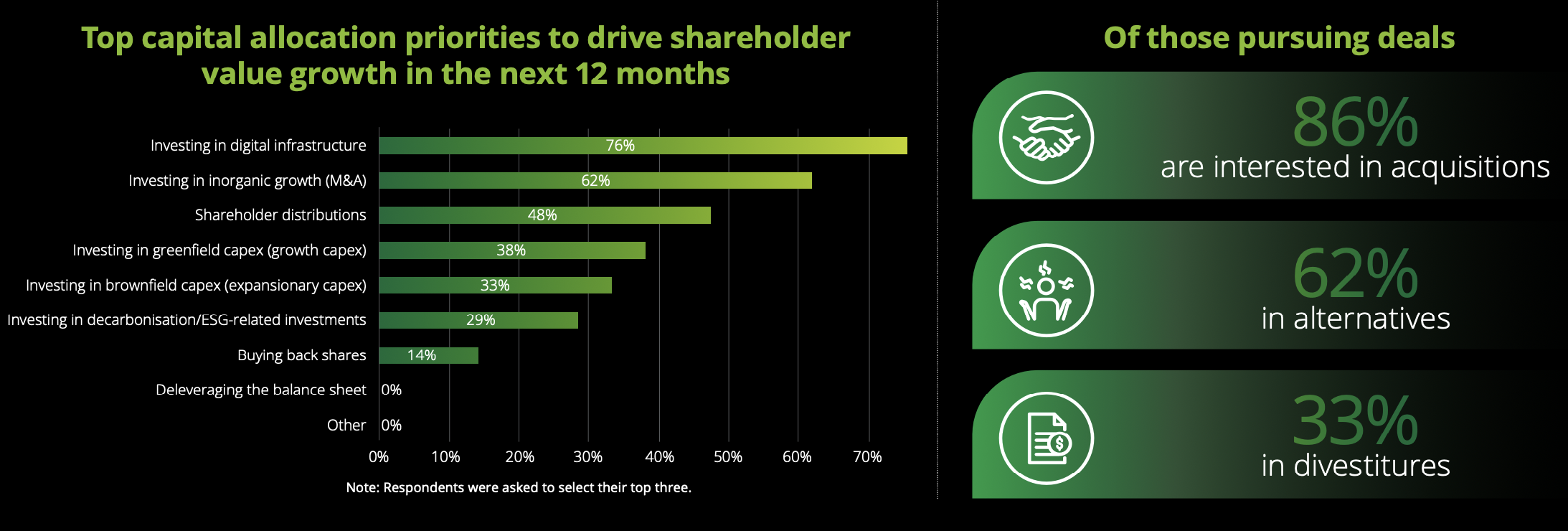

“In our survey, 86% expressed interest in acquisitions and 62% considered M&A alternatives. Digital infrastructure is a key priority, with over three-quarters of leaders prioritising it in their top three capital allocations for the next 12 months, compared to 45% across all industries,” the analysis said.

“However, when it comes to sealing the deal, only 28% of M&A leaders feel highly confident in demonstrating a strategic competitive advantage over other buyers.”

Overall, the Deloitte analysis said that after a choppy 12 months for M&A leaders, its 2024 survey had painted a surprisingly bullish picture.

It said that when economic certainty improved, deal activity would follow.

Two concurrent ASIC actions, one already resulting in a $27m fine, and who knows what the eventual (negotiated) fine will…

So by this logic, it's ok to allow Darth Vader to be the CEO for the Council of Jedi's. No…

"Compare the pair" hah? "From little things, we're keeping your money!" Pffft....horrendous! Bet this doesn't make the newspapers or media…

Of course the regulator needs to focus on advisers because they are the despicable ones with no ethics. Not the…

In my opinion, Super Governance in Australia is utterly archaic and not suitable for purpose in the 21st Century. Why…