High-fee ETPs hit a wall as investors draw a line at 0.65%

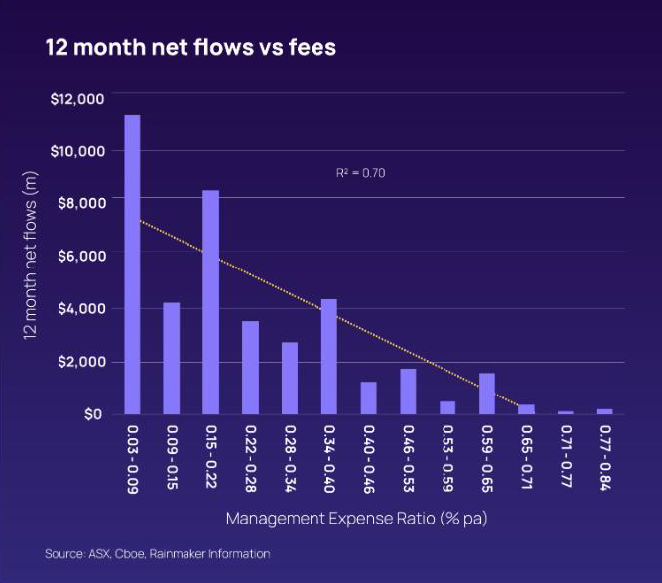

Exchange traded products (ETP) charging management fees above 0.65% a year are facing a structural challenge as investors increasingly treat the threshold as an informal ceiling, new Rainmaker Information’s Exchange Traded Products Report shows.

As per the report, ETP managers can no longer rely on performance or brand strength alone to attract investors if their fees sit above this level unless they offer a distinctly niche or practical values.

Head of Investment Research at Rainmaker, John Dyall, said the data shows a clear turning point in investor behaviour, and managers should treat the 0.65% mark as a practical upper limit.

“ETP managers should pay close attention to their fee structures. Unless a product has a highly unique value proposition, fees above 0.65% per annum significantly limit the likelihood of success,” Dyall said.

“Products with lower fees consistently experience higher net flows relative to peers. While performance and innovation remain important, pricing is the deciding factor in an increasingly competitive ETP landscape.”

Using a sample of 331 ETPs with at least a year of history, Rainmaker compared management fees against net funds flow and changes in revenue. The relationship between fees and net flows was strong with an R-squared of 0.7 compared with just 0.3 for the link between fees and revenue.

Additionally, the report shows the ETP market splitting into two distinct segments: low-cost products (below 0.65%) and higher-fee products that fall outside the mainstream investor appetite.

In the low-fee segment, 10 products recorded revenue gains of more than $2 million each. These ranged from the 0.07% Vanguard Australian Shares Index ETF to VanEck’s 0.59% MSCI International Small Companies Quality ETF.

Half of these top performers came from Vanguard, four from VanEck and one from Betashares, the NASDAQ 100 ETF.

The picture was noticeably different for products charging above 0.77%. Among the 59 funds in this bracket, only three increased revenues by more than $500,000, two actively managed Aoris global equity funds and the Betashares US Equities Strong Bear Currency Hedged ETF.

Although these products also attracted positive flows, they were not enough to offset the broader trend of withdrawals across higher-fee offerings.

Always back self interest when a body is marketing a submission to the government

In other words the system is achieving what the government wanted to happen.

Every day I come on here it feels like it is just the SMC trying to lobby to make one…

Well our compliance and red tape costs average around $200-$250k per adviser. Go ask the government why advice is so…

Personal Financial Advice should be offered, but it needs to be independent of the Industry Funds and their trustees of…