Insto investors switch to cash

The economic disruption being wrought by US President, Donald Trump, has manifested in institutional investors pulling back their risk exposures.

It has also led to investors switching out of exposure to US equities and moving to European equity exposure.

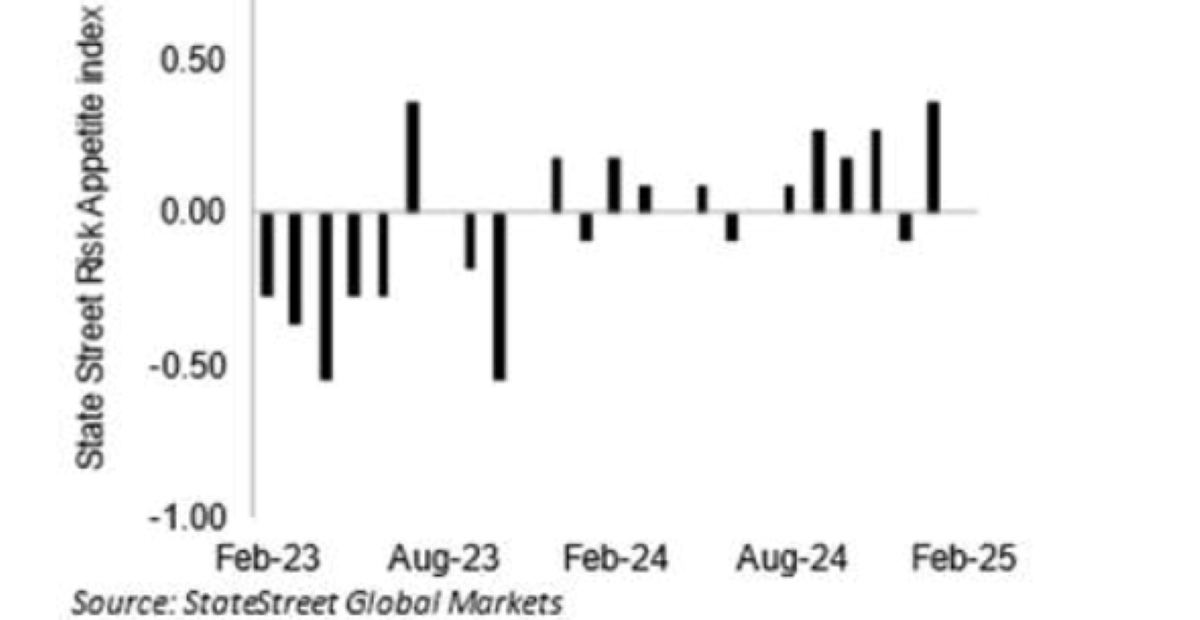

The latest State Street Global Markets Risk Appetite Index fell back to 0 in February, ending a four-month run of risk seeking activity.

The analysis said that long-term investor allocations to equities fell sharply from close to their highest level in 16.5 years with the money moving into cash holdings.

Commenting on the index, State Street Global Markets head of macro strategy, Michael Metcalfe said investors’ fourth month run of risk seeking activity “decisively broke” in February as incoming US economic data raised concerns that growth has abruptly stalled, offsetting hopes of more stimulus from China.

“But how and where investor sentiment changed was, perhaps even more telling than the headline change in sentiment itself,” he said.

“For some months now investors’ holdings in equities relative to fixed income have been exceptionally stretched. But once again in February, when investor holdings of equities did fall, the primary beneficiary were allocations to cash not fixed income. So while investors are keen to de-risk and move their aggregate equity holdings closer to average benchmark levels, they remain hesitant on fixed income.

“Given how concentrated investor holdings in equities and foreign exchange markets have been, it is perhaps unsurprising that February’s move back to benchmark showed significant regional variations. Investor holdings of US equities, and within that tech, bore the brunt of the correction with both seeing significant reductions in investors’ overweight positions.

“European equities were the major beneficiary of flows out of US equities such that long-term investors have now completely unwound their underweight in the region’s equity markets. For now sentiment toward emerging markets by contrast did improve, but like fixed income allocations, remains a little more circumspect. One exception here is Chinese equities which have continued to receive inflows such that long-term investors by our metrics have now eliminated their underweight position.”

I think these numbers are too low. Especially if you live in major cities. I try to ensure none of…

Are Interprac / Sequoia going to pay the 10’s of $$ millions in AFCA complaints ? Even after Macquarie &…

Always back self interest when a body is marketing a submission to the government

In other words the system is achieving what the government wanted to happen.

Every day I come on here it feels like it is just the SMC trying to lobby to make one…