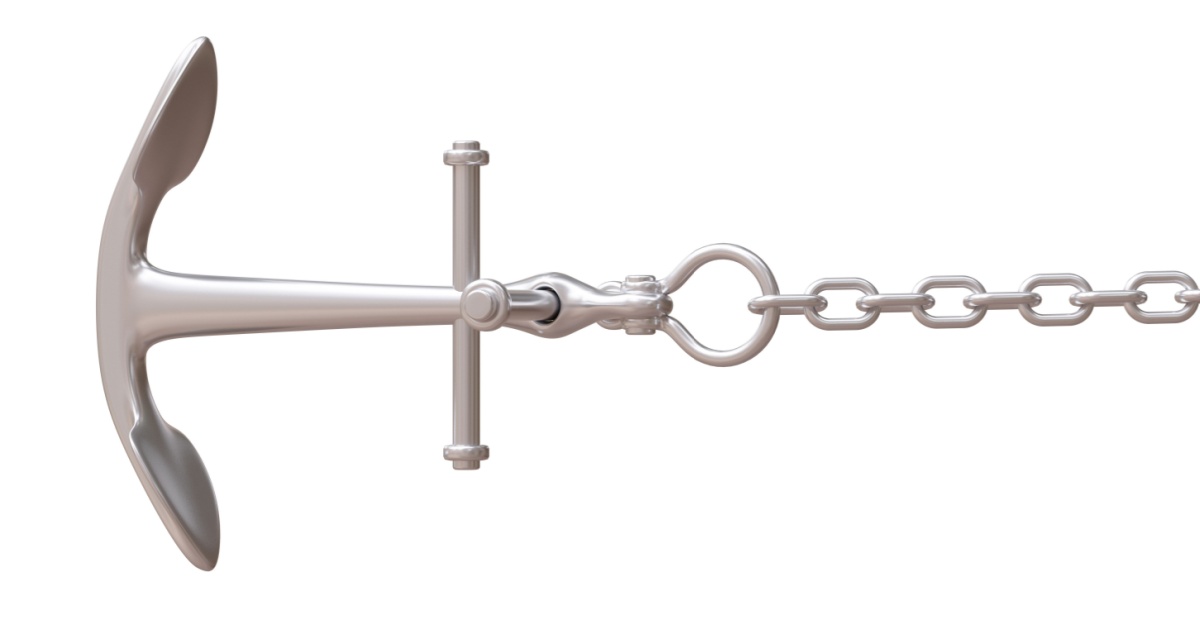

Trump risks cutting Fed’s global anchor status

The Trump administration’s legal moves against Federal Reserve chair, Jerome Powell, risks the Fed losing its global anchor status, according to the chief executive of UK-based wealth manager, de Vere.

De Vere CEO, Nigel Green said that, as well, investors are already looking for the safety of assets insulated from political influence, including Bitcoin.

“Pressure on the central bank of the world’s largest economy carries global consequences.

“Confidence in monetary governance in the United States anchors financial stability far beyond its borders.

“When that confidence weakens, capital moves quickly toward assets designed to exist beyond political reach.”

Green said legal scrutiny of the chair of the most influential central bank on earth, set against sustained political demands on interest rates, sends a signal investors do not ignore.

“Bitcoin, typically, responds positively to precisely this kind of signal.”

The De Vere CEO said the Federal Reserve’s role reaches far beyond US borders.

“Its decisions shape global interest-rate cycles, capital flows, currency stability and risk pricing across continents, influencing trading desks, treasury teams, and policymakers across emerging markets.

“Monetary credibility in the US sets the tone for financial credibility everywhere,” Green said.

“Financial systems operate on trust in institutions. The Fed anchors that trust for the dollar, for global bond markets, for equity valuations and for cross-border investment flows.

“When legal pressure appears alongside political frustration over interest rates, investors reassess the durability of that anchor.”

This reassessment has already translated into market moves.

“Equity futures have softened on concern around policy uncertainty. Gold has climbed to record territory as investors seek insulation from political risk.

“The US dollar has weakened against major peers as traders recalibrate faith in the institution behind it. Bitcoin has risen alongside these shifts.”

The problem is the underwriters, which have turned themselves into a global oligopoly, largely working out of London. The solution…

Typical lefty response whereby someone disagrees with your position so you just call them "extreme right wing". Symptomatic of someone…

Bzzzz Wrong again, from extreme right wing Terry! I came from the private sector and have returned to it. Some…

The clients will no doubt be better off. I recall when TAL sold its super business to Mercer. It was…

The Head of Compliance, The Head of Sales, the Business Managers and other Seniors Managers are all still working because…