Uncertain economy looms as jobs and inflation diverge

Rising inflation, a softening labour market and mixed household signals have left Australia’s economic outlook highly uncertain, Janus Henderson’s fixed-interest strategist Emma Lawson says, as November’s volatility highlighted the market’s struggle to reconcile strong domestic data with a cautious Reserve Bank stance.

Australian bonds weakened through the month with the Bloomberg AusBond Composite 0+ Yr Index down -0.88%, while three and six-month bank bills edged higher and government bond yields rose across the curve as traders recalibrated expectations for the RBA.

“The RBA were cautious, continuing to be data dependent at their November meeting,” Lawson said.

“There are uncertainties surrounding the economy, as the labour market is easing, while inflation remains higher than the RBA are comfortable with. Remaining on hold, in the near-term, is the prudent move in the face of conflicting risks.

“The first release of the new monthly consumer price index (CPI) series was much higher than expected. The series was biased upwards by changes in Government policies relating to electricity and rental assistance, as well as the timing of school holidays.”

The CPI data confirmed headline inflation at 3.8% and the trimmed mean at 3.3%, reflecting broader price pressures and government adjustments. “This shows that inflation remains a renewed headwind for households and the RBA,” Lawson said.

Capital expenditure on non-traditional sectors, including new data centres, continued to support investment while employment showed signs of easing with unemployment steady at 4.3% but forward indicators suggesting slower hiring ahead.

“Labour market momentum is softening, which may weigh on household incomes and spending over the coming quarters,” she said.

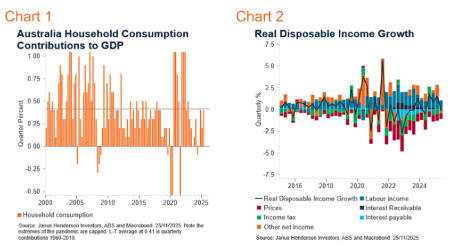

Household consumption remains the critical swing factor for growth, having only returned to trend in mid-2025 after almost two years of weak spending.

“Overall economic growth in 2026 is, as always, dependent on the rate of household consumption,” Lawson said.

“We expect a more sustained restoration of trend growth rates, but these will be dependent on levels of income and wealth growth.”

She further highlighted that boosts to real disposable income from past tax cuts and lower inflation are fading while labour income has moderated.

“The income support for a sustained pick up in household consumption may pull back a little in the coming few quarters, as some of the easy gains are behind us. Households can turn, instead, to savings,” Lawson said.

Lawson also noted that the economy has already seen a slight pull back in the savings rate and a reduction in excess mortgage payments, suggesting households are using savings to maintain spending.

“In order to maintain spending, and indeed raise growth rates, households will need to be confident about the coming year,” Lawson said, while noting that rising household wealth from housing and superannuation gains provides partial offset.

Global markets added further complexity with the US government shutdown limiting official data, forcing reliance on surveys showing weaker manufacturing activity and mixed services performance while debate over AI investment continued to influence risk appetite.

Market expectations have also shifted with futures pricing the first RBA cut as late as 2027, though Lawson says Janus Henderson’s base case sees easing starting in the first half of 2026 with policy still above neutral and a modest long-duration position maintained.

A sustained lift in consumption is therefore “probable but not guaranteed,” she added, warning that softer labour-market momentum, fading fiscal tailwinds, and renewed inflation pressures mean that policy or fiscal measures may be required if household spending falters.

It`s a created Moral Hazard that is now out of control.

It seems that the DBFO legislation may be designed for advice to be built off vertical integration. I wonder where…

yet banks are lending to 19 year old tradies to buy $100k cars without anyone saying boo

Well those two obnoxious pieces of adviser taxation have significantly contributed to mt departure from ther FAR, as of today.

Gone are the days when individuals take responsibility for their own choices.