APRA confirms TAL’s group market dominance

TAL’s dominance of the superannuation group insurance space has been underlined by the latest data from the Australian Prudential Regulation Authority (APRA) revealing that it accounts for 45.5% of the market.

The data contained in APRA’s life insurance and disputes statistics for the 12 months to June2025 reveals that the Japanese-owned insurer’s closest competitor is AIA Australia, which accounts for 26.9% of the market by annual premium, followed by Metlife with 13% of the market.

TAL holds mandates for some of the largest industry superannuation funds, including AustralianSuper with the APRA data revealing that the insurer covers 4,106,000 lives in the superannuation group space accounting for $1,007,325 in annual premium.

The APRA data also revealed an improvement in claims processing across the life insurance sector, generally, in the wake of concerns around delays experienced by members of some major industry funds.

However, the data reveal that total and permanent disability claims are still taking longer than many people would find acceptable, with 34% taking two to six months, and 13% taking six to 12 months and a further 5% taking more than 12 months.

Similar issues appear with respect to Disability Income Insurance (DII) with the data revealing that must over half (52%) of claims are being processed within two weeks, while 36% are taking two weeks to two months and 13% are taking longer than two months.

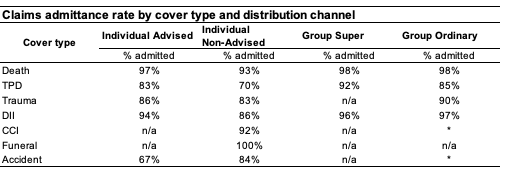

When it comes to life insurance channels, individually advised insurance represent a good option for clients with respect to DDI with 94% of claims being admitted, compared to 96% of claims for group super.

It is a different story for non-advised individual cover, which are lower than advised cover across the board.

Will we be able to look up and compare AMP’s underperforming and performance test challenged funds too?

Yawn. This is pretty rudimentary stuff, and largely looks like regurgitated and reskinned stuff that anyone can get off the…

The pay for research model is not perfect but I note ASIC have not actually raised this as an issue…

Here we go. The current test is rubbish, notably the Trustee Directed Product one, yet this feels like rationale for…

I think there needs to be a Royal Commission into the links between legislators, unions and super trustees. A deep…