Dearth of advisers hits insurers’ bottom lines

In what appears to be a ripple effect from the cost of living crisis, new data has revealed a significant decline in people taking out life/risk insurance coverage.

As well, the new data from specialist research house, Dexx&r has confirmed that the individual disability income insurance market has still yet to recover from the Australian Prudential Regulation Authority’s (APRA’s) intervention in 2021.

Dexx&r founder and managing director, Mark Kachor also attributed the problems besetting to the life insurance sector to the dearth of financial advisers and, in particular, the dearth of life/risk advisers.

He noted that while financial adviser numbers had nearly halved over the past seven years, the loss of specialist life/risk advisers had been even higher.

“What is more, most of the dealer groups are no longer capable of providing the technical support needed by advisers to increase their advice around life/risk,” Kachor said.

The Dexx&r analysis covering the 12 months ending 30 June reveal that total individual Risk new premium decreased by 8.5% to $1.27 billion, with total risk in-force premium decreasing by 0.8% to $16.3 billion over the same period.

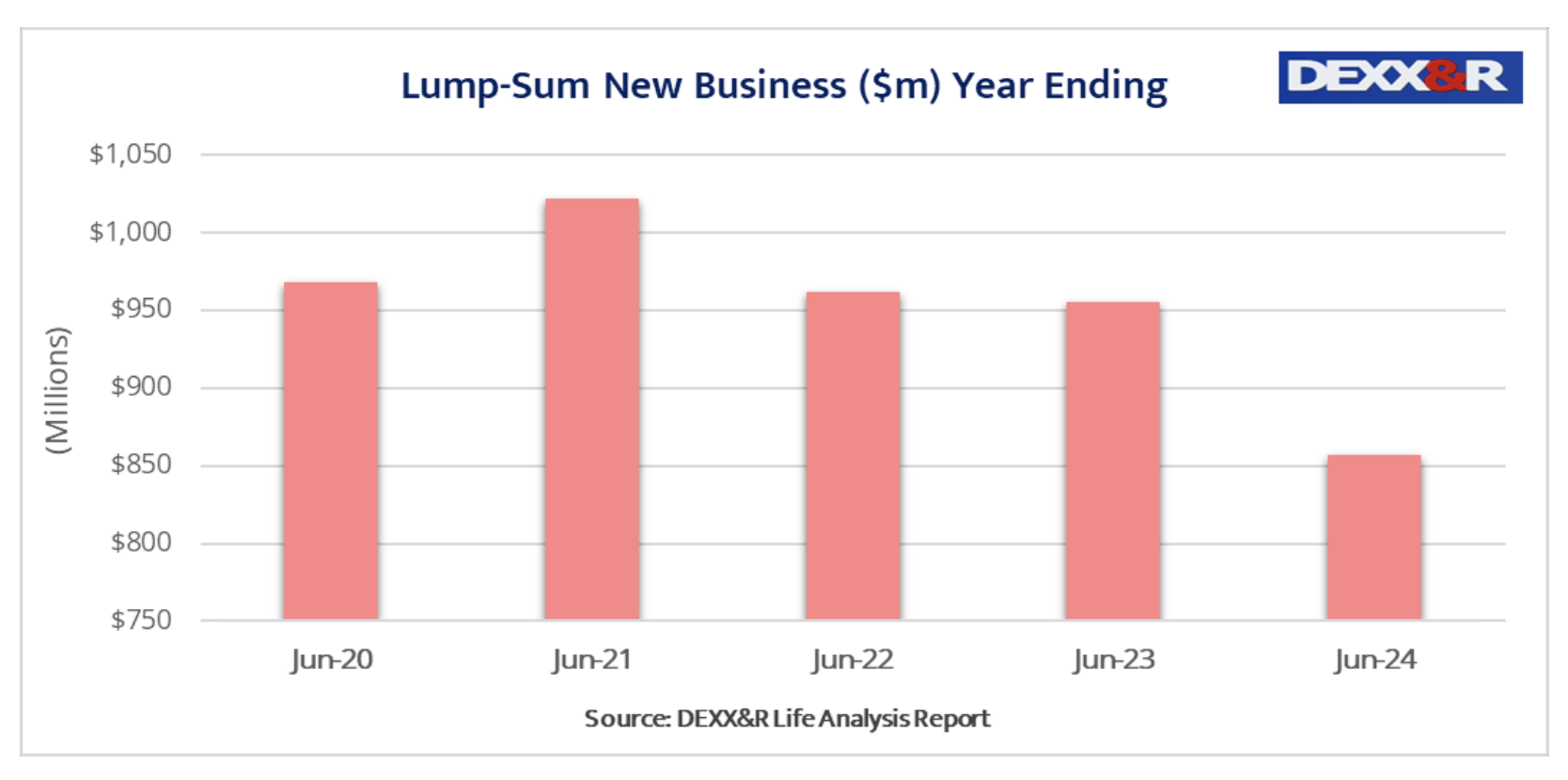

The analysis also revealed that lump sum new business premium for the year ending June 2024 was down 10.3%.

The Dexx&r data also pointed to the continuing problems besetting IDII noting that the attrition rate had increased to 10.4% in June this year, up from 10% a year earlier.

It said Disability Income new business increased by 4.5% to $411 million down from $431 million.

TAL continues to dominate the life/risk space commanding 31.7% market share with $5.18 billion in in-force Risk Annual Premium, followed by AIA with 20.7% share with $3.37 billion and Zurich/Onepath with 15% market share with $2.44 billion.

Congrats moronic and corrupt ASIC, Canberra bureaucrats and greedy Life companies.

Once Dodgy Direct Life Ins was dead from RC. You were all stuffed.

LIF is going soooooooooo well.

FARSEA too.

Life premiums up well over 100% in 5 years.

Suggesting the decline in insurance new business is a “ripple effect from the cost of living crisis” is deluded. The decline is a direct effect of the regulatory destruction of insurance advice.

The best indicator of this is not the decline in the small number of specialist insurance advisers, or even in adviser numbers overall. It is the abandonment of insurance advice by remaining generalist advisers, who are fully qualified and licensed to provide insurance advice, and have clients that need insurance advice. But those thousands of existing advisers don’t provide insurance advice any more due to the regulatory challenges. Increasing adviser numbers won’t make any difference while the regulatory environment makes insurance advice unviable.

Without appropriate advice, most consumers simply will not purchase or retain the insurance they need.

@ Anon

You’re Absolutely correct !

Insurance was always been bought on the needs of consumers and the benefits the insurance policy provided, “just in case or “what if”.

LIF legislation, a dearth of competition (ie fewer Life companies) and a suite of poorly designed products that provide few benefits at an exorbitant cost to consumers, is it any wonder, no one will sell these products and no one wants to buy them.

And the ruminative structure simply makes it un – profitable

I wonder which industry recovers following government intervention / regulation?

LIF and the woeful nature of the current IP policies compared to those in super are much more to blame than cost of living. Though cost of living would be affecting the cancellations as most people can’t afford the substantial premium increases that are being implemented by insurers.

Also the issue of life company price gouging and pathetic service standards makes risk advice barely worth writing.

What is the Dearth you speak of. It is mentioned several times??

How ridiculous is it, that it is impractical for a generalist adviser to give personal risk protection advice.

Doesn’t serve the nation or individuals at all well.

Well done regulators.

You are all correct!! But unless you are in the industry you don’t see it. There is a great amount of “greed” in the Industry from Insurance Companies with their price “Gouging” and re- structuring of Income Protection policies to such an inferior standard that we risk our own future in writing them. The cost is prohibitive even for the most Adent insurance person that understands the reasons for having it. Not just for job access. The 60% Commission paid it is not going to cut the work involved. And they WILL NOT pay fees to cover the work required! Whoever says they will be “kidding” themselves. And don’t get me started on a 2 year “claw back” It’s the same procedure for $50.00 a month or $500.00 {not many of them in my field}. After 43 years in the industry, I KNOW insurance is sold not bought.!! People are being affected by the cost of living certainly, but they are also aware when they are being had. Without substantial change it will only put the countries under insurance rate much higher than it has ever been, and the industry into the “black Void” it is slowly disappearing into.

There needs to be a Royal Commission into the collapse of life insurance advice in this country before it completely collapses.

Exhibit 1 – ASIC’s REP413 life insurance advice research

Why did ASIC work with the life insurance industry to stack the files with high volume risk writers suspected of churning, and then sell the results as a representative sample?

Why did ASIC subsequently conduct similar research into accountant-led SMSF advice and industry fund intra-fund advice, which had similar findings, but then go further to clarify that the majority of issues did not have material negative impacts on consumers; something which they have refused to provide for REP413.

Has their ever been a greater example of regulatory capture corruption? The Australian public are now paying for this misbehaviour while the life insurance cartel and deplorable government bureaucrats get off Scott-free.