Gutting of life/risk advice again hits premium sales

The decimation of the life/risk adviser distribution channel sits behind yet more negative numbers for life insurance sales, according to the Dexx&r managing director, Mark Kachor.

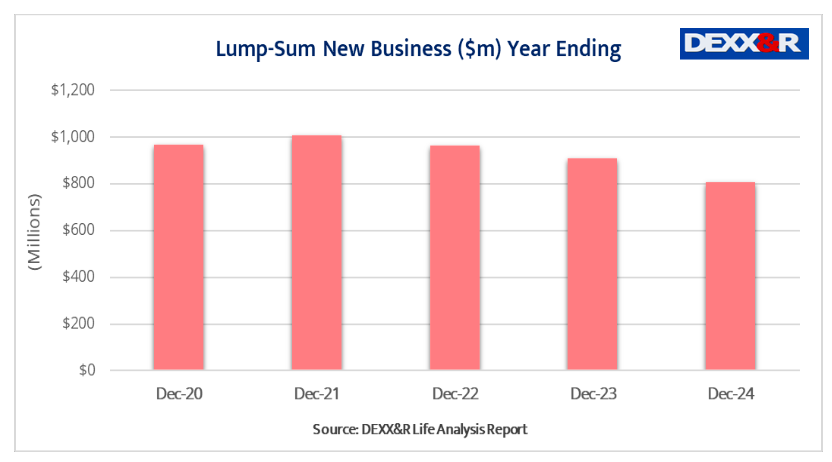

Specialist life/risk research house, Dexx&r released its latest Life Analysis Report based on data for the 12 months ending December, 2024, and the bottom line was that individual risk new premiums were down 18.5% for the period to $1.11 billion.

It said that total risk in-force premium decreased by 1.7% over the 12 months down from the $16.5 billion recorded at December 2023 to $16.2 billion at December, 2024.

Commenting on the data, Kachor said that the most important factor impacting the life/risk data was the exit of specialist life/risk advisers.

“It’s a distribution issue,” he said. “Over the last few years we have seen an exodus of life/risk advisers; many of the old and bold and most experienced have left the industry and moved on.”

He said the negative data had little to do with the quality of the products being taken to market by the life insurers in circumstances where death cover, for instance, had rarely been cheaper.

The Dexx&r data also pointed to the fact that Disability Income new business decreased by 33.3% to $301 million over the year, down from $451 million in the prior corresponding period.

It said that the Dexx&r attrition rate for disability income business increased to 11.4% in December, up from 10.9% a year earlier.

The analysis said that the discontinuances had continued to climb from the 9.1% low recorded in December 2020 immediately prior to the release of a new range of disability income products following the Australian Prudential Regulation Authority’s (APRA’s) intervention and the release of new products in 2021.

In the group risk market dominated by superannuation fund default cover, the Dexx&r data actually pointed to a modest 0.3% increase over the 12 month period, noting that while the Protecting Your Super legislation had meant fewer super fund members with default cover, total premium received had continued to increase as a result of the re-pricing of existing benefits”.

“negative data had little to do with the quality of the products being taken to market”

This may be the case for life cover, but for IP, product quality has a great deal to do with the decline in new business. The new IP products are so inferior they are not worthwhile for many clients, and a big compliance risk for advisers to recommend.

The IP product innovation that was needed to ensure IP sustainability was to make mental health cover an optional extra, priced accordingly. But due to fear of the mental health lobby, regulators chose to rein in runaway mental health claims with measures that impact a much wider group of potential claimants, where sustainability was never an issue.

The option of the adviser being able to recommend to the client that they opt out of mental health cover in IP was tried out by One Path around 15 years ago.

The problem then, is the same problem now, only magnified by FASEA. That is the adviser, who recommended that cover without mental health cover, was effectively deemed to be playing God. Today under the communication provisions of Standard 5, if you recommended IP cover without the optional mental health cover, especially if you tempted the client by a 15% or 20% premium savings, you could book your place in front of the firing squad. If you are lucky, you might get to ask the squad “Shoot straight, you Bastards”

Far better, but time demanding, to allow the insurer to exclude mental health, and depending on the product, offer that 15 or 20% discount.

And on the subject of mental health, can someone explain to me how many mental health conditions (yes, there are exceptions) are of such a nature that they could disappear overnight with a change of treatment, change of environment et cetera. Yet it appears insurers are approving TPD claims on an any occupation test withhout demanding proof of that word “PERMANENT” In a total and permanent disability Test.And then using it as justification for jamming up TPD premiums.

The adviser could still recommend mental health cover, but point out the cost difference to the client and let them decide. Even if the client went with the mental health option to begin with, the client would have the option to drop it later on if the mental health component increased by far more than the rest of the policy (which is effectively what’s happened over the last 10 years, but with mental health compulsorily bundled).

OnePath withdrew the mental health opt out option due to “lack of demand”. But that was prior to the mental health claims explosion, and the price difference was minimal. If they offered it again today, and the pricing difference reflected the current cost of mental health claims, demand for mental health opt out would be considerable.

LIF, FARSEA & APRA IP changes =

Moronic Regulatory Failure, that was pushed by the Life Co’s themselves.

How many instances do we need before even the most stubborn and bone headed bureaucrats admit they are nothing but a complete failure.

Advised Australians – only available to the wealthy (refer list below as to why)

Advisor numbers – destroyed by Moronic interventions and terrible policy

AFCA – guilty until proven innocent kangaroo court

ASIC – should administer companies only. Biased and totally inept

CLSR – completely ridiculous and not sustainable

Code of Ethics – written so badly not a single planner can comply. Refer Hayne also.

Competition (Lack of)- allowing massive consolidation in the life insurance sector which is one of the many regulatory reasons that premiums have sky rocketed and cover levels collapsed

Cost of advice (refer this list)

FARSEA – Moronic interventionist by virtue signalling no nothings – we got what you’d expect from this group of idiots

Financial Adviser Levy – no accountability and unrestrained spending

Financial Adviser Numbers – decimated by flip flop and ridiculous regulations

Hayne – complete joke of what could have been a proper investigation. Incompetent conclusions and outcomes

LIF – probably one the most disastrous outcomes of 2 decades of complete regulatory failure and incompetence

SH1T – SoA, RoA, FSG, OSA, OFA, AFSL, SoT – No wonder clients are confused

And the successes that bureaucrats and legislators achieved was

???????

Unless you count looking after the union funds especially by firstly removing vertical integration from the banks and insurance CO’s and now on the cusp of legislating vertical integration for what has now clearly been shown in the media but we’ve alway known – union funds are corrupt and incompetent.

The only solution is a professional standards board with teeth. Choice, academics and product providers need not apply. Completely ban vertical integration. Remove advice (not product) from the corps act, AFCA, CLSR. Redirect the adviser levy to fund the Board. Totally redo the impossible Code of Ethics.

Nanny state, vested interest and inept public officers have created this unholy mess. The best way to clean it all up is to remove them and their vested interest backers from the process completely.

Yep and besides Frydenberg losing his seat.

No other Pollie or Bureaucrat ever held to account.

Good idea. I have no idea why we don’t have a professional standards board, who control compliance and discipline, and then do-away with the useless AFSL system. I can imagine a industry board could approve a standardised fee consent form in 20 minutes, yet here we are…..

Could also have something to do with the fact premiums have gone through the roof, and in a cost of living crisis the first thing people cancel is their life insurance.

And existing premiums have gone through the roof because there is a 5 year drought of new Life Ins policies placed.

LIF, FARSEA & APRA IP changes.

So you are saying that reducing the quality of the product, charging more for it, making the underwriting process near impossible, reducing the payment to the party doing all the work and then holding them on the hook for two years were those payments can be clawed back didn’t work. Who would have thought?

Perfectly summed up….

Congratulations Canberra. Great job!

This is just the start. It is a compounding issue. APRA and the Liberal government destroyed the industry, and the life insurance companies were the turkeys voting for Christmas.