Rate hike risk renews mortgage stress concerns

Australia’s red-hot inflation could leave 41,000 more borrowers “At Risk” of mortgage stress in February, according to the latest Roy Morgan data, as rate hike expectations are all but certain ahead of the Reserve Bank of Australia’s (RBA’s) first meeting of 2026 next week.

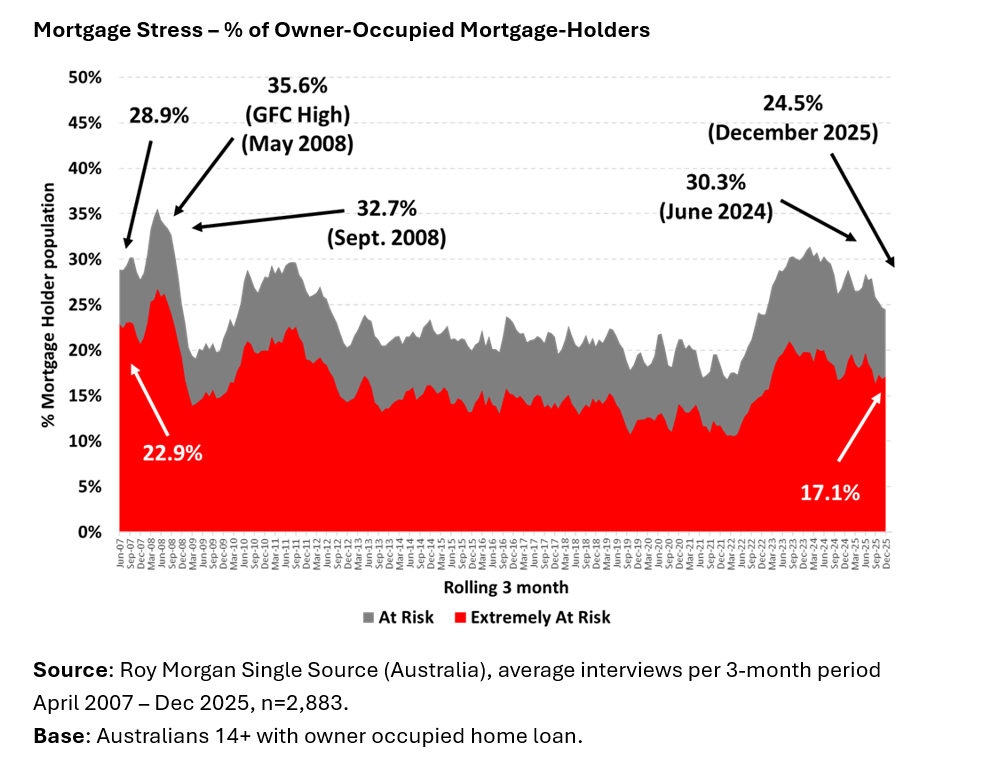

The survey, which involved 60,000 Australians including 10,000 owner-occupied mortgage-holders, found 24.5% of borrowers were ‘At Risk’ in December and the decision to leave interest rates on hold helped the number remain unchanged in January.

But inflation’s two-fold increase in six months, from 1.9% in the year to June 2025 to 3.8% in the year to December 2025, has heightened concerns borrowers should brace for multiple rate hikes in 2026.

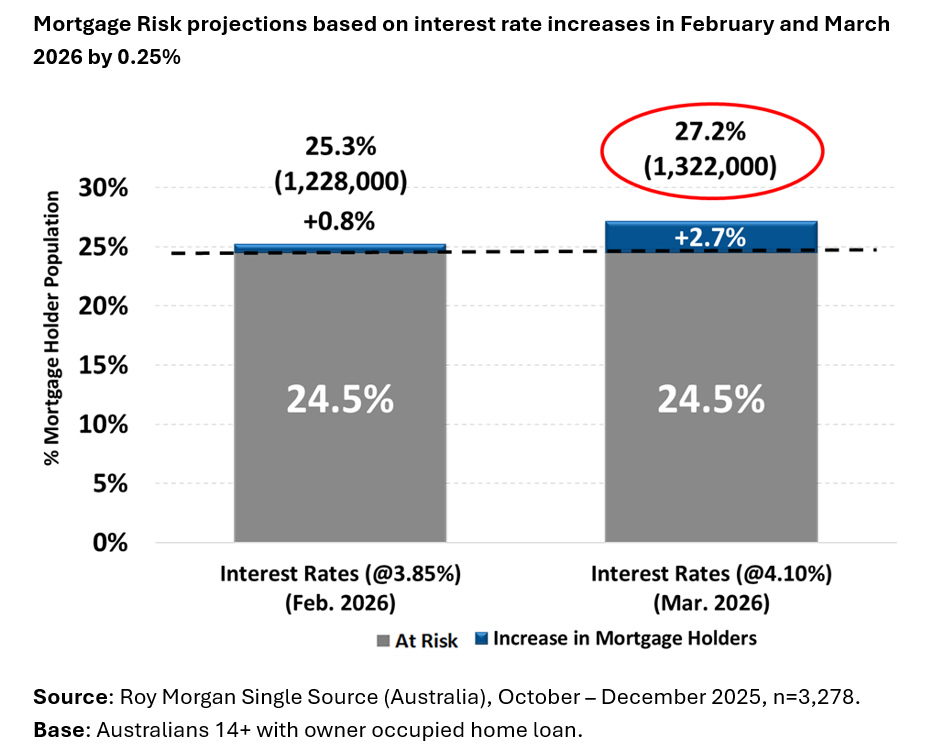

If the RBA was to increase the official cash rate in February by 25 basis points to 3.85%, the share of mortgage holders ‘At Risk’ would increase to 25.3%, and another similar basis-point hike in March would push 27.2% borrowers into that cohort.

The The RBA’s decision to slash the cash rate on three occasions last year helped reduce the percentage of borrowers “At Risk” of mortgage stress to its lowest number since January 2023.

The The RBA’s decision to slash the cash rate on three occasions last year helped reduce the percentage of borrowers “At Risk” of mortgage stress to its lowest number since January 2023.

However, the overall number of ‘stressed’ borrowers has increased by 380,000 since May 2022 when the RBA first commenced its tightening cycle, which lifted the cash rates by a total of 4.25% – from 0.1% in November 2023 to a high of 4.35% until February 2025.

The number of Australians considered ‘Extremely at Risk’ now sits at 830,000 or 17.1% of mortgage holders, which is just above the long-term average over the last two decades of 16.3%.

Roy Morgan said both “At Risk” and “Extremely at Risk” categories are based on those paying more than a certain proportion of their after-tax household income towards their home loan, based on the appropriate Standard Variable Rate reported by the RBA and the amount they initially borrowed.

Roy Morgan said both “At Risk” and “Extremely at Risk” categories are based on those paying more than a certain proportion of their after-tax household income towards their home loan, based on the appropriate Standard Variable Rate reported by the RBA and the amount they initially borrowed.

Roy Morgan chief executive, Michele Levine said the interest rate was only one variable defining where people fall in these categories.

“The largest impact on whether a borrower falls into the ‘At Risk’ category is related to household income – which is directly related to employment,” Levine said.

“The employment market has been strong over the last three years, and this has provided support to household incomes which have helped to moderate levels of mortgage stress over the last year along with the three interest rate cuts by a total of 0.75%.”

Perhaps you might show us evidence that SMA's don't provide a superior outcome for clients. Make a case, demonstrate the…

Show me the evidence that they improve the outcome for a client. Yes they assist with adviser efficiency but there…

They can be if not managed correctly. Every product recommendation can be perceived as conflicted one way or another. The…

Wonder if this is Alan Kirkland?

SMAs run by a third party with no relationship to the adviser, and no inhouse product from the SMA provider,…