Retail leads $49.8b commercial property surge

Australia’s commercial real estate market has staged a measured rebuild after stabilising asset values and stronger fund performance helped unlock $49.8 billion in transactions in 2025, making it the first year for consecutive annual sales increase since 2019.

According to MSCI’s latest Australia Capital Trends report, retail assets led the growth by generating $13.1 billion in trade as large shopping centres including Macquarie Centre, Westpoint, and Top Ryde city, assisted to drive activity.

While transaction volumes softened in the final quarter with activity totalling $13.0 billion, down 42% from the record-setting December quarter of 2024, full-year volumes exceeded both five- and ten-year averages by around 10%.

Head of Private Assets Research, Pacific at MSCI, Benjamin Martin-Henry said the headline Q4 slowdown masks a much healthier underlying trend.

“2025 marked a clear turning point for transaction activity, supported by easing financing conditions earlier in the year and improved pricing clarity across several major sectors,” Martin-Henry said.

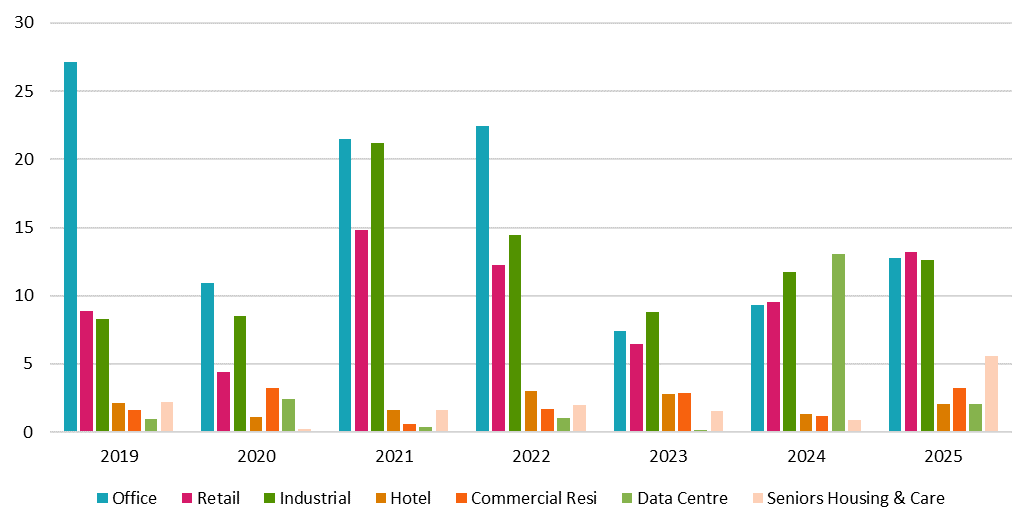

While retail claimed the top spot for the first time since 2015, office investment also rebounded strongly with volumes rising 31% annually to $12.2 billion as investors increasingly targeted Sydney CBD assets.

The report further showed that industrial volumes of $11.9 billion broadly matched 2024 levels whereas living sectors continued to gain prominence with investment reaching a record $8.2 billion, driven by entity-level and portfolio transactions.

Data centre, which came in the top spot last year for sales, descended below hotel, commercial residential, and seniors housing & care in the list, to make it the smallest contributor.

Quarterly Sales Volume by Sector

However, the fourth-quarter overseas investment declined sharply due to the absence of the exceptional Air Trunk transaction recorded in late 2024, but full-year offshore volumes reached $19.7 billion, exceeding historical averages once adjusted for that outlier.

“Large platform and portfolio transactions are reshaping the composition of offshore capital flows,” Martin-Henry said.

“Australia’s living sectors, in particular, continue to attract global capital seeking demographic-driven growth and operational scale.”

The report stated that investor sentiment shifted through the year as early Reserve Bank rate cuts supported dealmaking, while a more cautious late-year environment reinforced pricing discipline.

That will be ASIC's next move and no one should be surprised. Dealer groups have a responsibility to both the…

Why not go after The Dealer Groups as well that had them on there APL!!!

I guess it depends if it's "one of these" super funds or not. Not sure of Shield's AA but AusSuper's…

So ASIC consider a balanced fund to be a high risk investment?

Taylor nails it. This is unfinished business wearing a new cover page. The 2023 review went to wholesale investor thresholds,…