5 biggest super funds hold 47% of members

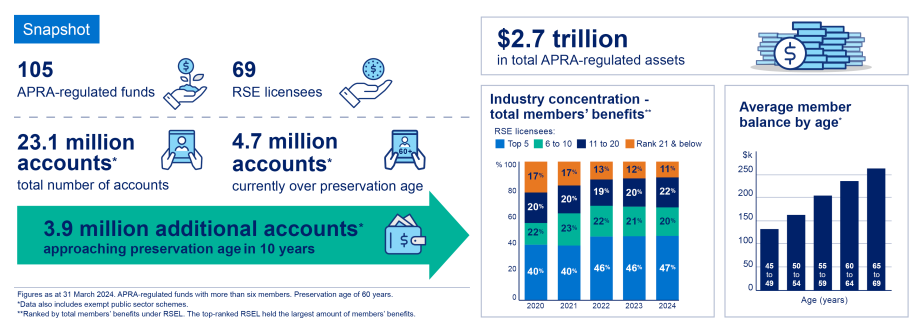

Australia’s five largest superannuation funds now cover 47% of members, up from 40% just four years ago, according to the latest data from the Australian Prudential Regulation Authority (APRA).

In a snapshot of the superannuation sector contained in its 2024-25 corporate plan, APRA has revealed the impact of the superannuation fund mergers and exits which have occurred since 2019 as a result of its heat maps exercise and the imposition of the superannuation performance test.

The data shows that the growth of the big five has been predominantly at the expense of smaller funds which have reduced from representing 17% of members in 2020 to just 11% in 2024 with the impact on mid-sized super funds far less pronounced at minus 2% over the same period.

The data shows APRA to be overseeing 105 funds covered by 69 superannuation licensees.

Also of note is that while there are 23.1 million superannuation fund accounts in Australia, 4.7 million of those accounts are held by people who have reached preservation age, currently 60.

It also shows that 3.9 million superannuation account holders will reach preservation age in the next 10 years.

The data also show that APRA-regulated superannuation funds hold $2.7 trillion in assets.

So, given the vast majority of Australians bank with one of only four retail banks, which BTW represent nthe greatest financial services concentration risk in the world, why is there so little concern and hand-wringing about these exemplars of corporate best practice and governance purity? (LOL)

Oh, hang on, could it be that these are listed, way overvalued in case of one, routinely whacked and fined by the regulators, unlike our top super funds that are regarded by the world as the most successful for member profit funds in the world?