5 consecutive months of positive super returns

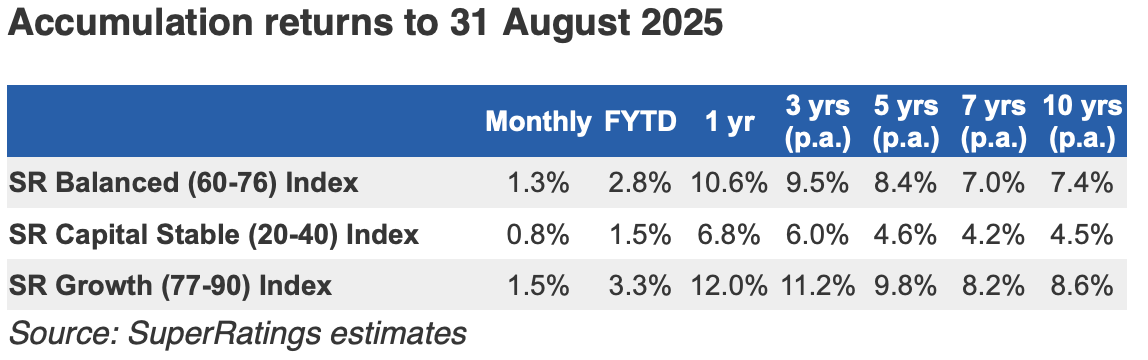

Superannuation fund returns have stayed in positive territory as they move further into 2025/26 with the latest SuperRatings data estimating the median balanced option returned 1.3% to members in August.

SuperRatings director, Kirby Rappell said that in contrast to the volatility witnessed at the beginning of August in 2024, returns had seen a smoother performance over the first two months of this financial year.

The median growth option grew by an estimated 1.5% in August, while the median capital stable option, rose an estimated 0.8%.

“We expect the major factor influencing super returns over the short term will shift from the impact of US tariffs back towards inflation levels and central bank decisions on when to act on interest rates, both in Australia and the US,” Rappell said.

“We have now had five consecutive months of positive monthly returns for super, building Australian’s retirement savings.”

“While the longer-term impacts of US tariffs, high valuations and the trajectory of inflation need careful monitoring, members should be comforted by the track record of Australian funds delivering strong returns for members over the long term.”

Surely "implemented consulting" belongs to a bygone era given the question marks over governance in term of separation of powers,…

Agree. LIF has been a joke. Actually pretty much everything that Canberra has been involved with has turned into a…

The current super products offered by platforms are now under huge threat, due to the regulatory risk of acting as…

Let's not forget FSC promoting aggressively LIF. As they wanted the Life companies to flog Dodgy Direct Life Insurances. Wow…

You wrote, "Decades of unlawful conduct" That's a massive statement. Where's the evidence of their conduct? (Not banks etc.)