ASIC stonewalls Bragg on death benefit intentions

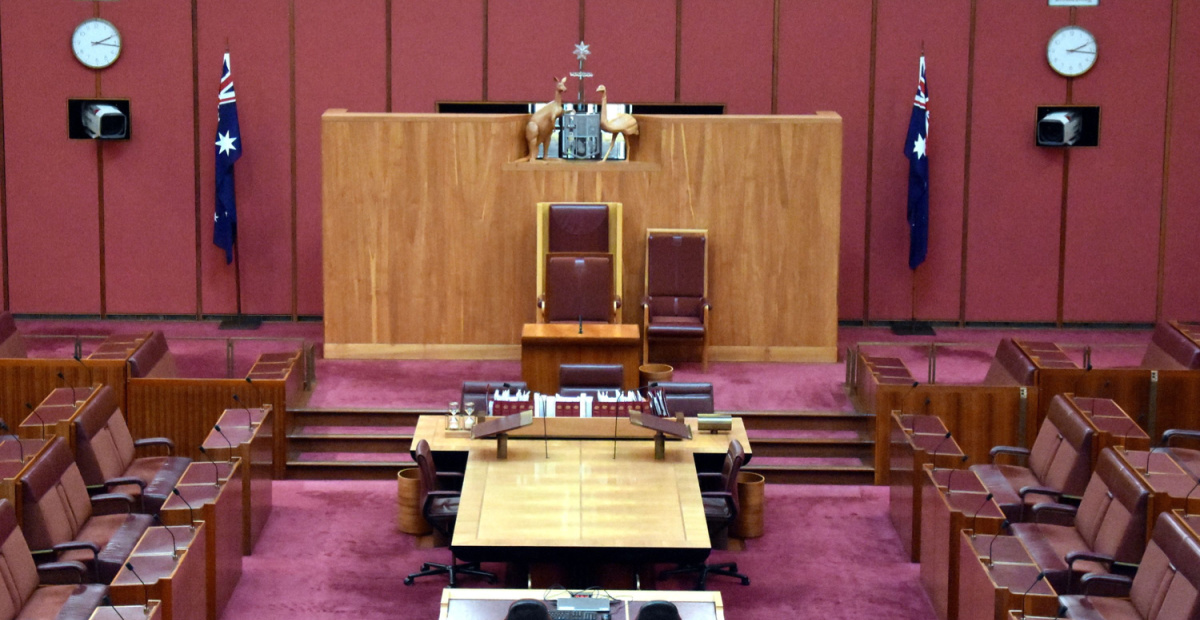

The Australian Securities and Investments Commission (ASIC) has avoided disclosing to a Senate Committee whether it will deal with superannuation fund failures around the handling of death benefits via court action or less transparent mediation.

Despite being pressed on the issue by NSW Liberal Senator, Andrew Bragg, ASIC commissioners Simone Constant and Alan Kirkland decline to specify the regulator’s intentions with respect to its handling of big construction industry fund, Cbus.

Constant argued that it would be inappropriate to disclose or discuss ASIC’s intentions because the matter was still on foot.

Bragg asked Constant whether, given that the Cbus claims handling issue was a matter of great public interest, “ASIC is seriously thinking of dealing with this matter through mediation?”

Constant said that she would take the question on notice but believed it was something which ASIC could not comment on.

Bragg said that his issue was that if a case was taken by ASIC to mediation rather than through a court “would there be less information known to the public?”

“I cannot comment on that,” Constant said.

She denied Bragg’s assertion of silence around the issues and said that, in her professional view, “ASIC has been anything like silent on the processing of claim”

Pressing the issue, Bragg noted that it was important to get deterrence in a situation where a lot of bad stuff had occurred with respect to death benefits handling and the “risk of going to mediation risks to further bad behaviour if the detail doesn’t come out”.

Bit early to say, but I’m firmly of the view that we have a two-tiered system when it comes to enforcement.

And yet they publish bannings and such for ‘crimes’ of far less…for smaller fry advisers…

100% just ask this financial planner they banned for alleged churning based on incomplete & manipulated information.

I guess this financial planner’s independent expert & their experts had similar findings.

ASIC hardly need to stonewall questioning of them, it’s benign stuff. Anyone who’s watched Bragg in action and especially those that appear before his committee know he’s a very ineffectual prosecutor.