AustralianSuper paid $26.6m to ISA over five years

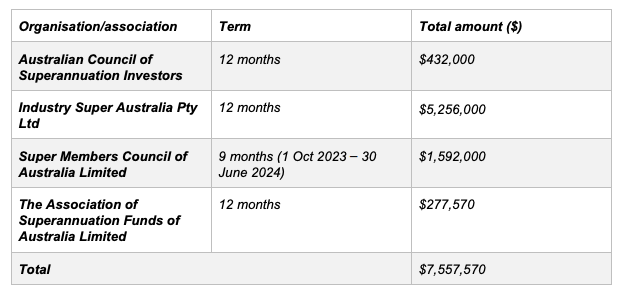

Australia’s largest industry superannuation fund, AustralianSuper, has revealed it spends over $7.5 million on memberships of industry associations and bodies a year.

In particular, AustralianSuper revealed that in 2023/24 it spent over $5.2 million on the business behind the so-called “compare the pair” advertising campaign – Industry Super Australia Pty Ltd.

Its next biggest expenditure was nearly $1.6 million for its membership of the Super Members Council (SMC) covering the nine months between 1 October, 2023 and 30 June, last year.

Answering questions on notice from NSW Liberal Senator, Andrew Bragg AustralianSuper said that it believed the Senator was probing “key superannuation industry organisations/associations that AustralianSuper is a part of (i.e. organisations with whom AustralianSuper has an industry strategic partnership and not, for example, memberships held with organisations such as the Australian Securitisation Forum or Diversity Council Australia)”.

It then outlined what it described as “strategic partnerships with four key organisations/associations – the Australian Council of Superannuation Investors, Industry Super Australia, Super Members Council and the Association of Superannuation Funds of Australia.

Bragg’s question also asked what legal advice, if any, AustralianSuper had received “that justifies your position within their organisations” under Best Financial Interests Standards.

AustralianSuper responded that any legal advice received would be protected by legal professional privilege and AustralianSuper should not be expected to waive that privilege.

Answering a specific question from Bragg on supporting the “compare the pair’ advertising campaign, AustralianSuper acknowledged its involvement.

It revealed that payments to ISA over the past five had amounted to over $26.6 million.

“AustralianSuper makes payments to ISA for delivery of marketing services that include the Compare the Pair marketing campaign,” the fund said. “Payments to ISA are disclosed in AustralianSuper’s Fund Annual Financial Reports available in the Financial Statements section of the AustralianSuper website. Payments made by AustralianSuper to ISA for the past 5 years were:

I am disgusted by the misleading and biased claims of the “Compare the Pair” campaign.

You cannot compare without taking the range of investment strategies which are available.

To claim that all industry funds outperform all retail funds is absolute nonsense.

Furthermore, a well-managed SMSF typically outperforms both industry and retail funds.

And yet ASIC has had no problems with the campaign for years ?

The claims have always been false.

It’s a disgrace.

BTW – who was it that thought up the term “qualified adviser” ? Have we found that out yet ?

Can you point me to any independent research, report or other reputable data that evidences that ‘a well managed SMSF typically outperforms both industry and retail funds. I’m genuinely interested in such evidence. thanks.

If you need to ask that question, maybe an SMSF is not for you…

And the net result of this disclosure, will be a big fat zero, no one cares, Aus Super, ISA are all a protected species

Union super = world’s largest ponzi scheme.

When it comes undone within the next 15 years as the ageing population draw more out as pensions than SGC brings in, it will be diabolical.

Hence why the Australian Super CEO last year was so very keen to get their hands on ‘helping pensioners access the equity in their homes’ and ‘assist with processing their Centrelink benefits’.

Imagine the outcry if AMP / CFS etc used the following line to Hayne:

AustralianSuper responded that any legal advice received would be protected by legal professional privilege and AustralianSuper should not be expected to waive that privilege.

As a very eperienced jurist Mr Hayne would utterly understand that stance.

This might upset a few of my advice colleagues but I always supported the essential concept of the SGC, provided there was a compulsion on members to also contribute to their accumulation.What I never supported was the rubbish risk covers on offer and that nasty temptation to invest in unlisted assets.Anyone remember that famous discovery that funds supposedly invested in London were actually being held in the Bahamas?

But I’ve always known that from an early 1990s on, that the people behind the people who set up all those industry funds based on various awards were going to make a lot of money. I would draw the analogy of the gold strike: few people searching for alluvial gold made money but those who provided “services” on the gold fields i.e. alcohol, personal services and “companionship services”, made, and kept,a motza.

Those originators back in the 1990s were, and still are, carpetbaggers, taking a clip of members funds without telling the members. Most of these entrepreneurs became millionaires. Most of the industry funds never really employed people in administration or claims management, that was all done by boutique organisations closely connected, but legally independent of, the trustees. Money for old rope!! If you were in the in crowd

We’ve had around 30 years of industry funds being a protected species, apart from the occasional Ideological attack by Liberal governments looking for a diverson. The political problem was always that the retail funds also engaged in nefarious activities which were not to the benefit of the members.Many of those failings were outlined in Hayne.

We had two regulators who have ignored complaints from the advice industry about some of the more outrageous ” gouging” activities of the industry funds. We watch football stadiums and football teams being sponsored with members money but somehow the trustees were never held accountable. The only members that benefited from that money were those who are supporters of the particular football team, and bugger the rest

And as Senator Bragg has discovered, the funds can thumb their nose at parliamentary questions hiding behind some fancy piece of legislation.

$26m million in Oz Supers case is chicken feed

AustralianSuper does not and should not be expected to follow the rules and regulations of Australia. The laws around false advertising, misleading and deceptive conduct, or bribing public servants (albeit via a separate entity such as the ISN) simply do not apply to us. Afterall, Comrades we are working in the best interest of our beloved and privileged leaders.

I suspect this troublesome Minister will soon get a lovely donation and go very very quite……and if any of you Financial Planners want to start acting in the best of Australians and want to rock the boat, we’ll send some of my ASIC mates around to audit your Fee Disclosure Statements from 2019 for spelling mistakes and we’ll see how many seconds you’ll last in this industry.

So, if my math is still reasonable, I make this ‘marketing/membership’ expenditure as being around 0.00002112676 of AustralianSuper’s FUM.

For comparison, balance and pair comparing, can someone enlighten us as to what other major industry and retail funds spent as a percentage of their FUM too.