Best super performers reward with double-digit returns

Specialist superannuation research and ratings house, SuperRatings has placed passive investing into context amid confirmation of the role it played in the double-digit returns being enjoyed by many Australian superannuation fund members.

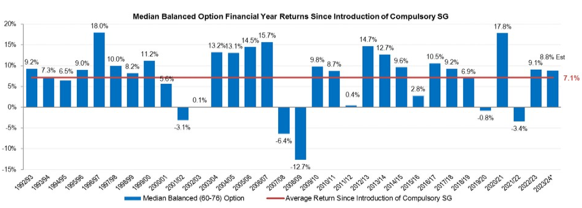

SuperRatings has estimated that the median balance option returned 0.7% in June, bringing the financial year return to 8.8%.

The company’s executive director, Kirby Rappell said super fund return had made a strong turnaround since November, last year, with the result that the top performers would be generating double digit returns for members.

He said technology shares in the US and bank shares in Australia had proved major drivers.

The SuperRatings analysis said that similar to last year, international shares were the standout performers for super funds, with the sector estimated to return 17% as developments in artificial intelligence and associated industries led a small number of technology shares in the US to unprecedented highs.

“The Australian share market also made a strong contribution to super fund returns, with an estimated 11% return for the sector. We expect all major asset classes to contribute positively to fund returns for the year, although the fixed interest and property sectors had a tougher year and are expected to make the smallest contributions.”

Putting index investing into context, the analysis said the small number of shares driving performance resulted in passive investment options, those which track a specific benchmark and often have a higher allocation to shares, outperforming most other strategies over the year.

“SuperRatings estimates the median passive balanced option will return 11.6% for the year, compared to 8.8% for the SR50 Balanced (60-76) Index, while 5-year performance for passive options is estimated to be 6.0%, compared to the SR50 Balanced (60-76) Index 5-year return of 6.2%,” it said.

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…