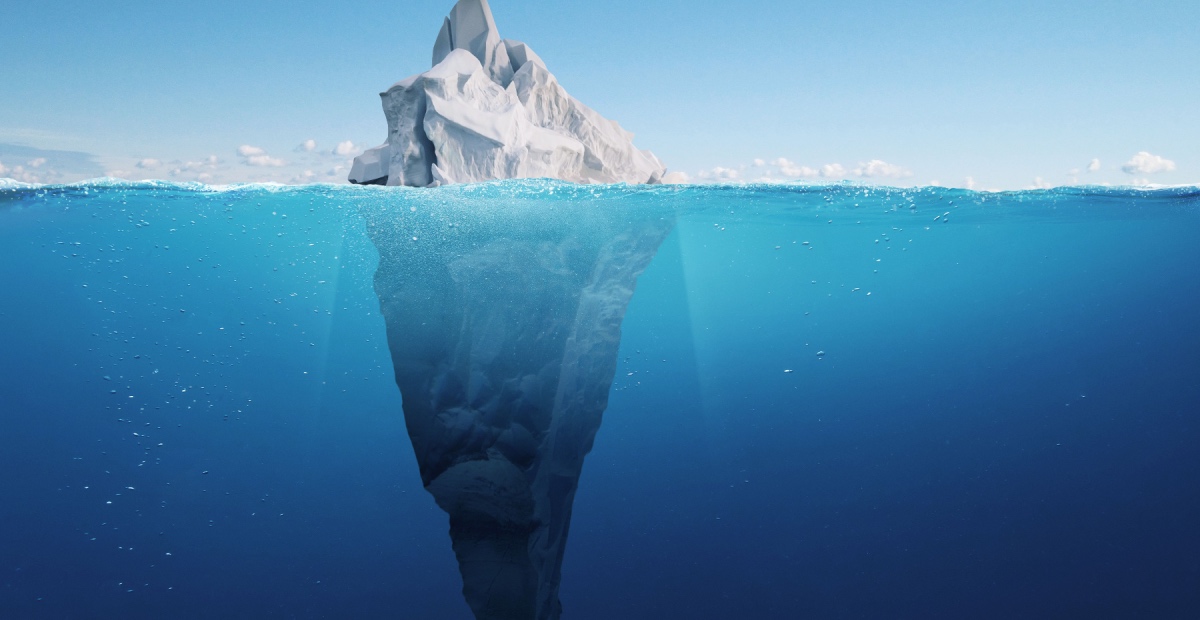

Cbus claims handling issues ‘tip of broader iceberg’

As major construction industry superannuation fund, Cbus, faces into Federal Court action initiated by the Australian Securities and Investments Commission (ASIC), industry experts have suggested the fund is not alone and that its problems represent the tip of an iceberg.

The Australian Financial Complaints Authority (AFCA) has listed life insurance claims handling as a ‘systemic issue’ for at least two years and recently admitted closing out an investigation because the “firm” was already talking to other regulators over the issue.

At the same time, life insurance claims handling expert and principal of specialist firm Integrity Resolutions, Col Fullagar, said he had seen delays of up to three years.

“It has been a real problem and remains one,” he said.

“I have found from my own experience and talking to both clients and advisers just how entrenched the problem has become,” Fullagar said while noting the roles of fund administrators and insuerrs.

AFCA recently listed as systemic issues:

- Adequacy of claims handling process

- Breach of obligations under SIS Act and SIS Regulations

- Cancellation of policies

In a recent systemic issues report, AFCA cited the following:

“Issues with administrator cause poor complaints handling and processing of insurance claims

“A financial firm was failing to handle complaints appropriately both at IDR [Internal Dispute Resolution and EDR [External Dispute Resolution] and was consistently delaying in processing death benefits and insurance claims.

“These issues were affecting multiple members and had led to increased complaint volumes at IDR and EDR. Once AFCA raised the issue with the firm, it acknowledged AFCA’s concerns and said the firm’s administrator was failing to meet agreed Service Level Agreement timeframes, and delays were also caused by resourcing issues and internal process failures. “

“The firm further told AFCA that it was already engaging with the regulators about these issues. AFCA elected to close the investigation based on the firm’s ongoing engagement with the regulators regarding the systemic issues to avoid duplication of effort. While the file is closed, AFCA continues to engage with the financial firm to ensure it addresses the issues and reduces complaint volumes.”

Industry Super completely taking advantage of its best buddy regulators APRA, ASIC & AFCA that simply don’t regulate Industry Super.

Regulatory Capture Corruption between Industry Super & wilfully blind Regulators.

You can tell an ex-Labor politician, ex-union leader is heading up CBUS, just using the well-worn tactic of “Don’t look at us, look over there at everyone else”.

Labor, unions, industry funds + sickening corruption and lies.

worked within the reinsurer that was looking after many super funds like cbus, they actively would teach us staff how to deny a claim rather than how to approve a claim, they all say they pay claims but the reality is a team of assessors doing everything they can to make it a lengthy process when the money is required by the client and make them feel like a criminal at times for doing so. Insurers dont’ care other than their bottom line and the population suffers.